- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Need serious advice on my rebuild

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need serious advice on my rebuild

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need serious advice on my rebuild

So my data points. On my rebuild.

Eq 540 Ex560 TU543

1 paid collection..Convergent. $675(paid half) INQ...1 (EX I THINK)

Nov 2020..start rebuild

Capital one AU...$3800CL

20+YRS no lates 84% usage

Score Jan 2021

Eq588 Ex592 Tu602

1st CC Hughes federal credit union

Secured CL $2200

LOC $500

FEB 2021

Scores Eq 630 Ex651 Tu 656

2nd card AMEX Delta plat $1700 CL 24.67%

3rd card NFCU Platinum $3000 CL 5.99%

4rd card Credit one AMEX( thought it said capital one) $500 CL 26.95%

Scores Eq628 Ex 646 Tu650

Mar 2021

Personal loan HFCU $300( No loans on file. Thought I could do it like a SSL LOAN) NO..paid it off in April.

5th card Capital one( pre-approval mailer) $300 (3 INQ hits)

APR 2021

I do a true SSL LOAN NFCU $3150 paid it too $248 once it showed in my NFCU Accts.

My usage 63%

INQ 9

Score drops to 560-580'S

NO MISSED PAYMENTS

HIGH USAGE

Scores drop to 530-540's

Now I start to garden..2 cards too late.

I don't do the 91/3 USAGE too high.

AMEX ALWAYS PIF.

NFCU got to 80% usage. keep a balance 0%apr 12months

HFCU got to same but made good size payments.

LOC $400/ of $500

Credit one AMEX $350

CAPITAL ONE $225

SO I keep trying to bring down balances (can't for one thing or an other)

Pay down ...add it back on...

No lates no missed payments

May 2021

I applied for a personal loan at HFCU $1000... ( I live in Arizona..and my central air conditioner. Needed repair.. longest 110+ streak in 20 yrs..and 3 weeks out for first appointment to fix had to buy some window A/C's to get by...)

Back to gardening...

June July same no lates no missed high usage..

Scores Ex 595 Eq 588 Tu579

Aug 2021

I get my only derog deleted( Convergent)

Scores Ex620 Eq 625 Tu615

Usage 55%

I start to be able to pay down cards...

50% small increase in scores

43% same

Now I am at 36%

My scores are at.

Ex 699 Eq688 Tu714

But still on pre qualify sites for AMEX and NFCU only secured cards come up.

My AMEX score is 681

My NFCU score is 689

I plan to 0 out my 2 small cards now.

And get my NFCU card to under 870..right now it is at $1612

So for this months totals per card will be.

AMEX $0 always pif

NFCU...$870. currently $1612

HFCU...$1100 currently. $1629

Capital one AU $200. currently $428

Credit one $0 .. currently $117

Capital one $0... currently$107

LOC. $250... currently $400

NFCU SSL loan $244... currently$245

HFCU personal loan $908 currently $954...(payment is $46 a month)

So usage will be about 19% or so...Hope for some more score increase.. I want to wait until my scores are all over 720+ and most all but 1 inq is over 6mo old before trying for CLI OR second card from NFCU...thinking instead of late September..maybe November or should I wait longer??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

@Anonymous

That is a lot of data (and I love it!).

Seems to me like there is one challenge here: keeping your utilization below 30% (or, even better, below 9%). Here is a bit of a breakdown (best I could translate):

Credit Cards:

HFCU Credit Card (January, 2021) $XX SL (is it possible to add the SL here?)

AMEX Delta (February, 2021) $1,700 SL

NFCU Platinum (February, 2021) $3,000 SL

Credit One AMEX (February, 2021) $500 SL

Capital One (March, 2021) $300 SL

Loans:

Secured CL (January, 2021) $2,200

LOC (January, 2021) $500

HFCU Personal Loan (March, 2021) $300

NFCU SSL (April, 2021) $3,150

So, I would do possibly three things:

1. Close out the Credit One AMEX CC

2. Close out the Capital One CC

3. Truly garden (as in, apply for no more credit of any kind)

Why Number 1? There is a lot of talk about how Credit One is predatory and how they try to trick people into thinking that they are Captial One (worked on you). They also have no grace period - and just about every other credit card company out there does. No grace period, as in the moment that a charge hits your account (the purchase is posted, to use their terms) then they start charging interest on it.

Why Number 2? That Capital One card is very likely "bucketed". You will never see any meaningful CLIs with that....I am assuming that it is the Platinum Card. You will likely never be able to PC (Product Change). That card is "bucketed" as if your credit history |credit score is forever what it was the day you applied for it.

Why Number 3? You have a poop-ton of inquiries and they do indeed drag down your credit score (temporarily...the points do eventually come back). And only by a few to several points (depending on your credit profile....so, you might be affected by four points per INQ and I might be affected nine points per INQ....for example). But nine in such a short period of time is likely costing you some 60 points (give or take....just an educated guess).

I would then work on reducing the overall utilization. FICO likes to see 30% or lower. I would suggest keeping things at 9% or lower (I almost never exceed 6%.....typically am between 1% and 4%).

Another way to lower your utilization is to get some CLIs (credit line increases). :-)

And once you are able to get that utilization under control then I might humbly suggest you entertain the idea of AZEO (All Zero Except One). Are you familiar with what that is? And some people swear by this method while others categorically deny even considering it. Totally your call.

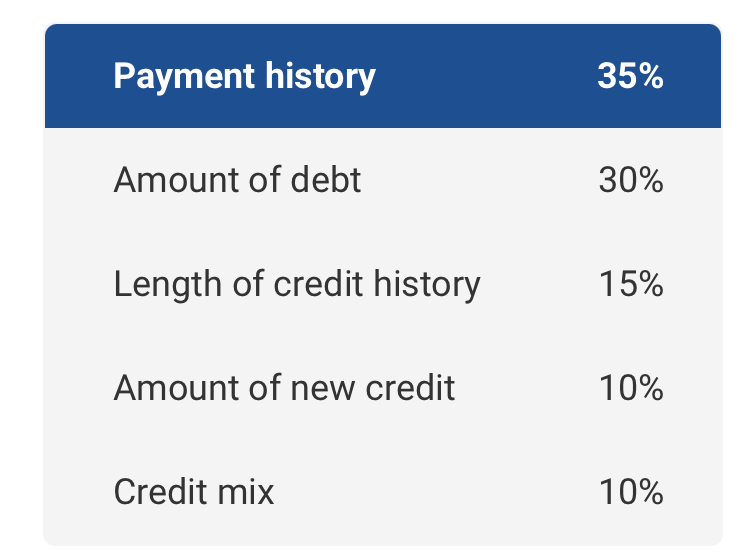

Why am I focused on getting utilization down? Because payment history (35%) and credit utilization (30%) are the two biggest factors in your credit score.

I would also - and this is a VERY general suggestion (one that I make to everyone just about) - get your credit reports each week from annualcreditreport.com (because of COVID-19 the three CRAs are allowing us all to get our credit reports every seven days). Check everything just to make sure. And check all of the details....you might just be surprised what you actually find when you make the time to look with intent!

If I might - and I put this at the end intentionally - it appears that there *could* be another challenge for you: budgeting! I do not want to step on any toes here, but (and answer this for yourself...) is budgeting something that you do? If not, have you considered it? If yes, is there room for improvement in that process? Not judging and no tone in those questions (again, for you to answer for yourself...no need to reply to these questions in this forum).

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

@Anonymous wrote:

So my data points. On my rebuild.

Eq 540 Ex560 TU543

1 paid collection..Convergent. $675(paid half) INQ...1 (EX I THINK)

Nov 2020..start rebuild

Capital one AU...$3800CL

20+YRS no lates 84% usage Get off this card ASAP! 89% is maxed out and theres 20pts +/-

Score Jan 2021

Eq588 Ex592 Tu602

1st CC Hughes federal credit union

Secured CL $2200

LOC $500

FEB 2021

Scores Eq 630 Ex651 Tu 656

2nd card AMEX Delta plat $1700 CL 24.67%

3rd card NFCU Platinum $3000 CL 5.99%

4rd card Credit one AMEX( thought it said capital one) $500 CL 26.95% Bye!

Scores Eq628 Ex 646 Tu650

Mar 2021

Personal loan HFCU $300( No loans on file. Thought I could do it like a SSL LOAN) NO..paid it off in April.

5th card Capital one( pre-approval mailer) $300 (3 INQ hits)

APR 2021

I do a true SSL LOAN NFCU $3150 paid it too $248 once it showed in my NFCU Accts.

My usage 63%

INQ 9

Score drops to 560-580'S

NO MISSED PAYMENTS

HIGH USAGE

Scores drop to 530-540's

Now I start to garden..2 cards too late.

I don't do the 91/3 USAGE too high.

AMEX ALWAYS PIF.

NFCU got to 80% usage. keep a balance 0%apr 12months

HFCU got to same but made good size payments.

LOC $400/ of $500

Credit one AMEX $350

CAPITAL ONE $225

SO I keep trying to bring down balances (can't for one thing or an other)

Pay down ...add it back on...

No lates no missed payments

May 2021

I applied for a personal loan at HFCU $1000... ( I live in Arizona..and my central air conditioner. Needed repair.. longest 110+ streak in 20 yrs..and 3 weeks out for first appointment to fix had to buy some window A/C's to get by...) Could have placed this on a card and not another loan.

Back to gardening...

June July same no lates no missed high usage..

Scores Ex 595 Eq 588 Tu579

Aug 2021

I get my only derog deleted( Convergent)

Scores Ex620 Eq 625 Tu615

Usage 55%

I start to be able to pay down cards...

50% small increase in scores

43% same

Now I am at 36%

My scores are at.

Ex 699 Eq688 Tu714

But still on pre qualify sites for AMEX and NFCU only secured cards come up.

My AMEX score is 681

My NFCU score is 689

I plan to 0 out my 2 small cards now.

And get my NFCU card to under 870..right now it is at $1612

So for this months totals per card will be.

AMEX $0 always pif

NFCU...$870. currently $1612

HFCU...$1100 currently. $1629

Capital one AU $200. currently $428 Bye

Credit one $0 .. currently $117

Capital one $0... currently$107

LOC. $250... currently $400

NFCU SSL loan $244... currently$245

HFCU personal loan $908 currently $954...(payment is $46 a month)

So usage will be about 19% or so...Hope for some more score increase.. I want to wait until my scores are all over 720+ and most all but 1 inq is over 6mo old before trying for CLI OR second card from NFCU...thinking instead of late September..maybe November or should I wait longer??

No more credit apps until its all is paid down. Pay off all the loans except of course NFCU. The SSL bonus is being buried under the other loans. Get off all AU cards ASAP. You have enough on your own. More accounts does not mean higher scores. Keep whats in your name. Get off the 89% card. Your past AU cards. Once its all paid down. You will be at 700+. Then spread out apps 6 months at a time. Your almost there. Fix what needs to be tweaked and you'll be sitting good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

In my novel, I did indeed miss mentioning to remove the AU for that Credit Card that has nearly 90% utilization. Thank you for picking me up on that one!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

@HowDoesThisAllWork wrote:

In my novel, I did indeed miss mentioning to remove the AU for that Credit Card that has nearly 90% utilization. Thank you for picking me up on that one!

Thats hurting more than anything else at the moment. Once thats gone. Then get the loans excpet NFCU paid off. @Anonymous has 700 in their sites.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

Agree, 100%. All a matter of handling things in an educated manner (one that has eluded me for some time....that is hopefully changing).

I look forward to the update that his/her score is now 710 (or similar).

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

Thanks for advice.

To clearify...the AU card is now at 11%usage and the only reason I keep it... Is the 20yrs being open..for my overall oldest acct...until mine are at least a year on my own.

On the Credit one .yeah I will get rid of it..

But I took the hit on the inq..was going to wait 1yr and hope to increase my overall CL...RIGHT NOW it is $8945....with AU $12745

and that is the other issue. Once I can increase my overall CL's ....it will be easier to get my utilization lower.. it is hard to keep it below 30% with such low limits. (it is like a catch 22)

When should I consider a CLI...

I tried AMEX plat....denied they said score too low..(669) at the time ..higher than my score at approval...can re-app 6 months from may 5th so NOV 5TH and will do NFCU same time ....or wait longer???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

Honestly. Pay down all the debts on the cards. Get to AZEO and NFCU reporting. Dont know when the last new account was. But space them out a min of 6 months. The cards will still be there. End of the year IMO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

I still think you should get off that Cap1 AU - here is why (screenshot below)

You are using it to boost your Age only - which counts for 15%

yet you are taking a Hit on the much more important one - Amount of Debt - 30%

and even at 11% it is hurting you - plus the person ran it up to 84% which they can of course do again any time

remove yourself - give it a month or two, and i think you will see that you are still OK

you can always add yourself back if needed down the road, but i am pretty sure you wont have to

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need serious advice on my rebuild

Thank you all for the advice...it is a big help and I have al lot to think about..