- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Need help figuring out my credit reports and what ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help figuring out my credit reports and what steps to take first

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help figuring out my credit reports and what steps to take first

So I am currently in the market for a "new to me" vehicle in the next few months if possible. However, after ignoring my credit file for far too long, I've got some issues I need help wrapping my head around.

I would love for some of the moderators or members here with a lot of knowledge regarding the "rebuilding your credit" portion of this site to PM me if you'd be willing to take a look at portions of my credit reports and help me decide what steps to take.

Here are some things I'm having trouble with:

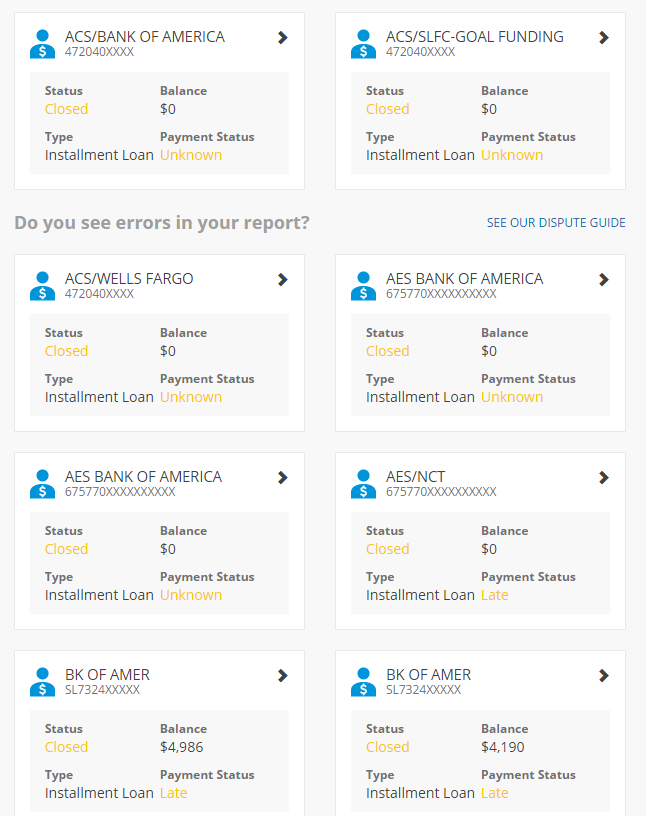

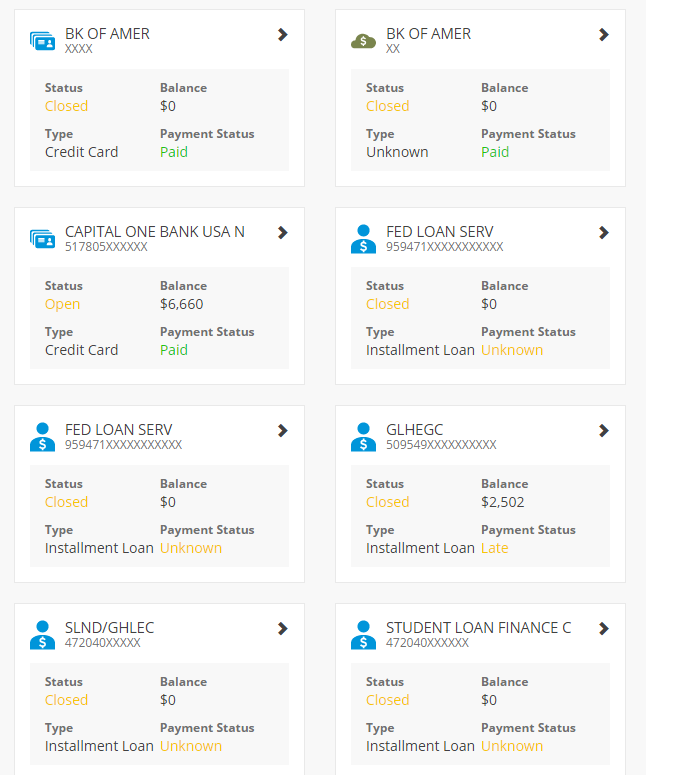

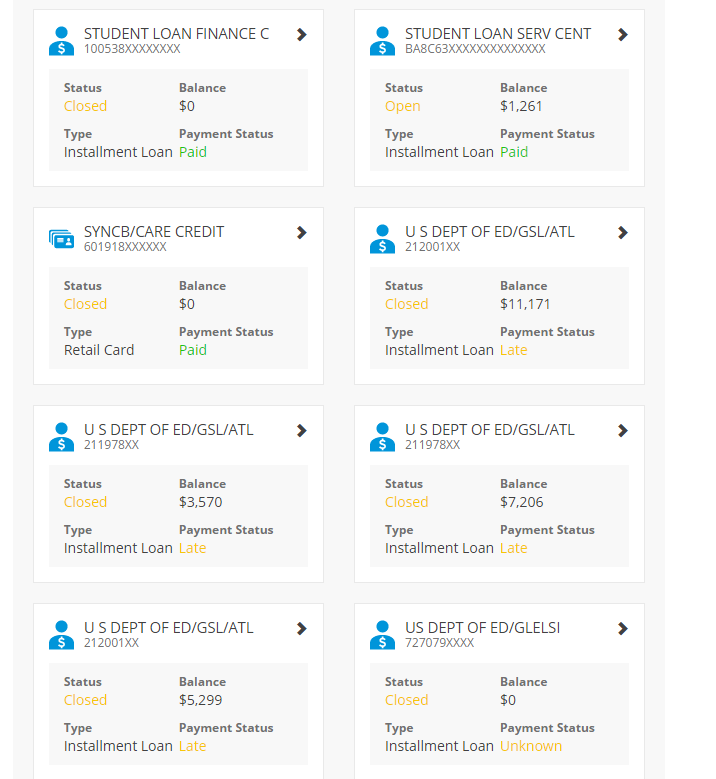

Figuring out certain student loan tradelines that have been transferred/closed/charged-off and which ones can be disputed/removed or will fall off my record or stop hurting my scores.

What are the best options for dealing with my private loans that have gone into default....settle? ignore?

Rehabbing federal loans currently, have 7 private loans in negative status, reporting badly

Credit card almost maxed out (94%), help figuring out best ways to tackle it. Only card on my record. Be an authorized user on someone else's account? Get a secured car?

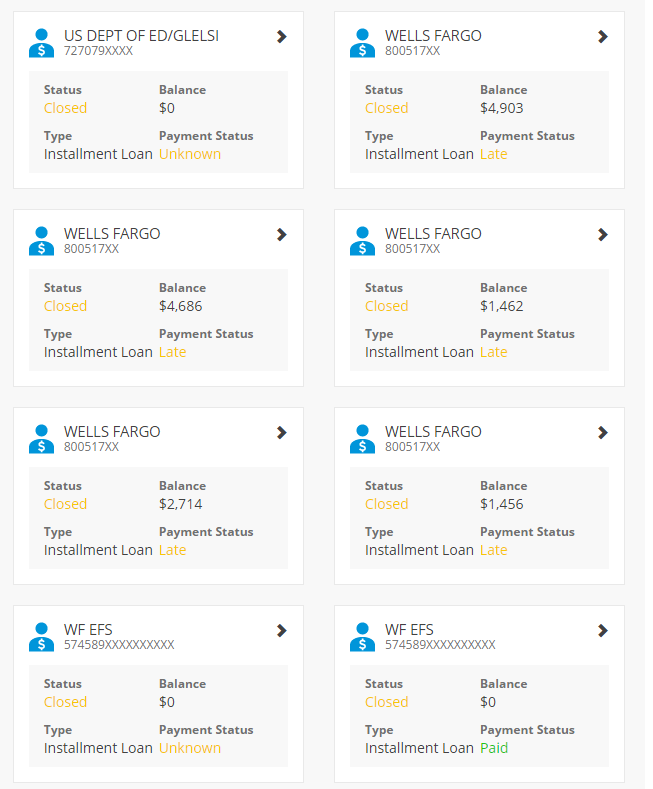

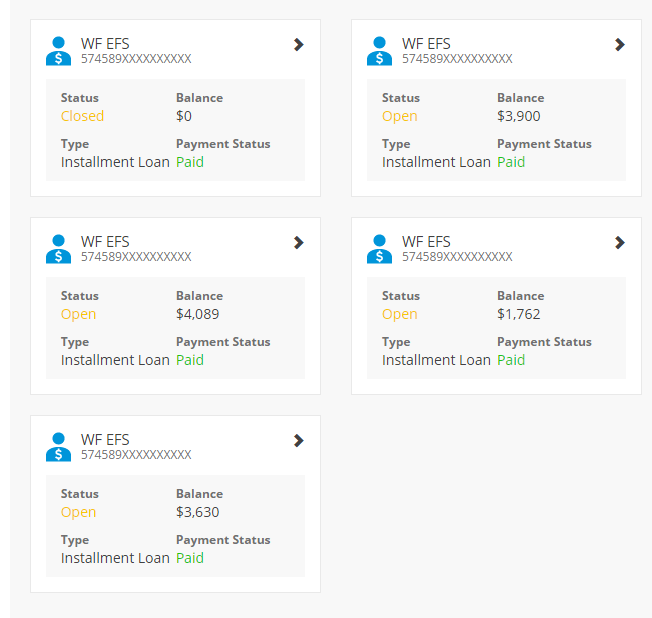

5 private student loans reporting paid but they have lates in their files - through Wells Fargo

I can certainly share certain things on this board with everyone but I could really use someone here that would be willing to really help me out so I don't have to constantly clog up the board with all my questions.

I just need some help clarifying some things so pretty please someone have pity and help a girl out : )

Current scores

EX: 582

TU: 588

EQ: 608

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

Your best bet is to post the whole history for everyone to see minus identifying information. It takes a village around here. Also different people have different expertise so one super regular or mod may not have all the answers for you. Keep the bulk of your questions on the same thread so people can follow the story.

Current Scores: October 2017 EQ: 715 TU: 710 EX: 716

In My Wallet:

Cap1 QS: $4.8K - AMEX BCP: $4.2K - Old Navy Visa: $7K - Nordstrom $3.8K - VS $500 (FTW!)

BofA AU: $12K AMEX AU: $25K

Business: AMEX BCP $15K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

@egypt04 wrote:So I am currently in the market for a "new to me" vehicle in the next few months if possible. However, after ignoring my credit file for far too long, I've got some issues I need help wrapping my head around.

I would love for some of the moderators or members here with a lot of knowledge regarding the "rebuilding your credit" portion of this site to PM me if you'd be willing to take a look at portions of my credit reports and help me decide what steps to take.

Here are some things I'm having trouble with:

Figuring out certain student loan tradelines that have been transferred/closed/charged-off and which ones can be disputed/removed or will fall off my record or stop hurting my scores.

What are the best options for dealing with my private loans that have gone into default....settle? ignore?

Rehabbing federal loans currently, have 7 private loans in negative status, reporting badly

Credit card almost maxed out (94%), help figuring out best ways to tackle it. Only card on my record. Be an authorized user on someone else's account? Get a secured car?

5 private student loans reporting paid but they have lates in their files - through Wells Fargo

I can certainly share certain things on this board with everyone but I could really use someone here that would be willing to really help me out so I don't have to constantly clog up the board with all my questions.

I just need some help clarifying some things so pretty please someone have pity and help a girl out : )

Current scores

EX: 582

TU: 588

EQ: 608

Easiest way to gain points is paying down the card to under 10%. What is the balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

It's reporting currently as $6660/6800 but I've already gotten it down to $6310. Hoping to get it down under 6k in a week or two. I already asked for a limit increase and they said not until I pay more than the mimimum due. Can't really get a 0% transfer card at the moment b/c that would help out tons.

My stuggle is that I currently have $1500 saved for a down payment on a vehicle. Not looking until December where hopefully I'll have another $1000.

Where would the $ be best served to go?

I'm only going to get around $1000 for my trade-in.

Was quoted 14% loan with Santander already which I will not take.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

THE FED LOAN FOR $2502 IS ONE THAT IS CURRENTLY 6 MONTHS IN REPAYMENT ON THE REHAB FED LOAN PAYMENT PLAN - WON'T FALL OFF/TURN POSITIVE UNTIL JANUARY.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

THE $1261 ACCT IS MY PERKINS LOAN THAT IS CURRENTLY BEING PAID $40/MONTH SINCE I'M ONLY BACK IN SCHOOL PT - HOPE TO GO FT NEXT SEMESTER.

THE DEPT OF EDU LOANS JUST FINISHED UP THE FED LOAN REHAB PROCESS AND I AM CURRENTLY AWAITING THEM TO FALL OFF/TURN POSITIVE ON MY REPORTS. I HAVE MADE MY DISPUTES WITH ALL 3 AGENCIES APPROX A WEEK AGO BUT HAVE YET TO RECEIVE ANY OUTCOME YET.

THEY WERE PICKED UP BY GREAT LAKES. I WILL MOST LIKELY CONSOLIDATE THESE AND GO ON SOME SORT OF A PAYMENT PLAN.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

UNCERTAIN WHAT TO DO ABOUT THE 5 WELLS FARGO PRIVATE LOANS THAT WERE BEING PAID ON (NOT ENOUGH ACCORDING TO THEM) AND WERE SENT TO COLLECTIONS/CHARGED OFF.

I CURRENTLY STILL HAVE 4 IN GOOD STANDING THAT ARE BEING PAID....

THEY HAVE OFFERED ME SETTLEMENT ON EACH AT ABOUT 50% DISCOUNT. I HAVE NOT AGREED TO ANYTHING AS I'M UNSURE OF WHAT I SHOULD DO AND I DON'T HAVE THE FUNDS TO DO SO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

*THESE WERE TAKEN OUT YEARS AGO WHEN I WAS HAVING DIFFICULTIES IN SCHOOL (MEDICAL REASONS) AND WASN'T ABLE TO GET FINANCIAL AID (I WAS STUPID AND MY MOM CO-SIGNED ON THESE SO SHE IS LIABLE ALSO) WE'RE TRYING THE BEST WE CAN, I'D LOVE TO CONSOLIDATE THEM OR GET LOWER INTEREST RATES BUT HAVE NOT DONE SO YET.

3 ARE AT 7% INTEREST & 1 IS AT 10.24%

SO HERE IS MY UGLY CREDIT FILE FOR ALL TO SEE ![]()

LET'S HELP ME GET IT LOOKING PRETTY AGAIN PLEASE!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help figuring out my credit reports and what steps to take first

If you have completed the rehab on the federal student loans, then the derogs should be removed within two reporting periods.

Give it a bit more time....

As for loans that are now showing $0 balance, are they currently delinquent, or are they paid?

Showing of $0 balance can mean either that the debt was paid or that it was sold to a debt collector, who may then report a collection.

As for the accounts that you show a current status of paid, the balance should show $0.

Did you pay those accounts? if so, a simple dispute of the current balance would be appropriate.