- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- I need help with next steps...Any advice?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I need help with next steps...Any advice?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with next steps...Any advice?

This site is amazing! I only started my credit repair journey 6 weeks ago so I'm hoping to glean some pointers on what to work towards next in terms of rebuilding my credit. My goal is to become an 725+ member by August 2019. I'm a bit confused on order of priority for the Challenges and Gardening on this site. I'd love feedback on recommended next steps. Here's my background:

My current scores as of 3/15/19: EQ: 656, EX: 643,TU: 660

DTI: 44% (will become $23% when I sell my house and remove $213K)

Debts:

- Mortgage (DiTech): $213K

- Student Loans: $200K (balance will be $0 in 9 more years, 2028)

- Auto (NFCU): $24K

Credit Cards: I had NO credit cards so I recently opened in February 2019 to re-establish:

- FingerHut $300 (8% utilization)

- BoA Secured Card $500 limit ($0 Bal)

- Self Lender Certificate of Deposit $1K (only 1 payment completed so far)

Outstanding: In February, I paid off ALL outstanding "negative" debts about $4K worth. They were mostly old medical bills that have been haunting me and one late payment fee from Wells Fargo charge-off.

Savings: 4 months savings living expenses in the bank

Income: solid 100K+ salary but only $1K surplus monthly

Oldest Account: 15 Years, 7 Months ago

Average Account Age: 7 Years, 7 Months

Utilization: 14% EQ, 33% TU, 14% EX

Negatives (reported on all 3 bureaus): Wells Fargo (CO), Khols (CO) and DiTech Mortgage (Pd late)

Collections: Comcast (EX)for only $50! (now $0)

Public Records: None

Any thoughts on next steps? Good will letters in order?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need help with next steps...Any advice?

Welcome to the forums. Some additional info would be helpful:

- What are the DOFDs of the charge offs?

- How many late payments?

- What was the severity of the lates (e.g. 30-days, 60-days, 90-days)

- What were the dates of the late payments?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need help with next steps...Any advice?

As the negatives age they will have less effect on your Fico score.The key will be to use your the cc's and installment loans to make monthly on time payments.Keep balances between 1-6% on all cc's.Utilization on installment loans count very little in the Fico score.Learn the azeo method.Ideal will be to have three cc's no rush.You have a great variety of credit accounts.No need to open any more credit accounts, let everything age.Keep your oldest credit account open if you can.With serious derogatories present on your cr it's possible to have a Fico score in the low 700's but highly unlikely to be in in the high 700's one day,but probably not in five months.GOOD LUCK...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need help with next steps...Any advice?

@DIYCredit,

Thanks for the feedback! I went back to look at the age of my negatives and there are 3 negatives and 1 collection. The odd thing I find is that one of them is reported as only "1 month" old (EQ) and that is actually incorrect so I will have to dispute that. They are reporting when the item was paid and reset the actual time it was delinquent. I think this is wrong. Any thoughts on remedying this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need help with next steps...Any advice?

@Caardvark,

Thanks for the feedback! See my responses in red:

- What are the DOFDs of the charge offs? Date of first delinquency was 1 Year and 5 MOS ago but ONE of the items is reporting only 1 month past due and this is incorrect. Apparently when I paid the item off last month it reset the delinquency date. I believe this is incorrect so I will have to dispute it. Let me know if you think this site provides any templates/language specific to this.

- How many late payments? with the mortgage at least 6 because I stayed behind while they modified my loan which took 5 months

- What was the severity of the lates (e.g. 30-days, 60-days, 90-days) 90 days+ - Mostly loan modification I had to do with my mortgage...I got behind due to rebuilding expenses from a home flood. not sure if its worth adding a "note" to my credit file about this or not.

- What were the dates of the late payments? October 2017

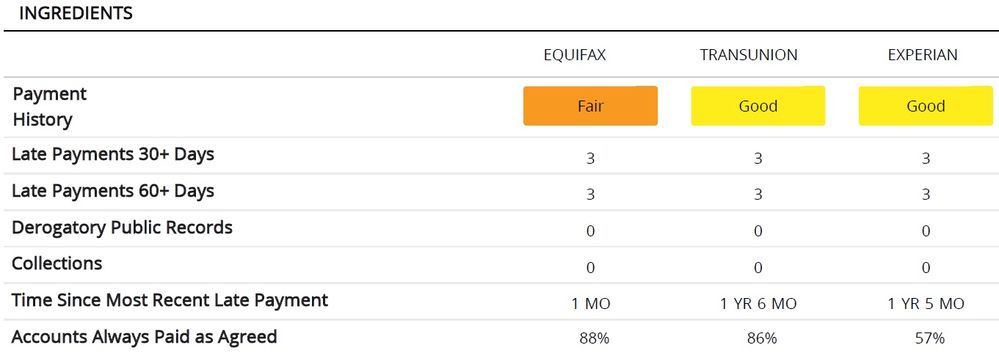

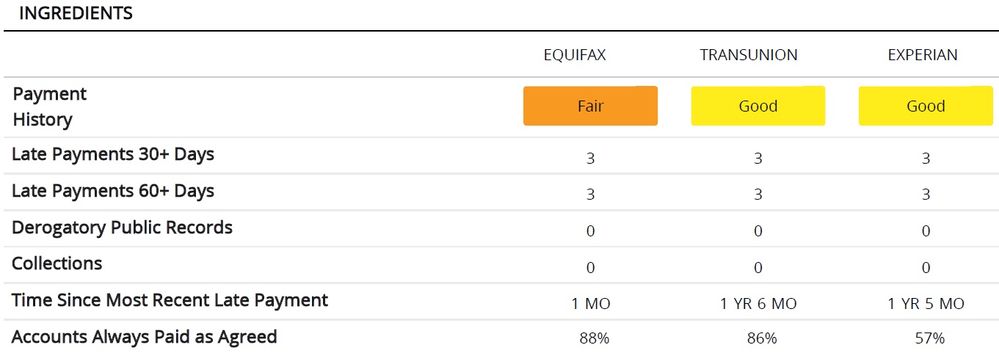

Here's the info from my latest 3B report: