- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Is this a reason for a dispute on DOFD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this a reason for a dispute on DOFD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a reason for a dispute on DOFD

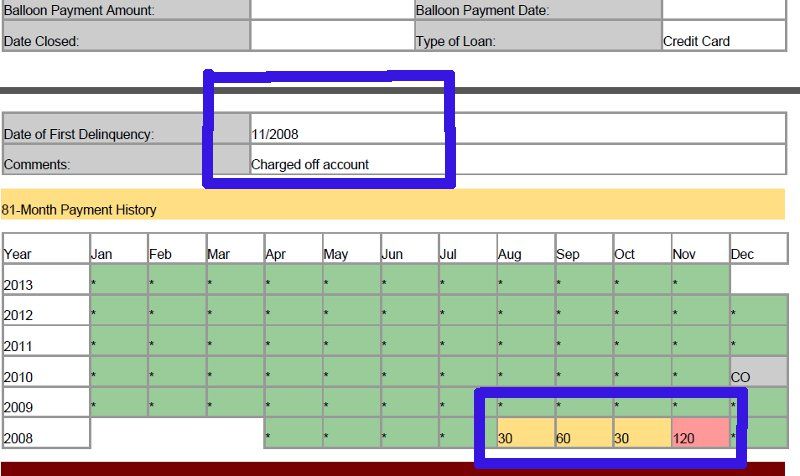

The following is a partial screenshot of my Eq report. Is it just me, or is the DOFD reporting wrong? If I understand DOFD correctly, it should be 08/08 not 11/08. It's reported this way on all three CRs. There are actually two seperate accounts from the same OC and both are reporting the same way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a reason for a dispute on DOFD

Tecnically, DOFD would probably be 7/2008.

A reportable 30-late means 30 days past billing due date. Delinquency begins after the billing due date.

However, even that is not conclusive, as the first deliquency could actually have occured months before they finally decided to report as at least 30-late.

DOFD only determines the max CR exclusion period, so as of today it remains academic, but will become important once 7-71/2 years from DOFD rolls around.

File a direct dispute, arguing that the DOFD must be the date of first delinquency in the most recent chain of delinquencies that preceded the CO, and it is clearly not reported as such.

If you have account records, you can tell them what you feel the actual DOFD should be.........

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a reason for a dispute on DOFD

DOFD is 08/08 not 11/08 looks like bogus monthly reporting there, CO 2 years later, if you have the statements you can prove the DOFD, you could dispute it but its not updating monthly any more and I think I would leave it alone till 08/15 and challenge it at that time. If it updates all those current payment entries could be commuted to negative status dropping your Fico.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a reason for a dispute on DOFD

They only reported correctly to TU, they mis reported (verified over the phone) on both ex and eq. Ex disputed the dofd without my permission (they thought they were doing me a favor, called back, but supervisor claimed it wouldn't hurt anything). They can back validating the misreported dofd, and changed the charge off date from AUG 2008 (should have been July 2008), to SEPT. 2014.

Because they were obviously taking advantage of loop holes, ex went ahead and deleted (the supervisor took over handling all my accounts), and they actually cleaned the whole report up early (cfpb helped).

Eq wanted to dispute the bad reporting, but I declined, because I don't want Amex to get spooked with a popped up new charge off that doesn't exist. They assured me the bank would be deleted beginning of January.

Just an FYI.