- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Need help raising my score, please.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help raising my score, please.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

Will the BK go away in Jan? Should I wait until then?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

@martinkk wrote:My score ranges from 690-725 or so depending on what I let report on my cap1 card. The limit is 3500 and I use it a lot but pay it off pay off every month. If I don't remember to pay before due date, it reports hi and my score drops about 30 points. I'm wanting to add some other cards because I think it will improve my score to have more trade lines. Is this correct? Also, I have a bankruptcy 10/05 but no other collections. I have two cap1 car loans. One opened 2/09, the other 12/11. The only other cards I have are a small cap one (500) and a SAMs credit (600) that I never use. I have had them both for 3 or 4 years. Should I apply now? To where? How many? I'm so tired of this one acct impacting my score so much. I usually have to pay it more than once a month, though because I use it extensively. Really interested in raising my score. Any help would be appreciated. Thank you so much.

Welcome to the Forums martinkk!

I think you have a shot with Barclays and Chase Freedom. Your bk is about 7 years old and both Chase and Barclays have been known to have a little foresight with regards to these future potential customers. I think you will probably be denied for both on initial application but will get approved with recon calls to both afterward. This is with the assumption that you have a low utility showing- You have no recent lates or baddies other then the bk showing ,you have a decent income to back up the ability to pay, you haven't been apping recently and most importantly, you didn't include these lenders in the bk. Be prepared to explain your bk. be positive about your financial outlook and the desire to build new financial relationships. I give you a 75%+ chance at approval. Call the backdoor numbers listed on the credit card sticky. I definitely think it will behoove you to gain a few more tradelines to offset your utility issues when you use your cap 1 card. In the short term, you will probably see a hit to your FICO and long term, it will help you immensely. Just my 2 cents. ![]() I recommend the Chase Freedom and Barclays Apple Financing VISA.

I recommend the Chase Freedom and Barclays Apple Financing VISA.

Current Score: EQ 773, EX 780, TU 777 (All FICO)

Goal Score: 800+

Cards: NFCU Flagship 50K, DC 30K, BCP 28.6K, Arrival+ 25K, Citi DP 22.8K, CSR 20.5K, TotalRewards 25K, QuickSilver 20K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

Hi and Welcome to the forums martinkk,

Here's what I found for you......Oh and question.Which chapter of BK did you file for?

Bankruptcy: Chapters 7, 11, and 12 remain for 10 years from the filing date. Chapter 13 remains seven years from the filing date. Accounts included in bankruptcy will remain seven years from the date they were reported as included in the bankruptcy.

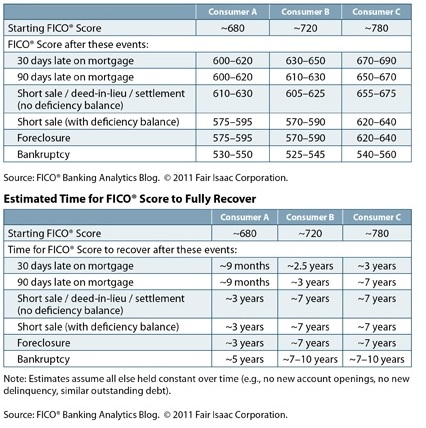

As for scoring, I believe you'll find this chart helpful..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

@LIGHTNIN wrote:Hi and Welcome to the forums martinkk,

Here's what I found for you......Oh and question.Which chapter of BK did you file for?

Bankruptcy: Chapters 7, 11, and 12 remain for 10 years from the filing date. Chapter 13 remains seven years from the filing date. Accounts included in bankruptcy will remain seven years from the date they were reported as included in the bankruptcy.

As for scoring, I believe you'll find this chart helpful..

This is a very helpful chart. Are there other, more obvious places that it is located?

$17k $8.5K Closed $19k $6.5k $24.2k Closed $5k Closed $8.5k Closed @2.49%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help raising my score, please.

I don't know why would you want another card when you don't really needed it......you had 3 right now why wouldn't you used it and rotate it somehow.....no offense but if I were you I would call the bank you had $5000 limit and ask them why they won't show on my report. Ask them a limit increase if you haven't for the last 6 months........also credit increase on Sam and Crappy one too......used your SAMs card a ill bit once in awhile.........I think you might also call them to convert to their Discover Sam card........

3 credit line and 2 loan should be good enough for your credit score.....it's just grow slowly I guess........

Starting Score: 560

Starting Score: 560Current Score: ?

Goal Score: 800