- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Is this ACCURATE reporting?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this ACCURATE reporting?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this ACCURATE reporting?

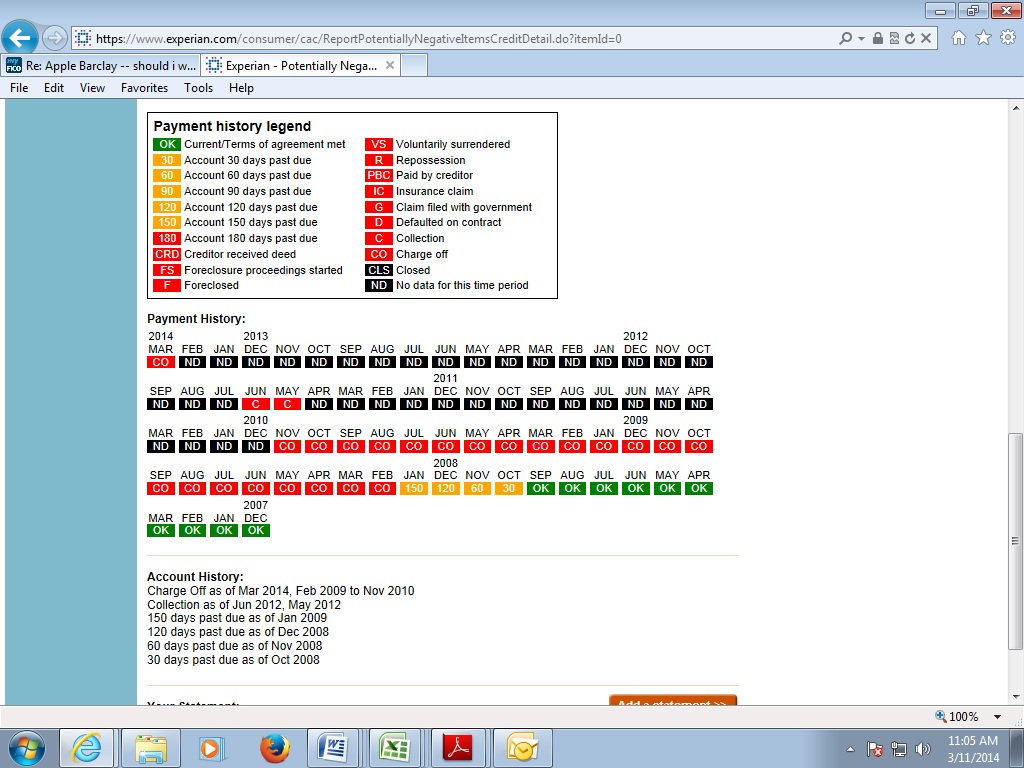

This is how a charge off from First Premier is reporting on Experian. You can see they changed the reporting to a collection in May of 2010 and then back to a charge off this month.

The DOFD was Oct 2008, then 60 days in November and it jumps to 120 in December.....what happened to the 90 days late? I guess he went out for breakfast and never came back that lovely morning of 2008 and mr 120 days took his place.

I really hate this bank with the utmost passion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

The answer is no and since they have reported it this month as a CO I would go after them for it, its not going to affect your score to do so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

@gdale....thanks. I have gone after them in every way possible to no avail. The only thing left to do is file suit against them but I havent yet found a very competent attorney to handle my case.

I had a chat with Experian this morning and they also insist that the reporting is correct. They say that as long as a charge off is unpaid it can be reported as a collection and a charge off at the same time and that they can keep updating the reporting of the CO until its paid or falls off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

The basic reporting is sound, showing progressive delinlinquencies, a charge-off, then a collection referral.

While there may be an inaccuracy in reproting a 120 late in the month immediately following a 60-late, that would be easily correctible, and would affect neither the DOFD nor the highest level of delinquency, the CO, nor the collection referral.

You can either call and request correction, or send a direct dispute if you choose.

In resolving any dispute, they always have the option of correcting the inaccuracy, so it is not apt to have any substantive effect.

Personally, I would let it be, and deal with the substantive issue of the unpaid debt. You may need their future good-will in deletion of any prior reporting once the debt is paid.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

That's exactly what I was talking about! They did that to me. My report looks just like that. That's why I said look closely at the reports. They have been doing this to me for five years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

@Robert......I have no issue paying off the debt. The only reason I have not paid it is because I did not want to have the update of a recent payment making the account appear as new and causing a further ding to my score.

I have disputed the innacuracy of the missing 90 day late several times but they have not corrected it. I realize that if they correct there will be no change in how the tradline is affecting me, but it is innacurate regardless of how substanative the effect may be.

Goodwill does not exist in the world off First Premier, so that is of no concern.

Their was no collection referal on this acount until this month. It was in their "internal" collection department.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this ACCURATE reporting?

With all do respect, I have to disagree with you Robert. I don't believe the reporting is sound. The consumer has already been punished for the original Co. When it is changed to CA, the CB's flag it as a NEW collection account. That would not be accurate reporting, it is not a NEW collection.

When it is changed back to CO, the CB's flag it as a NEW charge off. That would not be accurate reporting because it is not a NEW CO.

They can collect on an account until the cows come home. What they can't do, is change the code in the system because that triggers the change in status which in turn triggers the NEW account damage.

They most certainly can word the account to benefit them in any area that does not trigger a new account. That is not what they are doing.

I sued Experian in small claims because they did not correct the information after being provided proof and they are barred from accepting any more info from FP.

Unfortunately, they are still doing it with EQ and TU.