- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Letter from Convergent Outsourcing

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Letter from Convergent Outsourcing

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter from Convergent Outsourcing

I got a collection letter from Convergent Outsourcing saying I owe Velocity Investments $404. Two things are confusing.

1. Velocity is a collection agency and lower down on the letter it says Sprint was the original creditor.

2. I haven't had a Sprint account since 2005 but Convergent is saying that I still owe the debt.

The agent was trying to tell me there was no statute of limitation on a debt and that I still owed it. I informed them I haven't had Sprint since 2005 and that I don't owe the debt "even if it had gone to collections in 2005". I did not say the part in quotes out loud.

Should I still bother mailing a letter disputing the debt that they can't legally add to my credit report or be proactive and send to a letter to avoid any possible headache.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

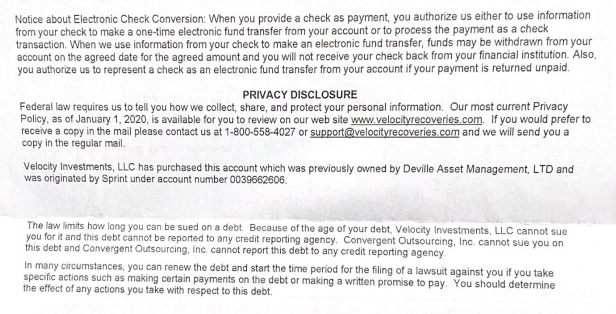

The agent possibly violated the FDCPA by claiming there was no SOL on the debt. Did the letter include a disclaimer stating that the account is time-barred or a statement that begins with "due to the age"?

Anyway, if you never revived the debt by making payments in the last few years, you could send a cease and desist letter stating that you dispute the referenced account and demand that Convergent cease and desist all collections efforts.

It is not necessary to reference the FDCPA or the fact that the account is time-barred.

Does the letter include an address for Velocity or just for Convergent?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

I just read this on the back of the letter. I think I am safe to ignore them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

It's definitely safe to ignore them. If you want to send a C & D you can, but it wouldn't stop a different debt collector from attempting collection efforts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

It should be completely illegal for them to contact people on a debt that is not legally collectable. It's completely shady.

Loans:

Revolving Accounts (in the order they were opened):

Closed accounts:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

@MileHigh96 wrote:

It always makes me wonder every time I see these kinds of posts. Do these bottom of the barrel CA's send out these collection letters hoping that someone doesn't know their rights under the law and they will just send in payment? Or do something that would trigger a new start on the SOL on the debt?

It should be completely illegal for them to contact people on a debt that is not legally collectable. It's completely shady.

These bottom feeders are looking for just that, the unwary and ones who have no idea of their rights. Most are scared of collectors, they make all kinds of threats even though the law barrs them from doing so and in doing this most will just pay it. This is how outright fraudsters also operate when they make up debts and then demand immediate payment or else.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Letter from Convergent Outsourcing

@MileHigh96 wrote:

It always makes me wonder every time I see these kinds of posts. Do these bottom of the barrel CA's send out these collection letters hoping that someone doesn't know their rights under the law and they will just send in payment? Or do something that would trigger a new start on the SOL on the debt?

It should be completely illegal for them to contact people on a debt that is not legally collectable. It's completely shady.

Yup, pretty much. I agree it's shady, but unfortunately legal. Now, some DO use illegal tactics to get paid, but as @gdale6 pointed out, most people don't know and don't try to research the laws about what CAs can and can't do. But trying to collect is legal, as long as they provide that disclaimer when it's time-barred and as long as they don't lie about your rights (which again, some do, as is the case in OP's post).

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores: