- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- My credit line was lowered - how does it affect sc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My credit line was lowered - how does it affect score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My credit line was lowered - how does it affect score?

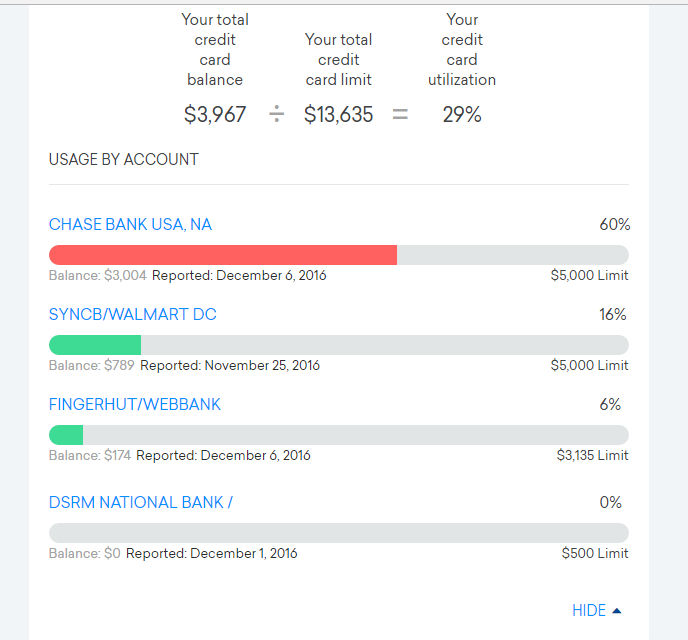

I thought having my credit limit(s) lowered would be a good thing because I just kept getting raises and I was thinking that would worry future creditors that I had access to more than I could pay one day. But one CC just sent me a letter saying that they had reviewed my account and decided to lower my limit due to me paying a few days past the due date the past couple of statements. I was surprised by that but I'm thinking that's ok until I go to CreditKarma and see what my current utilization rate is. That account (Chase) was just lowered to $3400, I owe $3004 on it and have no way to pay it down just yet. So if I did the math right that will mean that my utilization rate will be 33%. That is not too good huh? If I remember correctly I need to keep it under 20% for a good score?

Another question, I kind of thought that my score would be higher by now. My score is mostly just fair to right on the other side of good at 694-729. I've had the DSRM (Valero gas card) & Fingerhut accounts for about 3 1/2 years, the Wal-Mart card (which was just updated from the store card to the MasterCard) for 2 years and the Chase (Amazon) for over a year. I've been making regular payments, paying large chunks here and there and still using them to keep them active. Is it the large balance on the Chase card? Does me only making minimum payments more often than not figure into my score somehow? I just don't get it. Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

Your overall utilization is 36 percent, but for that Chase card, your utlization is 88 percent ... not good.

And actually, to the contrary, having higher limits help deal with utlization issues like this.

Under 20 is good, under 10 is better.

Making minimum payments is better than making no payments, but carrying balances also means you're paying interest, so you're losing money.

If you can, make a big payment on the Chase account ... like $1000 if you can.

Pay off Fingerhut ... there's no sense in carrying a balance there.

Make above minimum payments on the Walmart card, but get that Chase down. It's killing your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

Okay, just to be clear, "paying a few days past the due date" is not okay. It isn't a late payment in terms of credit reporting but it invites adverse action (AA) from your creditors. ALWAYS pay your cards on time.

I agree to get rid of that Fingerhut balance immediately. I would personally keep paying the minimum on the Walmart and dump ANY extra money into the Chase to lower the utilization. Because you're going to immediately be pushing 90% on the Chase card, I'd do my best to get that down under 50% and then work on paying both cards off from there.

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

No, you get rid of the Chase balance first. What Chase did was the first salvo in the "Balance Chasing" war - as you pay down the balance they will continue to lower your credit limit so that you always have a 60%-90% utilization with them. What looks better - the other cards with 15-5% utilizations or Chase with 60-90% utilization? Chase is telling you they no longer want you as a customer - take the hint, get rid of them and find someone else to dance with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

I don't understand why Chase wouldn't want me as a customer. Aren't they making more money off me in interest charges with me just paying the minimum balance? I can understand them bringing my limit down though. But like I said, I've made large payments to them before and then make more charges etc. Thought that's what they liked?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

Why don't they want you as a customer? Simple - you are paying them off without going right back in debt. They are afraid you will pay them off completely and become a poor credit risk. In the modern world, people with lots of debt are good credit risks, people with no debt are bad credit risks. The month I paid off my mortgage my FICO score dropped 40 points!!!! No more debt, bad risk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My credit line was lowered - how does it affect score?

@Anonymous wrote:Why don't they want you as a customer? Simple - you are paying them off without going right back in debt. They are afraid you will pay them off completely and become a poor credit risk. In the modern world, people with lots of debt are good credit risks, people with no debt are bad credit risks. The month I paid off my mortgage my FICO score dropped 40 points!!!! No more debt, bad risk.

This statement is completely false.

They are balance chasing the OP because he doesn't pay them on time and they most likely want to end the relationship.

As for your scores dropping because you paid off your mortgage, do some research. That's what happens when an installment loan is paid.