- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: I feel like I'm right outside the CAP1 bucket....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I feel like I'm right outside the CAP1 bucket..

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I feel like I'm right outside the CAP1 bucket..

And here's why...

I was approved for the Platinum Mastercard with a $3k SL shortly after the BK7 discharge hit my CR. I was able to PC it to a Quicksilver after three months, and got the $500 Credit Steps increase.

Seven months after being approved for the Plat(QS) card, I saw a message in the CreditWise app that I was pre-approved for the SavorOne card. I bit and got the same $3k SL with a $500 Credit Steps increase. BUT...this time it was a World Elite Mastercard. I have read that CAP1 will get higher swipe fees from this one with that designation, so CAP1 had incentive to do so, but is that the only reason? (BTW, this seems totally unfair to retailers)

So I guess what I'm saying is that I feel like the combination of the high starting limits, and the WEMC status is a sign that I am not bucketed. What are your thoughts?

UPDATE: 9/16/19 (This update refers to the QS card that was formerly a Plat. opened in Sept 2018)

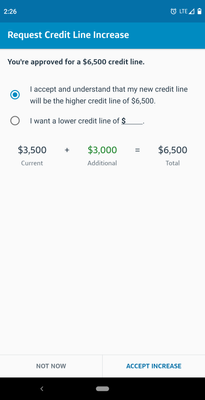

I said I would update this thread after I was eligible for another increase (had to wait 6 months after Credit Steps increase) and they offered a $3000 CLI. I accepted, of course.

I know this does not definitively prove my theory that me or my cards are not bucketed, but it sure makes a good case for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

You were placed into credit steps this in itself says its a bucketed card though you may be able to gain higher CLIs that others since they started with higher CLs. All you can do is use them and hit the CLI button every 181 days from last CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

@gorgon wrote:And here's why...

I was approved for the Platinum Mastercard with a $3k SL shortly after the BK7 discharge hit my CR. I was able to PC it to a Quicksilver after three months, and got the $500 Credit Steps increase.

Seven months after being approved for the Plat(QS) card, I saw a message in the CreditWise app that I was pre-approved for the SavorOne card. I bit and got the same $3k SL with a $500 Credit Steps increase. BUT...this time it was a World Elite Mastercard. I have read that CAP1 will get higher swipe fees from this one with that designation, so CAP1 had incentive to do so, but is that the only reason? (BTW, this seems totally unfair to retailers)

So I guess what I'm saying is that I feel like the combination of the high starting limits, and the WEMC status is a sign that I am not bucketed. What are your thoughts?

I am guessing that if you are in Credit Steps you are Bucketed. You are just in a higher bucket than those who get a $500 SL.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

Cards are bucketed not people. It’s possibly for the same person to have bucketed cards and non bucketed cards from Cap1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

@Anonymous wrote:

Can someone explain what bucketed means lol

When you open a card with Cap One they assign you to a bucket. If the card is considered a starter card such as the Platnium MC or Quicksliver you generally get a low starting limit, with a predertimed CLI after 5 on time payments. Generally speaking these cards will not see much credit limit growth even when your credit score increases.

If you have a bucketed card you are usually better off opening a new account as baddies drop off and your FICO increases instead of trying for CLI on a starter/rebuilder card.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

@Anonymous wrote:

Can someone explain what bucketed means lol

Here is a simplified explanation of asset backed securities, commonly referred as "buckets" around here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

@Remedios wrote:

@Anonymous wrote:

Can someone explain what bucketed means lolHere is a simplified explanation of asset backed securities, commonly referred as "buckets" around here

That is a very good read. Thank you Remedios for posting this link.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

You're welcome

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I'm right outside the CAP1 bucket..

I'm going to hit the LUV button as soon as I'm eligible on the Plat QS and see what happens.

Does anyone know if the 6-month CLI clock starts on the date I did the PC, or the date of the Credit Steps CLI?