- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Law Office vs Creditor

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Law Office vs Creditor

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Law Office vs Creditor

HI all!

I'm brand new here and new as of 1/2023 to re-building my credit. I am trying my absolute best to clean up any baddies and I've had good payment history on ALL open accounts for 12 months now. I am hoping to buy a new car this summer and a home early next year. I'm a noob at all of this.

As of 1/3/23, my scores were as follows (not horrible - I've been in a much worse spot, but not the best): Equi 603 (jumped to 626 this week), Trans 614 (up to 617 now), Exp 629 (pulled from myfico). I'm waiting for my next update, but they should jump significantly as I paid off 11 medical collections and have nothing showing in collections now.

All of that said, my questions/situations are as follows:

1. I had a charge off on a Crate & Barrel card with the delinquency date of 2/2019. It was sold to LVNV last year in August and I got my last offer to pay 12/30/22. I called on 1/3/23 and they said that C&B called back and asked for the debt back. LVNV removed it from my credit, and now I'm waiting to hear from either C&B, Syncrony, or a collection agency/lawyer. If I am contacted by a collection agency, should I pay it at this point? I'm 2 years away from them being able to sue me. BUT if I'm contacted by a lawfirm, I HAVE to pay it, correct? (it's currently not showing on any report)

2. For any other charge offs I have, 2 part question: 1 - do they fall off/get removed entirely after 7 years? (I just don't want to see them anymore lol). 2 - Is it from the FIRST delinquent payment or the most recent delinquency?

Thanks in advance for any help, tips, tricks, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

Welcome @BigGoalsBy40

Might have been pulled back to assign it to another CA with lawyers. Cant say here comes the lawyers just yet. Maybe someone who went threu the same situation can chime in. CO's fall off 7yrs after the first 30 day late that led to the CO date. Congrats on getting all the CA's in the past. With the hopes of homeownership in the future. All debts will have to be $0 balance. More you can get settled and paid. Better for the home. I'd go home first then car. Dont want new auto loans a year before applying for a mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

Not sure if this is the same thing you are experiancing, but I have had wierdness with LVNV in the past too. I had 2 collections from old Capital 1 cards with LVNV, one was serviced through Resurgent Capital Services and the other was assigned to TrakAmerica. The one with Resurgent was easy to take care of and was removed from my credit report shortly after settling with them.

The one assigned to TrakAmerica has been a big pain to deal with. They are the "lawyer" group LVNV uses. Every time I called to try and take care of this after getting back on my feet, they kept telling me that my account has not been assigned to a Lawyer yet and to call back in a week. I kept calling TrakAmerica about this account for 3 months straight and finally gave up last October. Fast forward to now, I still have not had any communication from them and they are now past the SOL which I intend to use as a barganing chip if they do finally communicate with me. I am not going to proactively attempt to contact them anymore for a collection account that is over 4 years old and that I did at least try to proactively take care of in good faith. However, I am not looking to buy a house in the near future either, meaning I can afford to wait it out a bit. The original tradelines with Capital 1 are no longer on my credit reports, so the impact of this collection account has a smaller blast radius.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

@ForwardLooking wrote:Not sure if this is the same thing you are experiancing, but I have had wierdness with LVNV in the past too. I had 2 collections from old Capital 1 cards with LVNV, one was serviced through Resurgent Capital Services and the other was assigned to TrakAmerica. The one with Resurgent was easy to take care of and was removed from my credit report shortly after settling with them.

The one assigned to TrakAmerica has been a big pain to deal with. They are the "lawyer" group LVNV uses. Every time I called to try and take care of this after getting back on my feet, they kept telling me that my account has not been assigned to a Lawyer yet and to call back in a week. I kept calling TrakAmerica about this account for 3 months straight and finally gave up last October. Fast forward to now, I still have not had any communication from them and they are now past the SOL which I intend to use as a barganing chip if they do finally communicate with me. I am not going to proactively attempt to contact them anymore for a collection account that is over 4 years old and that I did at least try to proactively take care of in good faith. However, I am not looking to buy a house in the near future either, meaning I can afford to wait it out a bit. The original tradelines with Capital 1 are no longer on my credit reports, so the impact of this collection account has a smaller blast radius.

LVNV is really Resurgent. All links from LVNV lead to them. Have you tried contacting Resurgent?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

@FireMedic1 wrote:

@ForwardLooking wrote:Not sure if this is the same thing you are experiancing, but I have had wierdness with LVNV in the past too. I had 2 collections from old Capital 1 cards with LVNV, one was serviced through Resurgent Capital Services and the other was assigned to TrakAmerica. The one with Resurgent was easy to take care of and was removed from my credit report shortly after settling with them.

The one assigned to TrakAmerica has been a big pain to deal with. They are the "lawyer" group LVNV uses. Every time I called to try and take care of this after getting back on my feet, they kept telling me that my account has not been assigned to a Lawyer yet and to call back in a week. I kept calling TrakAmerica about this account for 3 months straight and finally gave up last October. Fast forward to now, I still have not had any communication from them and they are now past the SOL which I intend to use as a barganing chip if they do finally communicate with me. I am not going to proactively attempt to contact them anymore for a collection account that is over 4 years old and that I did at least try to proactively take care of in good faith. However, I am not looking to buy a house in the near future either, meaning I can afford to wait it out a bit. The original tradelines with Capital 1 are no longer on my credit reports, so the impact of this collection account has a smaller blast radius.

LVNV is really Resurgent. All links from LVNV lead to them. Have you tried contacting Resurgent?

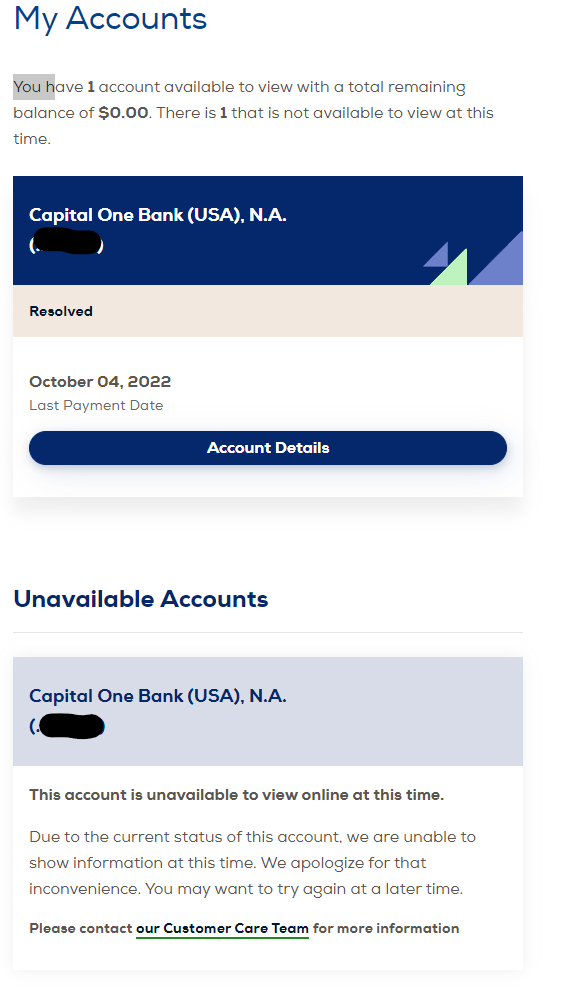

Yes, they are the ones that reffered me over to TrakAmerica via the Resurgent customer care team. Below is the account listing, top one was the one I was able to take care of and the other is listed as "Unavailable". It has been like that for well over a year and neither Resurgent or TrakAmerica would talk to me about the account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

Well you can file a complaint with the CFPB that you are trying to pay the debt. And no one will give you the time of day. Upload the above to them. The only way they shouldnt talk to you if they no longer owned the debt. Make sure it wasnt sent back on annualcreditreports.com to the OC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

@FireMedic1 wrote:Well you can file a complaint with the CFPB that you are trying to pay the debt. And no one will give you the time of day. Upload the above to them. The only way they shouldnt talk to you if they no longer owned the debt. Make sure it wasnt sent back on annualcreditreports.com to the OC.

It is not with the OC, at least not 2 days ago when I last pulled. CFPB was my next step, but I was waiting for the SOL to cool down a bit as it was just reached last month and I don't want there to be any question about it by them. My plan was to pick this up again to get sorted out in March.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Law Office vs Creditor

1. No, just because you're contacted by an attorney office, doesn't mean you have to pay it. There are many law offices that specialize in consumer debt. For the most part they're still just debt collectors with the only difference being the capability to pursue you on their own. They still can't threaten legal action unless they intend to take it. If they mention it, start negotiating a settlement and payment plan because they will follow through. That being said if it doesn't make fiscal sense to pursue, they'll sell the debt.

What you're thinking about is when they actually sue. You normally won't be contacted beforehand. You'll either be served the case documents or will start receiving ads from consumer protection attorneys for your business. Those letters will have case information that you can verify with the courts.

Having said all that, if it's not being reported yet, it may be in your best interest to be proactive and hunt it down. Offer to pay in exchange for not reporting.

2. Chargeoffs can be reported for up to 7.5 years from the date of your first delinquency. When they're actually removed is dependant on the bureau. Some at the start of the following month, some on the date of, some at 7 years, some later, etc.