- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How to increase credit score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to increase credit score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

@Anonymous wrote:

Update It’s says my scores are:

Experian 675

Exquifax 677

Transunion 666

It says exceptional payment history.

•8 accounts 71% (I just paid off two cards to zero it’s not reflected yet. Also my recent CLI with Saks & Bloomingdales aren’t reflected yet)

•6 inquiries

*one from 2017 it’s supposed to be removed but still there

•three from 2018

•two from 2019

*Denied by TD and Amex Blue delta this month. Smiley Sad (embarrassed to say TBH) The high util on the cards did you in on approvals.

*Student loans deferred, presently.

My Cards are listed as follows:

•Chase freedom 1000 balance with 1200CL Yes get this paid down quick and first I agree.

•Gap 1900 balance 2000 CL (I have to go through this account I suppect fraud) Maxed out

•Saks 3,000 balance with 7,000 CL (able to get line increases) High util

•Bloomingdales 1,600 with 5,000 CL (able to get line increase) Save for last

•Best Buy 147 with 3000 CL

•Newman’s zero with 2,000 CL

•Capital one zero with 500 CL

•Pink VS zero with 700 CL

I plan to tackle chase freedom first I guess.

I will try my best.

Realistically I can honestly put forth $600-800 a month on paying these down.

Thank you for all info.

Get the major CC Chase paid down fast. Dont want to spoke them. The rest are store cards. The highest util one (Gap) tackle it and work your way down. No more swipes until you get the debts under control. Once you can accomplish this. You'll see nice score bumps. You'll see them aslo as they are being paid down. So no lates anywhere on your reports then?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

I am a 9/11 survivor. I recovering from recent surgery. So I kind of lost my way now back on track. I really appreciate the info you are giving.

Correct there are no lates any where. I’m not sure why that vantage stated that in the summary. I never been late ever.

*Best Buy will be zero in two weeks.

*Chase will be zero paid off by February. So I’ll do minimum then Dec and Jan/2020 then zero February/2020.

*Gap maxed will pay minimum until I see what’s actually taken place.

*Will tackle Saks and Bloomingdales together albeit pay off Bloomingdales first.

Should I also ask again for the Saks increase just to fair out that utilization while paying it down? I can ask for CLI right before Christmas. I honestly believe I can get Saks from 7k to 12k and Bloomingdales to possibly from 5k to 8 or 9k CLI

The rest will sit bc I believe they are hard pulls.

I will not shop using any.

Will the zero balance cards CL be lowered bc they will be dormant?

How long before I see an increase in score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

TransUnion reporting 1 late payment serious delinquency

*Number of your accounts that were ever 60 days late or worse or have a derogatory indicator

4 accounts

I don’t havd any accounts that have been late nor delinquent. It doesn’t show what they are referring too so I don’t know how to dispute or ask what this is?

*Only TransUnion is showing this not the other two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

Sounds like a plan. You can call customer service for experian credit check and ask why is that there. Once you see your scores going up as the debts go down. It will give you move incentive to finally be back on track and you learned a lesson on how to handle credit to work for you and not for the banks. Which is happening now by the interest your paying each month. Good Luck and kep us updated! Happy Holidays!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

I see some amazing answers above. i"ll tell you my story. I started my Journey with lower 500s across board. This was exactly a year ago to this day. First i made short term goals, One step at a time. That is how credit building works. There is no shortcut to success here. Below are the things i've done in the last one year.

1. Applied for Few Secured Predatory cards. Had to, becuase no other bank was willing to give me a Credit card. Used these cards to my advantage and started paying them ONTIME. ALWAYS. This is a very important thing to make it a second nature. NEVER MISS ANY PAYMENT. This yeilds results in the longrun. You might not see the results instantly. Don't be discouraged. As i said, patience & Commitment is the key here. Regular payments started giving me good results about 8 months after.

2. Luckliy got couple of Cap1 secured cards with low CLs. Again, used them to my advantage.

3. One of the most important things i've done is that I NEVE PAID Credit card balances in full. i played with FICO Simulator and spaced out my payments ( without missing due date payments ). This resulted in good boost to my Credit score. But i suggest AT ANY GIVEN POINT INTIME, never let your Total Credit card balances to be more than 29%. That is your top limit and you should start brinign that balance down

by doing spaced out payments.

4. Lucky me, when is tarted this journey, I had an Auto loan account in good standing always. So i focused even more and made sure i never let my eye go off the payement date. What ever may come, i pay it on time. I skip going to bars, skip eating out but make sure i pay this ONTIME. This helped me in two ways. a) my Mix of accounts got really excellent. b) my Ontime payments ( CCs & Auto loan ) started aging in a very goodway.

Repeat the above 4 steps WIHTOUT FAIL EVERY MONTH. Don't worry, with in few months it becomes your most enjoyable hobby. I did that for 1 year now. My scores are now 675 across board. Things started upward for me now. both my Cap1s increased my CLI now. I got a new Disco with 10K sweet limit. I No longer use the Predatory Cards anymore. they all sit there with 0 Balance on them. Gonna close them next week when i'm back from vacation.

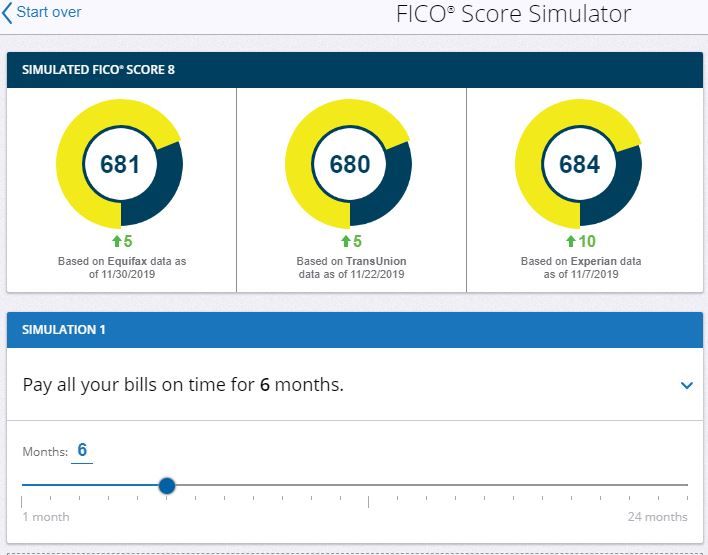

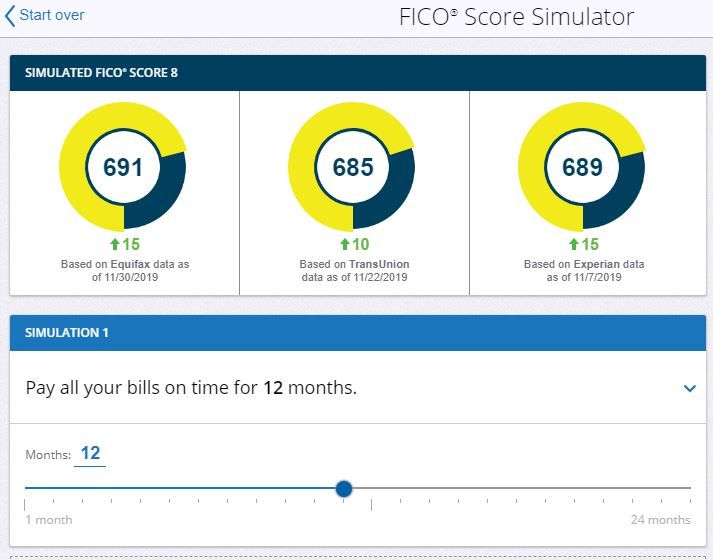

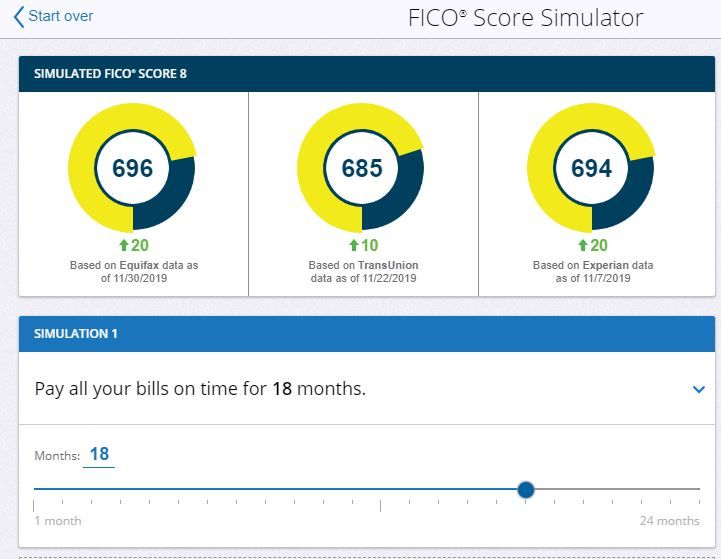

However, My journey did not end here. I see that i just scrached the surface. Now, i'm on a level playing field and now is my time to move up from here. So below is the 6/12/18 month plan i deviced for myself.

Short term goals are very important. That gives us a feedback as how we are doing. I will be following the below WITHOUT FAIL. i have that much confidence now.

Also, i have just 2 derog/Negative accounts which will fall off my report during this phase. Hoping that will take me into 700s with clean report.

See the power of paying bills on time.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

I never had a secured card just one Cap1 with low starting CL. I plan to use that for small under $25 purchases to pay off just to show good faith so the CL is increased.

I plan on getting the high balances down to zero. I never make any late payments. Albeit I have to call to see why TransUnion is reporting late payments on something I cannot see.

Presently my scores are 666 and up having lost points recently for high balances and opening new credit.

I thought opening new lines would help offset my overall utilization but it individual. I shouldve came here to ask before hand.

Questions: If you close the credit cards will that affect your score? I plan on closing my gap card as soon as it’s paid off.

How long have you had Discover and do you ask for CLI if so how often?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

1. Closing any Predatory CC is always good once its job is done ( which is to help rebuild your Credit). It will not have any effect on your Average Age of accounts, as i believe that this closed account will stay on your report ( closed in good standing ) for 10 years. That gives you enough time to get back in the game. Credit gurus, Please correct me here if my understanding is flawed.

2. I got my Disco Card only 2 months ago. I intend to use to as-is till i build atleast 6 months history on it before i ask for CLI.

3. Also, please do not go run into Opening new Credit lines for the sake of keeping your Util % down. Paying down your balances is awlays a good habit. That will also be recorded as Ontime payments ( 35% weight on your Credit score ) .Remember the number of Credit Inquiries "can" also will bring down your score and plays a part in seasoning your credit over time. Apply only the ones you are sure about getting approved. this way, you can take a small hit intially but those cards will help you build credit in the long run. Again, Apply to those you are sure about getting approved. I personally would check only if i'm prequalified.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to increase credit score

That was an error on my part albeit the two I applied for I was pre qualified for but was still denied. I was told my high balances. I won’t try again until these balances are down to 10% utilization or zero. I really want a Amex blue delta maybe discover since I see its builds quicker then maybe Chase cc. I’ll wait bc I realize opening to a good line of credit is better then just getting the card with low opening lines. I plan on closing the minor store cards and keep the major department store cards only since the give great CLI and build credit. I guess Gap Jcrew Pink are all on the chopping block.

Wishing you a Happy Holidays.