- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Late Payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late Payments

Hi,

I recently started learning about credit scoring cause I want to buy a home. However I have one recent late payment in Jan, and a handful of late payments over the course of the last year. Not cause I could not pay them, but the fact of the matter is I just did not really understand the rules of how credit works, I was horrible with money management, and just didn't know that it could affect you so bad when seeking a loan. I have only had credit cards for a few years actually. 4 1/2 years in total.

Now, I have a clear understanding of how things work, I have been doing a ton of credit education and I have paid down all my credit cards, but I know these late payments are really hurting me. So here is my big question...... If I keep my credit utilization low, at zero, does this still report to the 3 agencies as paid on time month to month, or do I litereally need to keep a tiny balance, and then just pay those small balances on time to get credit for on time payments?

Also, I know that late payments can stay on your report for 7 years, but how long do they actually have a heavy impact on your score? I understand that they have less of a impact as time passes, but what is this time frame?

Once I can figure this out and can work on getting my on time payments back into the 98%-99% over the course of the next year or two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

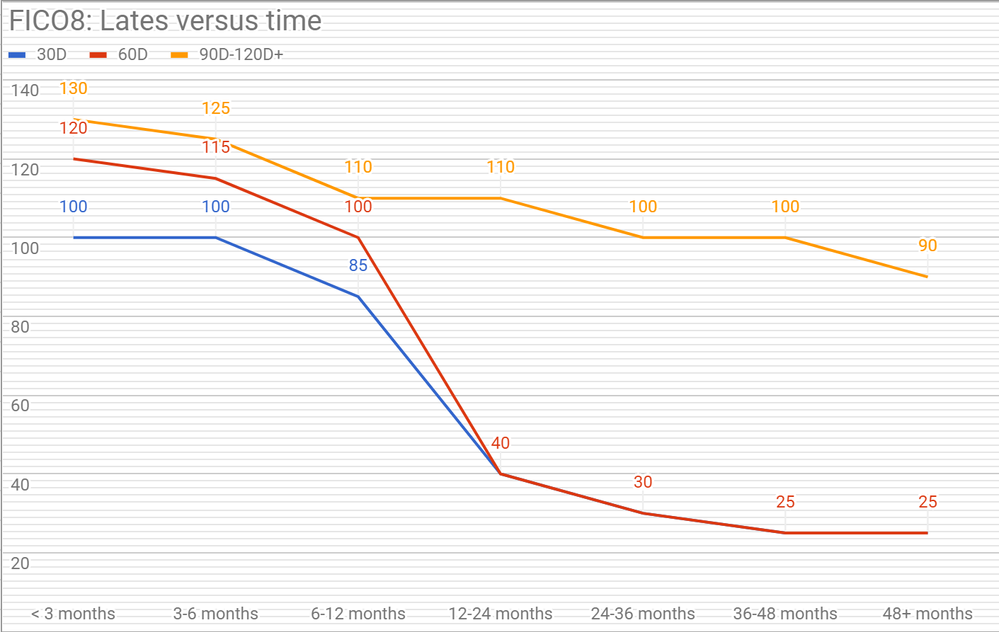

If you could list the lates and who they are with. Maybe. Just maybe it might be a GW success from past posts where members were successful with getting them removed. Otherwise here's a chart CGID used before on how lates affect scores. YMMV.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@Anonymous wrote:Hi,

I recently started learning about credit scoring cause I want to buy a home. However I have one recent late payment in Jan, and a handful of late payments over the course of the last year. Not cause I could not pay them, but the fact of the matter is I just did not really understand the rules of how credit works, I was horrible with money management, and just didn't know that it could affect you so bad when seeking a loan. I have only had credit cards for a few years actually. 4 1/2 years in total.

On time payments and utilization are the most important factors in scoring. Utilization can be fixed easily and has no memory, but missing payments "hurts" for quite a while. Dont sweat the ones you missed already, that's past now. Focus on making sure everything is paid on time.

Now, I have a clear understanding of how things work, I have been doing a ton of credit education and I have paid down all my credit cards, but I know these late payments are really hurting me. So here is my big question...... If I keep my credit utilization low, at zero, does this still report to the 3 agencies as paid on time month to month, or do I litereally need to keep a tiny balance, and then just pay those small balances on time to get credit for on time payments?

Yes, it will still report as long as there was activity during that period. Statement balance is not needed for card to report.

However, have at least one card report a balance, because if all cards report $0, there is a scoring penalty

Also, I know that late payments can stay on your report for 7 years, but how long do they actually have a heavy impact on your score? I understand that they have less of a impact as time passes, but what is this time frame?

That depends on severity of lates. They impact score the whole time, but number of points depends on number and severity of lates.

In your case, the one from January is going to hurt for a while. You can use the chart provided by @FireMedic1 as a guideline

Once I can figure this out and can work on getting my on time payments back into the 98%-99% over the course of the next year or two.

Dont worry about that percentage stuff. That's CK material. Fico does not "care" about percentage of on time payments. You either have derogs or you dont.

The most important thing is not to let it happen again. I'd set autopay for at least a minimum payment just in case