- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How was your 2019, what are the plans 2020.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How was your 2019, what are the plans 2020.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

2019:

2020 Goals:

AZEO < 9% by May.

More TBD.

I have sone thoughts about where I want my mid score to be and to start looking at mortgage specific scores - but nothing concrete yet.

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

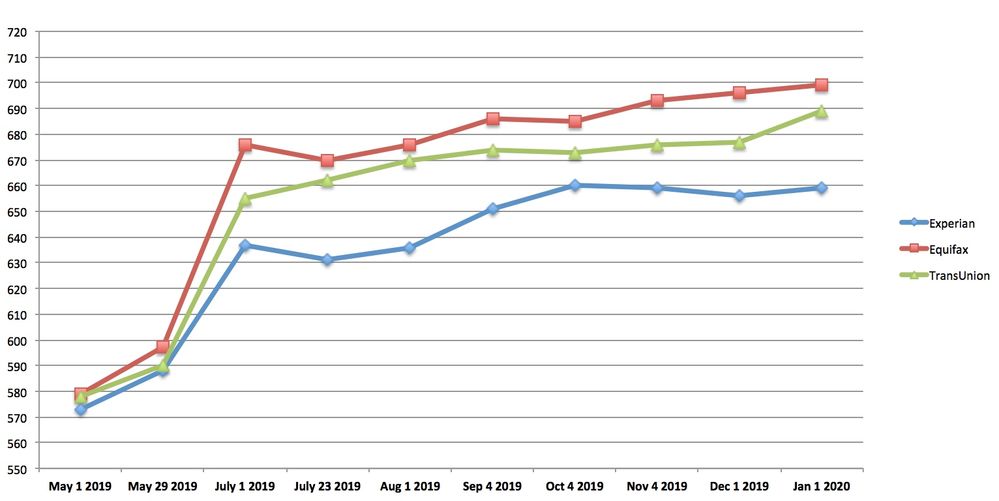

Superb upward Trend. i love seeing those go up. Congratulations. Where did you pull that Graph from ?

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

@Chestnut1 wrote:Superb upward Trend. i love seeing those go up. Congratulations. Where did you pull that Graph from ?

I pulled it from my spreadsheet where I (manually!) track credit limits, credit balances, APRs, ages, scores, INQs, etc.

I had a lot more scores which I deleted for the sake of simplicity. Last year It was not unheard of for me to get 3 or 4 FICO08 scores in a month.

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

Dang. Your Level of Detailing is Amazing. Good luck to you for 2020.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

2020 will be all about growing my personal cards, with sp cli and maybe 2 new credit cards... I'll most likely go for a 3rd year with discover.

My latest approval( December/19 of 2K sl )with amex Hilton honors helped me realize I had to stop applying(not really a big deal since it will grow, and I wanted the card and sub)

I'll be checking pre approvals in May and hopefully get a decent apr(even though I have dcu @ 10%)

I'll also put most of my focus on Buisness credit cards. Since I'm in my 3rd year, and I'll be applying for cards that dont show on personal credit reports.

Another goal is to get my Equifax mortgage score at 730 or above

Currently its 709.

Dcu will give me a cli without raising my apr 3 % with a 730 score..

I've had cli success with every card I have except amex, but they have given me 6 cards since May so that probably explains why...

I'll also decide if I'll keep my af cards, cap1 Venture (probably downgrade) citi aadvantage Ps (probably keep open due to 24 month SUB rule)

My DW amex delta gold(her only prime card of her own so will apply for no af card then cancel sometime after af hits)

Green biz amex charge( will close card after 1 year unless they seriously revamp this card)

Going to keep my amex gold card w 250 af. Not sure if I should even ask amex for a retention offer, dont want to push wrong buttons..

I'm also helping DW with her credit. Through a referal of mine she was approved for a 1k delta gold card in September w/ a 641 Experian! I'd like her to get something like everyday card in 2020.

Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

Well, my 2019 was pretty great! Started my rebuild in July 2019 and a lot has changed for the better!

Derogs:

July 2019 - 12 Collections/Charge-Offs

Jan. 2020 - Only 3 (PIF and 2 set to "fall off" this year)

Scores:

July 2019 - EQ 593 / TU 595 / EX 600

Jan. 2020 - EQ 640 / TU 641 / EX 658

Started off with a single $500 secured CC, now have 3 additional CCs and practicing AZEO.

Plans for 2020 - grow my CLs and try to get 700+ across the board.

Just so thankful for everyone on here. If I hadn't discovered this site, I know I wouldn't have been half as successful this year. You guys are awesome!

Jan. 2024

June 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

2019 was great. My scores increased to 650 (since I filed bankruptcy) and I got approved for a couple cards that I really wanted. And then….i found I was pregnant, got very sick and was out of work for 3 months! I learned a great lesson which is to HAVE AN EMERGENCY FUND!!!! (which I didn’t have) I had to use my credit cards to pay all my bills and I’m now around 85% utilization ☹

2020 Goals:

- Start an emergency fund

- Pay down all my credit card debt (should be done by June 2020 hopefully)

- Garden for the entire year to remove inquiries (amount of inquires is so high it’s embarrassing to reveal lol)

- Increase credit score over 650

Wish me luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

What a Great Story of Improvement each one of you has got in 2019. Amazing. Lets move with the same pace in 2020 and Lets never EVER lose sight. Good Luck all !!

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.

@DatGalMoe wrote:2019 was great. My scores increased to 650 (since I filed bankruptcy) and I got approved for a couple cards that I really wanted. And then….i found I was pregnant, got very sick and was out of work for 3 months! I learned a great lesson which is to HAVE AN EMERGENCY FUND!!!! (which I didn’t have) I had to use my credit cards to pay all my bills and I’m now around 85% utilization ☹

2020 Goals:

- Start an emergency fund

- Pay down all my credit card debt (should be done by June 2020 hopefully)

- Garden for the entire year to remove inquiries (amount of inquires is so high it’s embarrassing to reveal lol)

- Increase credit score over 650

Wish me luck!

All you have to do as first steps is to being down that UTL% under 8.9%. That will shoot your scrores up and maintain that go forward without ANY lates. you should be all set.

and Big Congrats on your Pregnancy. We have to be successful on all fronts. Personal, Professional & Financial. Good Luck to you.

And Remember that the Definition of success is unique to each one of us.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your 2019, what are the plans 2020.