- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- MooseMoney's Progress Thread!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MooseMoney's Progress Thread!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

Some details on my Inquiries:

TU: 2

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

- Mar 2018 - Local Credit Union Savings Account opened - ages off Mar 2020 (did not realize they were going to do a credit check to open a savings account *facepalm*)

EX: 1

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

EQ: 3

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

- Jan 2018 - Discover IT Secured Card - ages off Jan 2020

- May 2018 - Comenity Ulta Card - ages off May 2020 (I used SCT on this but went through as a HP)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

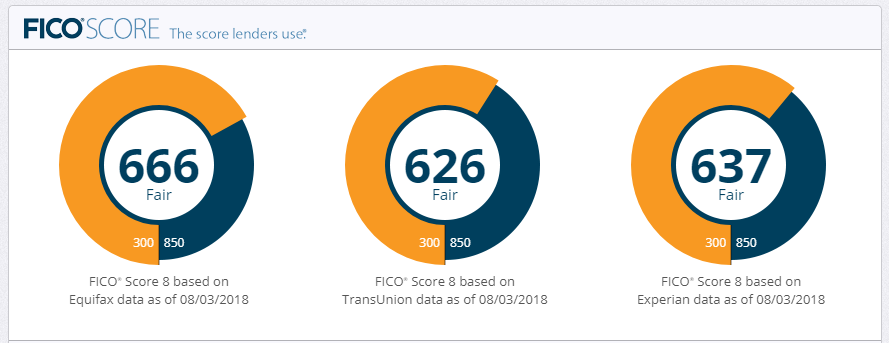

Finally signed up for a paid MyFICO account. Turns out my TU score DID increase in July!

EQ is spooky! LOL

Some other things I am seeing:

- My Experian does indeed show my mortgage as being low balance and/or substantially paid off. That is the most likely reason for the 20 point jump this month

- My FICO 9 scores are way higher (EQ:712, TU:662, EX:649), so when lenders decide to switch to that model, I'll be happy

- The old charge-off card is doing a significant amount of damage and that needs to be my number one priority

I'm loving the paid subscription so far! ![]()

Amended monthly change to my scores:

- EX: 637 (+20 this month, +75 since 01/31/18, +162 since 06/30/17)

- TU: 626 (+11 this month, +64 since 01/31/18)

- EQ: 666 (+14 this month)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

Congrats, I really like the myfico subscription. Especially being able to see the other versions of my scores. Those have turned out to be really useful.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

August 2018 End / September 2018 Start Update

My scores took a dip this past month due to a couple things, the biggest being a reemergence of an old collection account. Back in June I signed up with Collection Shield 360 with help in removing an old unpaid collection from my report. It did in fact go away, and was gone for a couple months. I thought I was in the clear, but in August it reappeared. ![]() This is mostly reflected on my EQ score, because my EX and TU already showed a paid off collection. My EQ had no collections at all, so this one popping up was a big hit to that score.

This is mostly reflected on my EQ score, because my EX and TU already showed a paid off collection. My EQ had no collections at all, so this one popping up was a big hit to that score.

So here's my September 1st update:

FICO 8 Scores:

- EX: 636 - down 1 point from last month (+74 since 01/31/18)

- TU: 625 - down 1 point from last month (+63 since 01/31/18)

- EQ: 646 - down 20 points from last month (do not have 01/31/18 score)

Inquiries:

- EX: 1

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

- TU: 2

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

- Mar 2018 - Local Credit Union Savings Account opened - ages off Mar 2020 (did not realize they were going to do a credit check to open a savings account *facepalm*)

- EQ: 4

- Nov 2016 - Mortgage Retention credit check - ages off Nov 2018

- Jan 2018 - Discover IT Secured Card - ages off Jan 2020

- May 2018 - Store Card - ages off May 2020 (I used SCT on this but went through as a HP)

- August 2018 - Store Card - ages off August 2020

Total Open Accounts:

- EX: 1 Mortgage, 3 CC, 1 Charge-Off, 1 Collection Paid in Full (ages off Sep19), 1 Collection w/ Balance

- TU: 1 Mortgage, 3 CC, 1 Charge-Off, 1 Collection Paid in Full (ages off Sep19), 1 Collection w/ Balance

- EQ: 1 Mortgage, 3 CC, 1 Charge-Off, 1 Collection w/ Balance

Total Derogs:

- EX: 1 Charge-Off, 1 Collection Paid in Full (ages off Sep19), 1 Collection w/ Balance, late payments on mortgage

- TU: 1 Charge-Off, 1 Collection Paid in Full (ages off Sep19), 1 Collection w/ Balance, late payments on mortgage

- EQ: 1 Charge-Off, 1 Collection w/ Balance, late payments on mortgage

Misc Notes:

- I received my Discover IT Secured Card's 8th statement at the beginning of this month, and I must have graduated to an unsecured card! My limit was the $400 security deposit I paid in as of yesterday, but this morning I see my limit is now $2000! This is very exciting for me! (I made a seperate post about my Discover story here.)

- I am still loving my paid MyFICO subscription

- I wouldn't suggest using Collection Shiled 360 to anyone, seeing as they were only able to have my derog removed temporarily.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

you are a symbol of hope for me , also making me crave the discover IT secured more (was declined) thinking about calling and seeing if there is any possibility that they can reconsider as thats a great card to have with all I've seen here. many kudos to your recovery efforts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

I didn't update last month because I haven't made any huge leaps, but I wanted to pop in today to say my EQ jumped to 671 this morning, in the "good" range! *happy dance*

Here are my stats as of today:

FICO 8 Scores:

- EX: 660

- TU: 641

- EQ: 671

Inquiries:

- EX: 0

- TU: 1

- Mar 2018 - Local Credit Union Savings Account opened - ages off Mar 2020

- EQ: 3

- Jan 2018 - Discover IT Secured Card - ages off Jan 2020

- May 2018 - Store Card - ages off May 2020 (I used SCT on this but went through as a HP)

- August 2018 - Store Card - ages off August 2020

I haven't opened any new accounts or gotten any derogs removed yet, but my Ulta card is 6 months old this month so I will trying for a CLI. Other than that I'm using my Old Navy and Ulta card a little bit each month and paying in full before the statements cut, and my Discover I have been using a LOT (for the cash-back) and pay in full every Friday, making sure the card reports a balance of less than $150. I'm still working on getting things situated to try for a new bank card in January when my mortgage shows 24 straight months of perfect payments, but I haven't decided on which one to try for yet (but I have narrowed it down to a couple options).

I can't thank you guys here enough. As you can see in my signature I started with horrific numbers, and now I've got a toe in the "good!" Hard work and persistence does pay off!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

Congrats on that EQ score jump! All around nice progress!

FICO 8 (Sept 2022):EX- 706, TU- 685, EQ- 684

What's in my wallet:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

Year End update!

I haven't been focusing too much energy on my FICO scores as of late. I've been using my cards and paying them off in full, doing the AZEO method. My current scores are:

EX: 660

TU: 652

EQ: 672

That means, I hit my 2018 goal of hitting 650 across the board!!!

January my mortgage will be reporting 24 months straight of on-time payments, so I think I may get a tiny bump from that. I had planned on trying for a fourth card in January, but I think now I am going to wait until I do the PFD with Applied Bank. I have an email from them confirming they will indeed delete teh TL once it's paid, but I still haven't done that *facepalm*

Once I do that I will wait for the bump and then try for a fourth card. At least that's the plan. ![]()

My 2019 goal is to get to 700 by the end of the year. Wish me luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

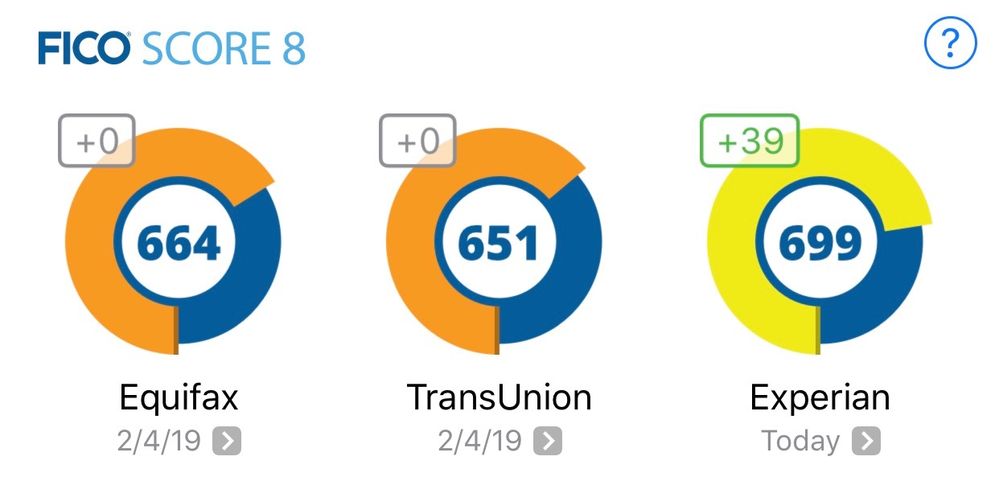

I finally did my PFD with Applied Bank, and the letter said it should be gone by 03/25/19 at the latest. Looks like it came off my EX already. I will update any more changes, and if anyone wants contact info to clear an old Applied Bank charge-off from their report, send me a message and I'll be happy to share that with you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MooseMoney's Progress Thread!

Applied Bank $920 came off my Transunion and my TU score jumped 59 points ![]()