- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Next Step Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Next Step Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Next Step Question

Hope this isnt too long winded, have been a lurker on these boards for months and would love some advise!

Just had my first kid a few weeks ago and looking to buy a house in the future. That's 5 year Goal.

I was simply ignoring debt for years. I own a condo, pay cash for my vehicles so I thought I could just let these derogs age off, stupid, I know. In the last few months I have saved every possible penny and have paid off 2 collections and PIF an old Amex. That was about $5,000 altogether

Baddies-

What's left:

Discover $5800 original CL of $4800 - CO not in Collections

BofA $5100 original CL of $4500 will age off 9/1/2021 according to TU - CO not in Collections

Chase $2000 original CL of $1500 also age off 9/1/2021 - CO not in Collections

Local Bank Car Loan (repoed) for $1143 from 2017 (tried disputing....failed)

Student Loans - various adding up to about $20k Collection CO

State University loan for $2800 Collections CO (not sure what this is, still collecting interest through COVID) also appears to be taking my Tax Refunds for the last few years.

Good stuff, sorta?

Current Mortgage on the Condo, 4 lates from 2017 just about 3 years solid no lates.

Cap1 $500 cl card for a year no lates

Cap1 Walmart $300cl a few months no lates

Mission Lane $1750 cl card for a year no lates

Just Opened a NFCU Secured for $650 a few days ago

First Premier $500 opened a year ago, no lates going to close once NFCU arrives, hate annual fees.

(I have been PIF anything charged on these cards monthly, probably should keep a small balance on 1 right?)

Okay I think I gave you all the details you would need. My scores seem to range from 610-655

Question time! I am not wealthy, it takes me like 6 months to save up a few grand for these bills so I kind of want advice on the most efficient way to knock these out.

As of today I have $4800 saved, took me forever, lot of skipped meals etc. I called Discover a few minutes ago and inquired if I could pay the $4800 CL and have the card Paid as Agreed, as I never spent anything above that, that extra $1000 were fees and interest. (I know I agreed to pay them when I received my card) Hard no. As seen many times with Discover after CO they offered a 70% Settlement. Last payment made was 2016 so this will be on my report for awhile.

Do I Settle for $4k and pay 1 of my smaller student loans or wait a few months until I can pull together another grand and PIF? Will it make a HUGE difference on PIF vs Settle?

Once the Discover is knocked out, I wanted to concentrate on my Student loans since the Chase and BofA age off in less than 12 months.

Or should I try to settle those first?

Once they age off, I think they will still be kind of there for an Underwriter to see, even in 5 years from now when I intend to try to buy a bigger place? And if they age off, I am guessing Chase and BofA won't ever want a relationship with me again unless paid, correct?

Thanks in advance, sorry for the long post!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

@Anonymous Settling versus PIF is irrelevant scorewise. Yes keep a small balance on one revolver.

when it's excluded from your credit report at 7 years, underwriters cannot see it or anyone else unless you are borrowing I think more than $150,000. Then I think it only stays 10 years as available to those for higher amounts.

Paying a collection does not help your score whatsoever unless it is removed and deleted from your credit report.

charge-offs kill your score, pay them as soon as possible; it doesn't matter whether it's settled or paid in full, unless you want to get back in with that lender. Arguably pay in full looks better on CR than settlement, but no difference scorewise.

Settle Disco if it's not aging off soon and then work on SLs. Their exclusion dates may vary depending on loan type. (See Scoring Primer for details.) You mentioned they were already in collections, do you know if they were sold or assigned?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

@Anonymous wrote:Hope this isnt too long winded, have been a lurker on these boards for months and would love some advise!

Just had my first kid a few weeks ago and looking to buy a house in the future. That's 5 year Goal.

I was simply ignoring debt for years. I own a condo, pay cash for my vehicles so I thought I could just let these derogs age off, stupid, I know. In the last few months I have saved every possible penny and have paid off 2 collections and PIF an old Amex. That was about $5,000 altogether

Baddies-

What's left:

Discover $5800 original CL of $4800 - CO not in Collections

BofA $5100 original CL of $4500 will age off 9/1/2021 according to TU - CO not in Collections

Chase $2000 original CL of $1500 also age off 9/1/2021 - CO not in Collections

Local Bank Car Loan (repoed) for $1143 from 2017 (tried disputing....failed)

Student Loans - various adding up to about $20k Collection CO

State University loan for $2800 Collections CO (not sure what this is, still collecting interest through COVID) also appears to be taking my Tax Refunds for the last few years.

Good stuff, sorta?

Current Mortgage on the Condo, 4 lates from 2017 just about 3 years solid no lates.

Cap1 $500 cl card for a year no lates

Cap1 Walmart $300cl a few months no lates

Mission Lane $1750 cl card for a year no lates

Just Opened a NFCU Secured for $650 a few days ago

First Premier $500 opened a year ago, no lates going to close once NFCU arrives, hate annual fees.

(I have been PIF anything charged on these cards monthly, probably should keep a small balance on 1 right?)

Okay I think I gave you all the details you would need. My scores seem to range from 610-655

Question time! I am not wealthy, it takes me like 6 months to save up a few grand for these bills so I kind of want advice on the most efficient way to knock these out.

As of today I have $4800 saved, took me forever, lot of skipped meals etc. I called Discover a few minutes ago and inquired if I could pay the $4800 CL and have the card Paid as Agreed, as I never spent anything above that, that extra $1000 were fees and interest. (I know I agreed to pay them when I received my card) Hard no. As seen many times with Discover after CO they offered a 70% Settlement. Last payment made was 2016 so this will be on my report for awhile.

Do I Settle for $4k and pay 1 of my smaller student loans or wait a few months until I can pull together another grand and PIF? Will it make a HUGE difference on PIF vs Settle?

Once the Discover is knocked out, I wanted to concentrate on my Student loans since the Chase and BofA age off in less than 12 months.

Or should I try to settle those first?

Once they age off, I think they will still be kind of there for an Underwriter to see, even in 5 years from now when I intend to try to buy a bigger place? And if they age off, I am guessing Chase and BofA won't ever want a relationship with me again unless paid, correct?

Thanks in advance, sorry for the long post!

While the BoA and Chase are included in revolving util and affects your scores, I am of the same mind as you: they age off soon, and as long as you have no intention of getting credit with them again, I'd make that an absolute last priority. No UW will see them on your CRs once they age off. There is chatter about acquiring a mortgage over 150k where a full credit profile can be pulled back through 10 years, but I have not seen one DP mentioned in the threads where this has happened to anyone. Once it ages off it is gone.

They are outside the SOL and if you do want in with them down the road, you can address it at that time.

If your goal is a home in more than a year, I would focus your efforts and cash elsewhere and less about getting back in with a lender, there are plenty of creditors out there besides BoA and Chase.

Remember just to hang in there and not to expect significant score increases until these 2 items age off/you request EE down the road.

Now, I was a bit confused about the SLs. Are they federal or private? In good standing or defaulted? This will be a lot of ground to cover possibly depending on those answers.

The state university loan is not bound to not charging interest during covid, that is not part of the cares act. In fact me and my SO have fed loans that are privately held and still are being charged interest. Grey area that they weasled through.

I would definitely deal with Disco since that is going nowhere fast and depending on where you live may still be within the SOL.

You will also need to deal with the repo balance.

Any outstanding debts that will be on your CRs at the time of app will need to be handled one way or another, wether settled or PIF. Many here suggest PIF for a mortgage app because it "looks better" to UWs, but priority one is getting them dealt with and within your financial means. Score-wise it makes *zero* difference.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

@Anonymous wrote:

@Anonymous wrote:Hope this isnt too long winded, have been a lurker on these boards for months and would love some advise!

Just had my first kid a few weeks ago and looking to buy a house in the future. That's 5 year Goal.

I was simply ignoring debt for years. I own a condo, pay cash for my vehicles so I thought I could just let these derogs age off, stupid, I know. In the last few months I have saved every possible penny and have paid off 2 collections and PIF an old Amex. That was about $5,000 altogether

Baddies-

What's left:

Discover $5800 original CL of $4800 - CO not in Collections

BofA $5100 original CL of $4500 will age off 9/1/2021 according to TU - CO not in Collections

Chase $2000 original CL of $1500 also age off 9/1/2021 - CO not in Collections

Local Bank Car Loan (repoed) for $1143 from 2017 (tried disputing....failed)

Student Loans - various adding up to about $20k Collection CO

State University loan for $2800 Collections CO (not sure what this is, still collecting interest through COVID) also appears to be taking my Tax Refunds for the last few years.

Good stuff, sorta?

Current Mortgage on the Condo, 4 lates from 2017 just about 3 years solid no lates.

Cap1 $500 cl card for a year no lates

Cap1 Walmart $300cl a few months no lates

Mission Lane $1750 cl card for a year no lates

Just Opened a NFCU Secured for $650 a few days ago

First Premier $500 opened a year ago, no lates going to close once NFCU arrives, hate annual fees.

(I have been PIF anything charged on these cards monthly, probably should keep a small balance on 1 right?)

Okay I think I gave you all the details you would need. My scores seem to range from 610-655

Question time! I am not wealthy, it takes me like 6 months to save up a few grand for these bills so I kind of want advice on the most efficient way to knock these out.

As of today I have $4800 saved, took me forever, lot of skipped meals etc. I called Discover a few minutes ago and inquired if I could pay the $4800 CL and have the card Paid as Agreed, as I never spent anything above that, that extra $1000 were fees and interest. (I know I agreed to pay them when I received my card) Hard no. As seen many times with Discover after CO they offered a 70% Settlement. Last payment made was 2016 so this will be on my report for awhile.

Do I Settle for $4k and pay 1 of my smaller student loans or wait a few months until I can pull together another grand and PIF? Will it make a HUGE difference on PIF vs Settle?

Once the Discover is knocked out, I wanted to concentrate on my Student loans since the Chase and BofA age off in less than 12 months.

Or should I try to settle those first?

Once they age off, I think they will still be kind of there for an Underwriter to see, even in 5 years from now when I intend to try to buy a bigger place? And if they age off, I am guessing Chase and BofA won't ever want a relationship with me again unless paid, correct?

Thanks in advance, sorry for the long post!

While the BoA and Chase are included in revolving util and affects your scores, I am of the same mind as you: they age off soon, and as long as you have no intention of getting credit with them again, I'd make that an absolute last priority. No UW will see them on your CRs once they age off. There is chatter about acquiring a mortgage over 150k where a full credit profile can be pulled back through 10 years, but I have not seen one DP mentioned in the threads where this has happened to anyone. Once it ages off it is gone.

They are outside the SOL and if you do want in with them down the road, you can address it at that time.

If your goal is a home in more than a year, I would focus your efforts and cash elsewhere and less about getting back in with a lender, there are plenty of creditors out there besides BoA and Chase.

Remember just to hang in there and not to expect significant score increases until these 2 items age off/you request EE down the road.

Now, I was a bit confused about the SLs. Are they federal or private? In good standing or defaulted? This will be a lot of ground to cover possibly depending on those answers.

The state university loan is not bound to not charging interest during covid, that is not part of the cares act. In fact me and my SO have fed loans that are privately held and still are being charged interest. Grey area that they weasled through.

I would definitely deal with Disco since that is going nowhere fast and depending on where you live may still be within the SOL.

You will also need to deal with the repo balance.

Any outstanding debts that will be on your CRs at the time of app will need to be handled one way or another, wether settled or PIF. Many here suggest PIF for a mortgage app because it "looks better" to UWs, but priority one is getting them dealt with and within your financial means. Score-wise it makes *zero* difference.

Good luck!

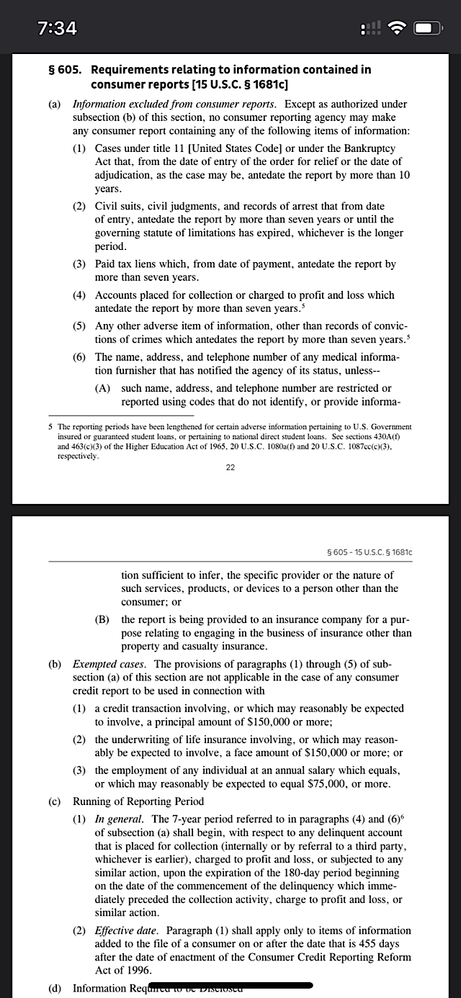

Here the law, FCRA, s. 605(b)(1):

so the fico score might not take it into account, but if you're borrowing more than $150,000, the UW is entitled to receive the report with the information not excluded see above.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Hope this isnt too long winded, have been a lurker on these boards for months and would love some advise!

Just had my first kid a few weeks ago and looking to buy a house in the future. That's 5 year Goal.

I was simply ignoring debt for years. I own a condo, pay cash for my vehicles so I thought I could just let these derogs age off, stupid, I know. In the last few months I have saved every possible penny and have paid off 2 collections and PIF an old Amex. That was about $5,000 altogether

Baddies-

What's left:

Discover $5800 original CL of $4800 - CO not in Collections

BofA $5100 original CL of $4500 will age off 9/1/2021 according to TU - CO not in Collections

Chase $2000 original CL of $1500 also age off 9/1/2021 - CO not in Collections

Local Bank Car Loan (repoed) for $1143 from 2017 (tried disputing....failed)

Student Loans - various adding up to about $20k Collection CO

State University loan for $2800 Collections CO (not sure what this is, still collecting interest through COVID) also appears to be taking my Tax Refunds for the last few years.

Good stuff, sorta?

Current Mortgage on the Condo, 4 lates from 2017 just about 3 years solid no lates.

Cap1 $500 cl card for a year no lates

Cap1 Walmart $300cl a few months no lates

Mission Lane $1750 cl card for a year no lates

Just Opened a NFCU Secured for $650 a few days ago

First Premier $500 opened a year ago, no lates going to close once NFCU arrives, hate annual fees.

(I have been PIF anything charged on these cards monthly, probably should keep a small balance on 1 right?)

Okay I think I gave you all the details you would need. My scores seem to range from 610-655

Question time! I am not wealthy, it takes me like 6 months to save up a few grand for these bills so I kind of want advice on the most efficient way to knock these out.

As of today I have $4800 saved, took me forever, lot of skipped meals etc. I called Discover a few minutes ago and inquired if I could pay the $4800 CL and have the card Paid as Agreed, as I never spent anything above that, that extra $1000 were fees and interest. (I know I agreed to pay them when I received my card) Hard no. As seen many times with Discover after CO they offered a 70% Settlement. Last payment made was 2016 so this will be on my report for awhile.

Do I Settle for $4k and pay 1 of my smaller student loans or wait a few months until I can pull together another grand and PIF? Will it make a HUGE difference on PIF vs Settle?

Once the Discover is knocked out, I wanted to concentrate on my Student loans since the Chase and BofA age off in less than 12 months.

Or should I try to settle those first?

Once they age off, I think they will still be kind of there for an Underwriter to see, even in 5 years from now when I intend to try to buy a bigger place? And if they age off, I am guessing Chase and BofA won't ever want a relationship with me again unless paid, correct?

Thanks in advance, sorry for the long post!

While the BoA and Chase are included in revolving util and affects your scores, I am of the same mind as you: they age off soon, and as long as you have no intention of getting credit with them again, I'd make that an absolute last priority. No UW will see them on your CRs once they age off. There is chatter about acquiring a mortgage over 150k where a full credit profile can be pulled back through 10 years, but I have not seen one DP mentioned in the threads where this has happened to anyone. Once it ages off it is gone.

They are outside the SOL and if you do want in with them down the road, you can address it at that time.

If your goal is a home in more than a year, I would focus your efforts and cash elsewhere and less about getting back in with a lender, there are plenty of creditors out there besides BoA and Chase.

Remember just to hang in there and not to expect significant score increases until these 2 items age off/you request EE down the road.

Now, I was a bit confused about the SLs. Are they federal or private? In good standing or defaulted? This will be a lot of ground to cover possibly depending on those answers.

The state university loan is not bound to not charging interest during covid, that is not part of the cares act. In fact me and my SO have fed loans that are privately held and still are being charged interest. Grey area that they weasled through.

I would definitely deal with Disco since that is going nowhere fast and depending on where you live may still be within the SOL.

You will also need to deal with the repo balance.

Any outstanding debts that will be on your CRs at the time of app will need to be handled one way or another, wether settled or PIF. Many here suggest PIF for a mortgage app because it "looks better" to UWs, but priority one is getting them dealt with and within your financial means. Score-wise it makes *zero* difference.

Good luck!

Here the law, FCRA, s. 605(b)(1):

so the fico score might not take it into account, but if you're borrowing more than $150,000, the UW is entitled to receive the report with the information not excluded see above.

They are entitled, but I have not seen a single report of anyone saying it was requested or used, as I said above.

Probably hundreds of DPs I have seen of individuals letting things age off or request EE have not once mentioned int was drudged back up during UW.

People around here are staunchly against not paying one's debts, while I say it is about prioritizing.

If you have a goal and can acheive it by working on the newest stuff and the oldest stuff ages off, so be it.

If one wants to wait it completely out, so be it.

One should do what is fiscally best for them and their family.

The debt will always be there, so when you finally get a chance to handle it, there is always that too.

If someone wants to point out a DP or their own experience about being questioned about debt no longer reporting on their CRs (aside from taxes, jusgements, and SLs), I am all eyes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

@Anonymous wrote:

I have not either, but I wonder if creditors disclose the fact they are aware of it, if it’s past seven years?

IMO, banks are businesses and they want to make money. They probably will do what is best for them financially and if all the boxes are checked on the applicants end, they will gladly take that money!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next Step Question

First off, want to thank you both for the wealth of information! Slightly different user name from my OP, signed up with an incorrect email, ha!

Slight update, just got off the phone with someone in the "Executive Office" of Discover, found an email address online and tried to get them to forgive some of the $1,000 over CL interest and fees.

They will not budge, 2 options pay in full or settle for 70%. I am no hero, but I definitely fall in the category of, it's my debt I am responsible so I want to pay it. That extra grand in fees and interest are just...wow. Looking through some old records and BoA only hit me for like $160 in lates and overlimit. If that wasn't falling off in less than a year I would totally pay them before Disco. (I do intend to eventually pay off BoA and Chase...once I clean the stuff that isnt falling off soon)

So I would rather PIF but am leaning toward the settlement. Wondering 2 things if anyone has experience with Discover. If you settle, are you ever eligible to get back in their good graces and get a new account? Once CO is 70% the lowest they will settle? If I am going to settle, want to get the best deal possible.

Thanks!