- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: New Scoring Info! BECU (Denial)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Scoring Info! BECU (Denial)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Scoring Info! BECU (Denial)

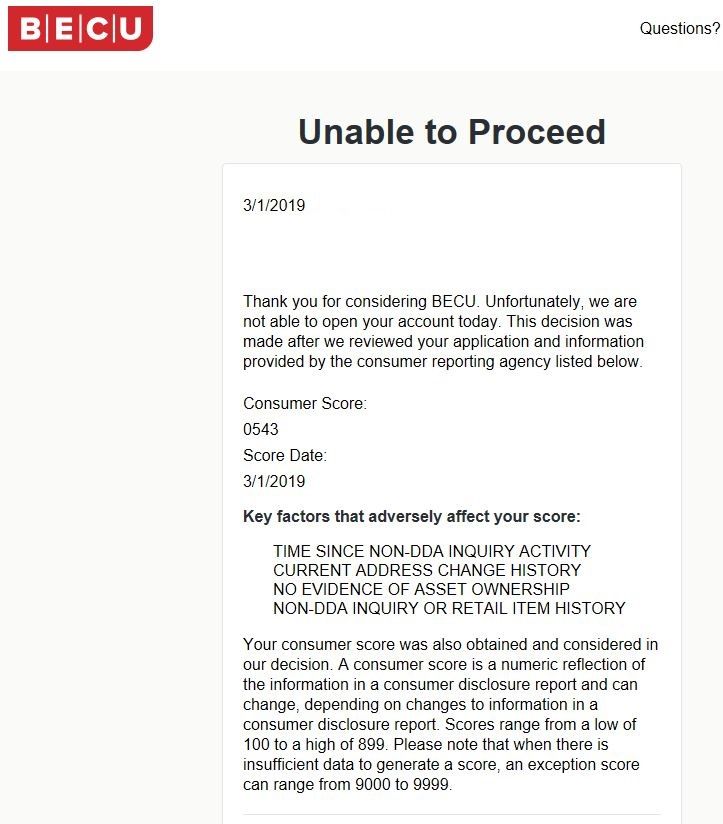

I did not apply for credit, this was for checking/savings initially, and rejected again for a savings account only. They did not ask for income, they did ask for basic info and how you meet membership qualifications.

I've never had a problem or derogatory history with a bank account or activity, so I'm curious to see the report, why exactly the score is mid 500s, and if there's something I'm unaware of or possibly fraud.

Below is the list of what LexisNexus delivers for risk computation according to other reports. I don't have my personal file yet, but I'll add to this one for anybody taking notes to share some insight with me.

Number of address changes reported in the last 12 months: 1

Number of address changes reported in the last 60 months: 10 (including the 12 month request)

Total number of properties owned: 0

Wealth Index (Based on watercraft, aircraft, and property asset records - 0 = no information on file. 1-very low evidence of wealth to 6- very high evidence of wealth): 0

Total number of non-derogatory records: 3 (traffic fines and/or accidents that did not result in further charges)

Total number of derogatory public records (felonies, liens, bankruptcies and evictions): 0

Total number of lien records (both filed and released): 0

Total number of released liens: 0

Total number of bankruptcy filings: 0

Total number of felonies: 0

Total number of evictions: 0

Non-DDA inquiry activity hurt me twice, both with a recent request and the number of inquires (3rd party checking account info requests, for me it could be the Wallet app that helps monitor my income/spending habits, I honestly don't know).

Not owning property (house, boat, plane, etc) hurt me.

Moving around (was military for almost 10yrs) hurt me.

A moose running into my truck at 3AM hurt me lol..(this seems like a really unfair and problematic way of rating somebody for a bank account).

Anyway, I hope this helped somebody. I'm certainly surprised, I thought I was on my way, but it looks like there's still some hard work to do!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Scoring Info! BECU (Denial)

BECU soft pulls TransUnion and pulls Chexsystems. They are not going to reject you for traffic accidents no matter what Lexis Nexis says.

You seem to be trying to guess why you were rejected. What exactly did the rejection say? They always tell you exactly why. You said you have a “consumer score of 500”. Was that the reason listed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Scoring Info! BECU (Denial)

I thought the picture was posted, I must have scrapped it somehow. It's back up now giving the reasons listed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Scoring Info! BECU (Denial)

Yeah, I can see it now. Lets take these one at a time

"TIME SINCE NON-DDA INQUIRY ACTIVITY"

This means you opened up another banking account very recently. Non-DDA can mean any bank account except checking.

"CURRENT ADDRESS CHANGE HISTORY"

This pop ups if the address you are applying with is new/different, especially if its new/different from the very recent account at your other bank they see on the inquiry above.

"NO EVIDENCE OF ASSET OWNERSHIP"

I have honesetly never seen this one so I'm going to take a guess. Probbaly means one or more of the recently opened accounts is not funded. So combined with the other two it looks like a pattern of fraud. (Opening a bank accounts, not funding them to set up for funds transfer fraud)

"ON-DDA INQUIRY OR RETAIL ITEM HISTORY"

This is just a repeat of the first one. This is saying there was an inquiry, and the first one is saying the inquiry was recent.

Sorry they rejected you. I know I have opened up online accounts then found out something about the bank or account I did not realize before and decided not to fund and just let them close it. Its best not to do this often or right before you apply to another bank thats inquiry sensitive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Scoring Info! BECU (Denial)

Thanks for taking the time to go over some of this stuff!

Considering I've had the same bank account since 2010 at NFCU, I expect a full cluster flafluffel when I receive this ChexSystem file.

I'm glad to be part of this amazing forum, the feedback has been really good, and the information to grow your credit score is amazing. My F8 EQ has gone up over 100pts in the last month just by moving some money around.

Thank you again!