- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- One 60-Day Late Payment, How to Bounce Back

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

One 60-Day Late Payment, How to Bounce Back

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One 60-Day Late Payment, How to Bounce Back

All,

Looking for some advice. Never have had credit problems in the past. My previous credit score was in the 750-760 range. However, last fall, I was in a motorcycle accident where the bike was totalled. I thought the insurance company had paid off my creditor (VW Credit). However, the account went 60 days late before it was paid off and closed (30 days late 11/17 and 60 days late 12/17). My credit score absolutely plummeted; here's why I stand now:

Demographics:

-27 year old male

-Salary: $187k/year

-Renting an apartment, own one car

FICO Score 8

EQ: 659

TU: 671

EX: 664

My accounts are as follows:

Chase Credit Cards (Sapphire Reserve, Prime Signature, Freedom Card): Total CL of $45,000

Auto Loan: 36 months at ~$1055/month

I always pay off the full statement balance every month.

No major purchases planned in the near future, but I would like to retain the option to apply for new credit cards etc. As a result, I want to recover my score as fast as possible. What would the group recommend?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

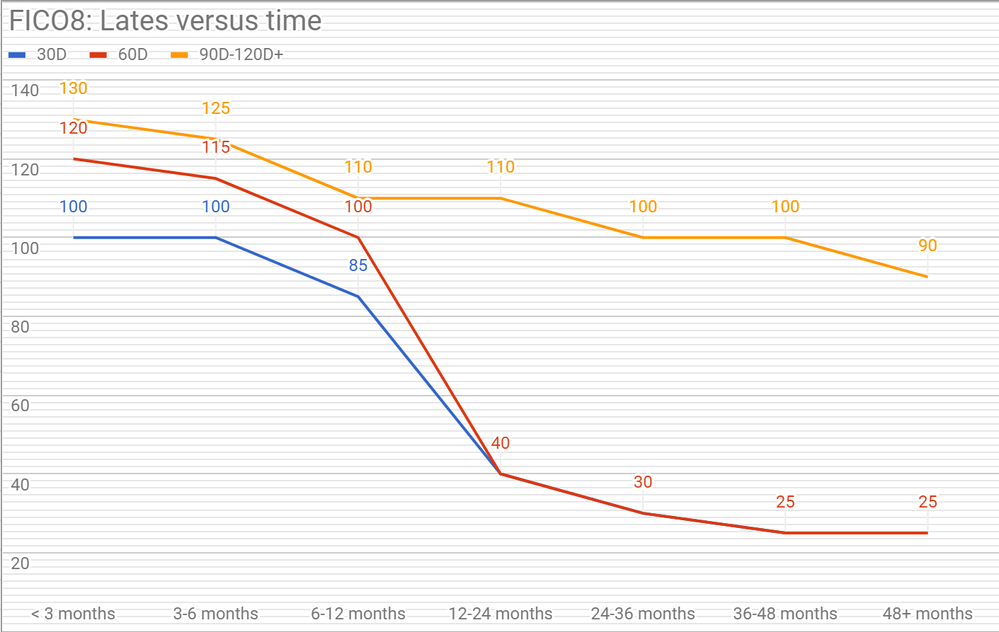

After 12-24 months, a single 60 day late doesn't hurt your score very much:

These are just averaged results from many reported data points from others, but my own reviews of profiles shows it's pretty accurate for a single late account across many different scorecards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

I believe you would best benefit from a "good will campaign". Write to VW Credit. preferably to an executive officer of VW Credit, and ask them to please consider removing the 30 and 60 day lates from your reports. It might take several letters. It might not actually work, but if it does, then you will have a clean record again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

Thanks for the quick response! I'm glad to hear that the impact will be lower in the next 12-24 months. Is there anything I can do in the next ~6 months or so to speed up the process?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

Start a letter campaign. Explain WHY you got to 60 days behind. Ask kindly for forgiveness. Don't give up.

I really think this is BS. Sometimes Ins. takes way too long. I think it's THEM who deserve a black mark for dragging their asses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

Goodwill saturation method, baby!!

Best of luck!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One 60-Day Late Payment, How to Bounce Back

MRDFW,

I agree with the above post. Utilize the Saturation Technique and get that 60 day off of there now. No need to say good that it'll impact you less in 2 years, because I'm confident if you follow the link below you'll have that thing gone in a matter of months. Your situation is one that a CSR or EO will sympathize with and understand pretty quickly, so I actually think your chances of getting this removed quickly are pretty big.

Your scores will immediately bounce back 50-75 points, or whatever the amount was that you saw them drop from the addition of the negative item.