- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Journey from 580 to 800. 3 year credit file over 4...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Capital One letter to CEO, resulting in callback from escalations department just FAILED. Called back and said there is nothing they can do and I should email their disputes department. SMH. Guy was useless. Could not even tell me who he worked for. He says "Capital One". SMH

The record is not even accurate. It was not 30 days.

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

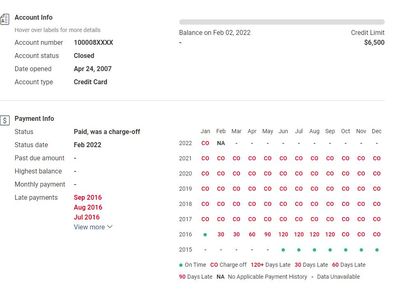

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

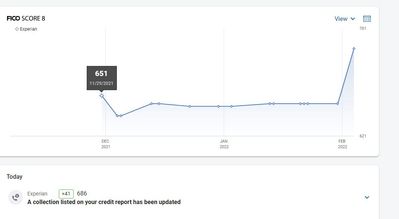

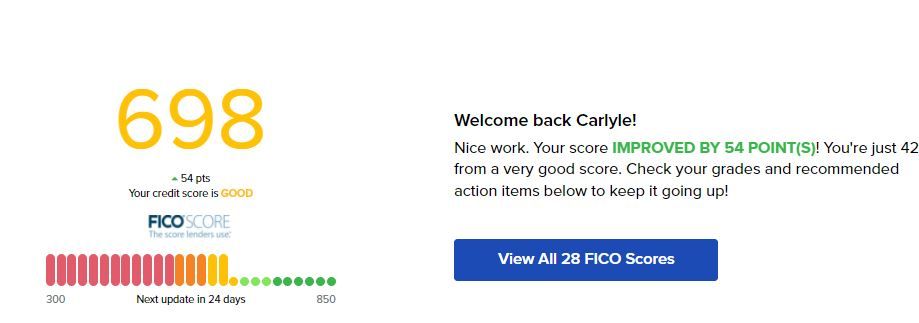

Ladies and gents!! WE UP 40!!! Now I'm not just good with FACO...even FICO is up up up!! It's a bird. It's a plane! It's SUPER FICO SCORES, falling from the credit heavens like sweat manna.

Charge off just updated, so now I should not get those phony utilitation hits that treat charge off balance like current util. This alone could save me a ton with my mortgage. Onward...upward!

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

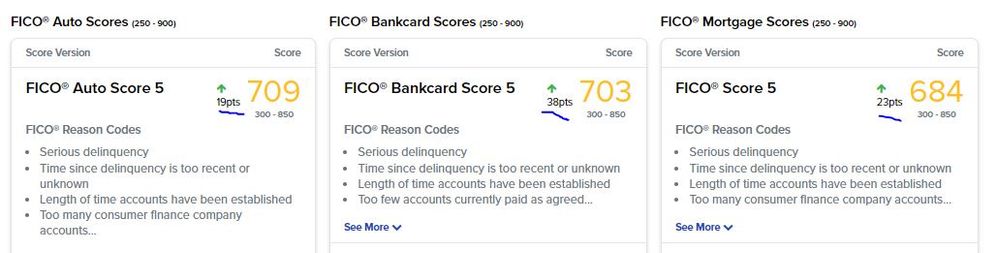

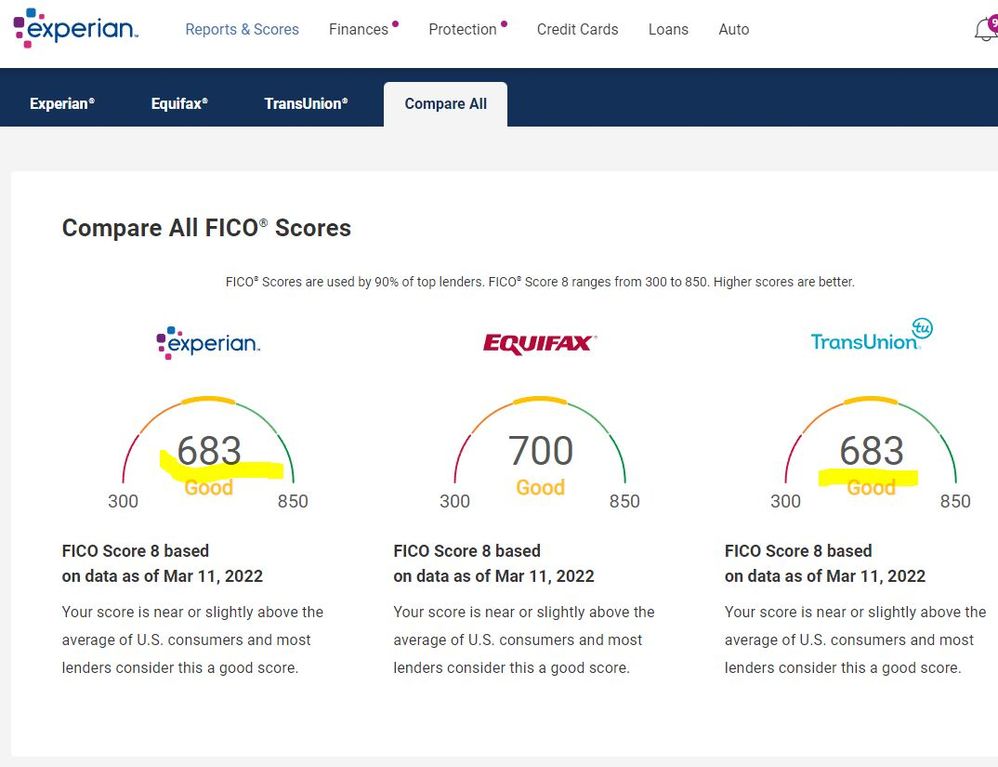

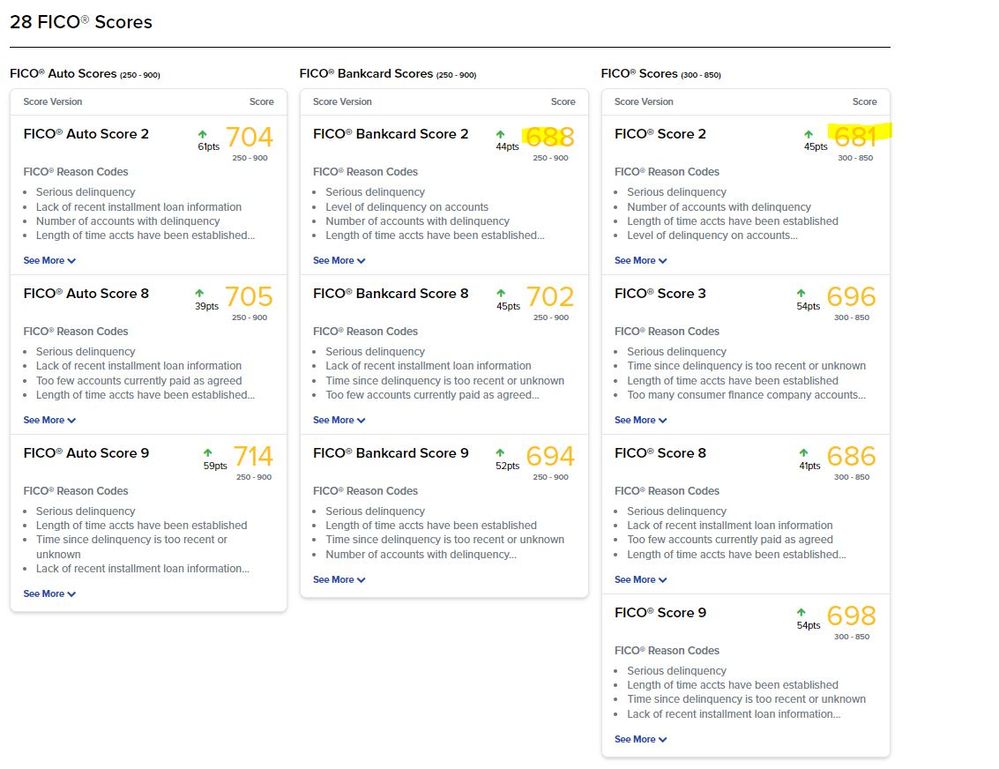

FICOs are starting to break into 700s!!

Only thing been happening is my cards are now quet. All transactions on single card also have not reported more than $300 total all year. My Cap1 late is still visible. One of my reports got screwed up by bank. $0 balance post charge off pay off, got reversed. Now it looks like I owe that money.

I've had maybe 6-7 mortgage inquiries.

New card still have not reported yet with it's $18k limit, so all my transactions have not been reported yet. All other cards are $0. Total debt is $0.

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

So my FICO scores are bursting through that 700 mark some are already passing through 740ish. So my goal of reaching 740 by mortgage closing, is in site. I believe that gets me prime mortgage rates? Of course I need the MIDDLE score to hit 740 for it to count. So the last moves again was December charge of paid in full, which gave me 30-40 points in early february, then credit union screwed me on one of the reports by reverting the pay off, so lost the points there. That was just corrected so should be back up soon. Other than that I've just been quiet on credit activity. All cards inactive but one with tiny balances.

So I'm running out of big moves, but I do still have some pending score boosting actions:

With charge off removed I can possibly:

-Graduate BofA secured, with possibly a CLI. So those two things can help?

-TD Bank might finally auto increase my $1k unsecured which has been solid for 3-4 years now

-Still trying to remove my Cap1 late.

-My NFCU $18k limit is pending to be reported for first time, which will push my available limit to $28k

After that, I've got nothing else that I can do, other than keep things quiet and let time pass. So hopefully most of the things above occur because they are the only things I have that could make significant moves now. After that, I expect a slow process that will not be relevant to the closing of my mortgage.

Already making offers on homes BTW. I've had about 4-5 mortgage inquires with no noticable decrease in score. I'm about to cross the 30 day threshold however, so if I get another inquiry for morgage, I'm afraid it might finally impact my score, so I really hope the next inquiry is the final closing inquiry.

It's a really good feeling seeing everything finally working out. It was a long hard journey getting here! Just 5 years ago I think, I was 570ish with no credit cards, struggling to pay my bills and occasioannly wondering if homelessness was in my future. Now I'm making offers on million dollar homes about to cross 750 score, with 800 in site by years end...

What a way to come out of the 'Pandemic era'. You guys are part of this journey! Thanks so much to all the contributers on this site! ![]()

j

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Congrats on all the progress!

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Paying off the CO would be always good. Even if the underwriter does a manual review you can explain and they will understand. I would agree that BOA is holding off your cli due to the CO. I have one unpaid CO on my account and I tried several times for a cli on BOA account and it was always declined. I paid off the CO about a month ago and waiting for it to be updated on my credit reports. Hopefully BOA might give me a cli once paid CO starts reporting. Go for it and take care of your CO. Would love to hear from you and your successes in your credit building journey.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

@Red1Blue wrote:Paying off the CO would be always good. Even if the underwriter does a manual review you can explain and they will understand. I would agree that BOA is holding off your cli due to the CO. I have one unpaid CO on my account and I tried several times for a cli on BOA account and it was always declined. I paid off the CO about a month ago and waiting for it to be updated on my credit reports. Hopefully BOA might give me a cli once paid CO starts reporting. Go for it and take care of your CO. Would love to hear from you and your successes in your credit building journey.

I will let you know results of BofA, once I confirm what they will pull has been updated already.

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

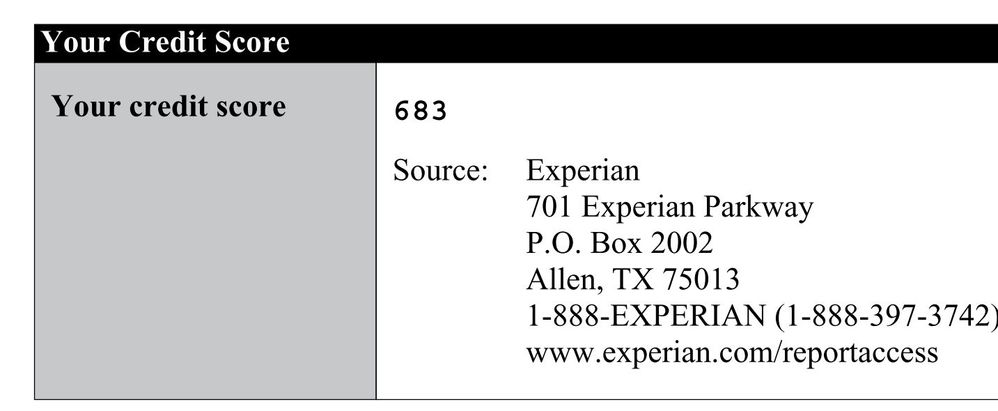

Just sharing a real mortgage score with what I see in Experian:

[Score from mortgage lender]

Score I see in my experian account:

Here are credit.com scores:

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Great job! I'm real close to your numbers, and scenario as a whole. I'll be sure to follow this one to see how things pan out.

Starting Score: 547EX

Starting Score: 547EXCurrent Score: 694EX 689EQ 696TU

Goal Score: 750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Journey from 580 to 800. 3 year credit file over 40. Mortgage soon.

Just as an FYI, the scores that you posted are Vantage scores from Credit Karma. Those are totally irrelavent and no lender uses those. You need to be looking at your actual FICO scores, speciflcally your FICO mortgage scores if you are planning to go for a mortgage in the future.