- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Need tough love - why did I let myself have so...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need tough love - why did I let myself have so many accounts < 2 years old

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

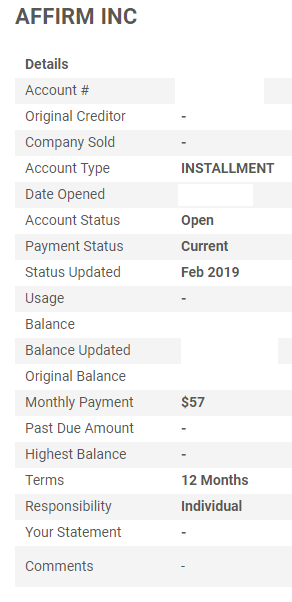

I still respectfully disgree because my FICO mortgage and Auto scores have gone up with Affirm not down.

I have 3 Affirm loans currently showing on Experian although one is paid off.

Pretty tough to resist 0% financing with Peloton as I was buying one either way.

Experian FICO Mortage Score 4/27/2019 650

Experian FICO Mortgage Score 5/31/2018 624 this was still before any Affirm loans and dipped likely because of high utilization and 2 auto loans refinanced.

Experian FICO Mortgage Score 11/9/2019 626

Experian FICO Mortgage Score 2/22/2019 682 - the big jump is because I paid off a lot of credit card debt.

I am not in any way saying that Affirm boosted my score just that it seemed to have zero impact on it.

My Experian FICO Auto scores show similar gains with it currently being 54 points higher than it was 11/9/2019

I have had a total of 6 loans with Affirm 2 still have balances.

@Saeren I did google what you said and see people confirming the CFA but I do not see any negative effect on my scores and with a CH7 just shy of 3 years post discharge, 3 inquiries on Experian <6 months and a total of 8 inquiries on Experian less than 1 year and over 20 accounts that are less than 2 years old I think that FICO mortgage score is pretty good considering. Overal utilization is just shy of 20% AAoA is around 2.7 years.

I appreciate the advice but perhaps it's YMMV?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

@Anonymous wrote:I am sorry that is not correct info about Affirm.

They report as Installment loans not consumer finance accounts and do not wreck your score.

Additionally it only reports on Experian nothing shows on TU or EQ.

Affirm does many types of loans. Some at checkout counters in retail stores. And then personal loans. What was your loan. A personal line of credit or obtained from a retailer for a purchase goods?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

- Peloton exercise bike purchased from onepeloton.com with link to Affirm 0% financing

- Best Buy - applied at Affirm.com website $250 purchase online - testing waters didn't want to put on credit card PIF next paycheck

- Racechips.com cancelled order but refund came late so it shows as a paid loan no interest paid. Applied at Affirm.com

- Microsoft - Applied online at Affirm.com for enough to buy a Surface Pro 6 and some accessories. Ended up returning/refusing laptop but kept $60 in Accessories

- Microsoft 2 - in store evaluating Surface Pro 6 vs Surface Go decided on Surface Go. On phone applied for new Affirm loan as I saw I was pre-approved for more than needed. Sent virtual card to Apple Pay and went home with Surface Go.

- Valentine 1 and accessories. Applied on Affirm.com website paid online.

All in all my experience with Affirm has been excellent with one thing to point out.

They are not a Credit Card (doh) and because of that you do not have all the protections you would with a credit card.

I foolishly setup a loan to buy from Racechips an international company and while it was refunded before any interest accrued I wanted Affirm to just reverse the charges when I provided an email from RaceChips saying "sorry for the delay we are working on your refund in full we know the order was cancelled". Affirm did not react as a good credit card would and issue a refund but it was all OK in the end and zero interest was paid. Worst case is perhaps it appears on my Experian I would have to look closer which could affect my AAoA.

I will sum it up by saying based on my experience

- No hard inquiry ever

- Pre-approved amount shown in app

- Reports as installment loan (at least for me YMMV) which is better debt than credit card debt

- Some 0% offers - yes few and far between but 0% on my Peloton was huge.

- Fixed payments with no pre-payment penalty. I have paid all of the loans off early except the 0% interest one.

So again all of my 6 Affirm loans have been to buy something and not a line of credit.

I really do appreciate the warnings about CFA reporting but not sure that's still applicable with Affirm. Again YMMV

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

I have a real problem.

Daughter needed some furniture apply for Jennifer Furniture $2,500 Limit

Thought I applied at Bobs also but made a mistake and it was Sync Home which is good at lots of stores like Ashley Furniture $2,500 limit

Today buying $40 item on Paypal I clicked the credit thingy since it only asked for last 4 digits and gave me $2900 limit and $20 off my purchase.

I seriously need to pay someone to punch me int he gut if I bust out of the garden again until I have less than 2 inquiries per bureau and less than 5 accounts under 2 years old.

Sure in the last month since I posted some things aged but boy am I a dumb ass.

I am a creditholic and it's been 0 days since my last inquiry and 0 days since my last new account. I made it to 30 days then blew it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

Affirm is not YMMV. It’s a consumer finance account and when your report is clean enough, it will become your number one reason code for your auto scores and be in the top four for mortgage. It’s not a huge hit but it’s a hit.

Sorry, I missed when you responded.

If you are serious about gardening, go put a security freeze on all three bureaus. Gives you time to think about your apps while you’re going through the websites to lift each of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need tough love - why did I let myself have so many accounts < 2 years old

My Auto and Mortgage scores have gone up all things being equal with Affirm.

Also Affirm only reports on Experian.

You make it sound like the Devil but to me it sounds pretty good especially when there is 0% financing on things like a Peloton.

I appreciate the advice by my numbers do not collaborate what you are saying and yes I have logged my before and after FICO mortgage and auto scores.