- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Overwhelming Rebuild Questions- UPDATE

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Overwhelming Rebuild Questions- UPDATE

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overwhelming Rebuild Questions- UPDATE

My spouse has baddies. A lot. His Vantage score is at a 431 and lowering by the week. I am unsure of his FICO at the moment. He has no open lines of credit minus student loans (payments not due yet) and I added him as an AU on my one of my decent accounts. There are many excuses for his debt load: deployment, wife didn't pay bills she said she was paying, ran up credit accounts, and served him with divorce papers, had a laywer and he couldn't afford one, debt remained solely his, etc. I could go on and on but I will refrain. He is trying to work on credit, but unfortunately it is hard to know what to even start with in this case. We'd really like a house at the end of this year, early next year, but VA said we won't get close to qualifying for the home loan if he doesn't have at least a 650. We currently pay a little over a grand a month for our apartment so finances are a bit tight. We are both working to clean up his credit in 2017 and establish healthy, responsible credit habits.

I have the ability to pay off nost of his baddies, but I am wondering which agencies I should try for a PFD, which I should settle for vs. paid in full, etc. ANY advice you have is HELPFUL.

Good lines of credit

Student Loans (not due yet)

Added as an AU on my 2 year old credit account (didn't help him much with score according to CK) Ended up closing this acct since it was Credit One and I got in w/ NFCU.

Possibly wondering if I should add him as an AU to my new QS1 card, 3,000 SL? Advice? Added him as an AU.

Baddies

Comneity/Zales $895.02- In Collections Next on our list...

WOW- $924.00 Collections (equipment was lost in a previous house they had to abruptly move from)

Capital One- $389.33 Collections, Offered us settlement for $155.74 but eventually i'd like to get him a secured card so idk about the settlement offer PIF, no settlement, this collection agency will not delete.

Verizon- $583.86 (this is with a 89.06 added collection charge) wonder if we paid verizon off, if it would be cheaper? Paid VERIZON with the collection charge before they reported the information to the bureaus so I hoping this does not get added.

Department of Defense- $801.00 (I guess they overpaid him?- not yet reporting to bureaus but will be soon- submitting payment plan info) Submitted payment plan info, not reporting in collections, awaiting a response...

Progressive- $216.00 Collections PFD

During this time he also got notice from an attorney that an old account from when his son was in latchkey ended up in collections so that got paid too before it reported. We are making some progress yay! For anybody reading lol... this is now my little journal to myself I suppose. You all have been so helpful.

He also had a car repossessed during divorce a couple years ago for $10,406.00 but there is probably little we can do about that at the moment. The rest of the accounts can be paid off within the next thirty days, with the exception of WOW which would be 60 days.

There are probably no credit options for him at this point I am thinking, even secured... am I right?

Also I signed him up for Discover Scorecard- 536.

Purple Update: 3/9/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

Hi Socialworkersalary2017, Welcome to the community.

I am a disabled Navy Combat vet and I empathize with your spouse’s problems.

As for your questions, you have left out a few facts needed to provide the most thorough options for you. Not trying to be nosy, but the info is important to help give you the best suggestions possible.

Most important are the dates these accounts went bad and who is the collection agency/debt buyer. Also if he is on Active Duty, Retired, or medically retired, honorably discharged and is he eligible for the GI Bill.

If he is on AD then the SCRA helps him with certain potential aspects of these problems. It helps until 90 days after discharge but any violations that occurred during his AD time can work for you. Read this link http://www.military.com/benefits/military-legal-matters/scra/servicemembers-civil-relief-act-overvie...

If he is retired versus medically retired, he may have some other options.

On to the accounts.

I cannot tell you a thing about PFD’s, but others may chime in on those.

The DOD debt needs to be looked at carefully. If it is a mistake by personnel from years ago he may be eligible for relief instead of repayment. May be worth looking into.

The Cap 1 account –has it been sold to a debt buyer or does cap 1 still own it? If they own it, PAY IT OFF ASAP. If it has been sold, then take the settlement and try for PFD. Depending on the Collection Agency (CA) that might work out for you, some CA’s just refuse to PFD.

Verizon listing does not indicate being sent to collections, just your note about a collection fee. If Verizon still owns the account PAY THEM. You can try a Good Will letter to get them to remove the late pays if they still own the debt. If he was on AD at the time, then the SCRA can come in handy as well as a strong story about his service to the country.

About the divorce. You don’t say when it was and if you are still in the same state. You might have a chance to revisit that, but a lawyer would be the one to advise you on that. That repo, if it is the fault of the spouse and you can prove it, can be a cause to have the divorce decree amended and those debts she ran up returned to her and taken off his credit. It is a tough road but can be made to work for you. Talk to a lawyer for the most accurate advice on this subject.

As for credit options:

Does he have a checking or savings account that is currently in use in his name or is he on yours?

Most banks and CU’s won’t touch a 400-ish credit score even for a savings account so many options depend on you.

If he is AD or Retired (not medically retired) then run to NFCU and open a savings account. You as his spouse would have the right on your own to join. Do this, add him and then see below about share secured loans. NOTE: if he is not directly eligible for NFCU there is a method to getting in that involves joining the Navy League San Diego chapter. Search the forums for it and again it may have to be You that joins first then add him.

Same for USAA. They have a secured card that reports as unsecured, which is better for him. They also have share secured loans. Eligibility for you is based on his service unless you are also former military, or one of your parents was. Check their car insurance rates, they might be better than your current ones.

Search MyFico for Share Secured Loans. This is a link http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Adding-an-installment-loan-the-Share-Secu... to an explanation

But there is also a series of posts on how to maximize the impact of a SSL into a triple whammy in your favor. You must research those on your own.

Cap 1 is fairly forgiving from what I understand. Search the threads here for getting Cap 1 after shafting them in a bankruptcy or collection action.

Blue Sky offers secured cards with NO credit check. As a starting point this may be the best option depending on your other factors.

My Jewelers Club (MJC) offers a $5000 line of credit for what amounts to about $200 bucks. You but a $99 membership and some piece of really bad jewelry for about $100 bucks. In exchange they report an open and active $5000 charge account to the CRA’s, or at least to TU and EQ. There is a Hard Pull to EXP for most people but for some reason it does not seem to report to EXP. No one seems to know why. Search the forums for more info on them. As a starting point for someone so low, it might be a good tradeline.

Any other second tier card or account search the forums before you apply or consider them. Some like Credit One are just plain thieves, others just fly by night outfits. Places like Fingerhut will give anyone a card.

With all of them be careful because many demand to do automatic withdrawals from your checking account and that can mess you up. Read up on every accounts’ terms and conditions, and search the forums before you apply for them. The details matter.

I hope some of this helps and do post the dates and facts about the accounts that I mention above.

Mike

Fico 8 12/22/16: EQ 658 | TU 682 | EXP 721

Next Goal: 700's across the board

Credit Karma: EQ 554 | TU 551

CK 12/22/2016: EQ 637 | TU 637

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

Wow! I appreciate your detailed response. Let me respond the best I can.

He was honorably discharged a couple years ago. The department of defense mailed him a paper to fill out requesting income, monthly bills, etc to work out a payment plan. He is handling all that. I do not know much about it- I am not military. According to him, he was overpaid for something.. he has confirmed it was a legitimate debt and is making arrangements to repay that as well as for a class he failed that he used benefits for. Nothing from the DOD is in collections as of this point.

About NFCU.... him and his ex had accounts with them. Checking, savings, and they each had seperate credit card accounts. When they split up, she drained the account and overdrafted it by the limit, $500, and that increased up to almost $700 with late fees. In addition to this debt, scrambling to pay for other urgent expenses, my partner stopped paying on his CC with them for a couple months. He called Navy Fed to explain the situation but as they were both joint on the account, they stated there was little they could do (though they were empathetic). He ended up paying the $700 and took his name off the checking and savings that way if she overdafted again for the $500 now that it was at a zero balance, he would not be responsible again. He also set up a CC payment but they closed the account literally the next day. He appealed to get it re-opened but they would not. He owes $950 on that card but is in good standing with NFCU- he pays more than the minimum on it monthly. Paying off that 700.00 and taking his name of the account saved his butt before it went to collections. He may not have burned the Navy bridge.

Abous USAA.... yes, we have car insurance through them. Now this gets tricky as well. She has a car in her name with a $5700 loan in his name. She has not made an on time payment on this car loan in over a year. This is also contributing to his low score. We DID consult two lawyers about this about possibly having her re-finance or what not to get this out of his name. She was awarded car. Basically, the lawyers are telling us nothing we can do. So it looks like we may have to pay off her car since the loan is in his name. It is complicated and stressful.

He is on my credit union account for checking & savings.

Okay, on to accounts... I will try to answer the best I can but I was not around for when this debt was accumulated. I am learning more about it every day.

Verizon is in collections and offered a settlement. The date of the last letter I got from them is 11/04/2016. It is with Convergent Collections. I do not think they own the debt based on referring to their client as Verizon and stating they are willing to settle... but what do I know.. could be wrong.

Capital One is with FirstSource Advantage LLC. Sent letter 09/16, but deliquient well before that. They are first on my list to pay next check. They offered a settlement but I feel like it would be better to PIF, PFD if they will.

Progressive- we are not sure where this collection is because we never got a letter or anything. It just showed up in collections. We did call Progressive though and they will take the payment but won't do a PFD according to the customer service rep.

WOW is with credit management L.P.. Sent to collections 12/2015 for a balance of 2,274.49. We got this reduced to the 924.00 currently owed because we went through storage and hunted down most of the equipment not returned.

There was one other collection account for an energy company bill for $165.00 that we already paid but they wouldn't do a PFD either- despite spouse being actively deployed during the time frame the bill was accured.

Now.. he could speak to a lawyer to try to get debt moved on her shoulders or split between them but she also has a MASSIVE amount of debt she accumulated when he was in service... including 10,000 NFCU card, VS card, other CC's, and loans... it almost wouldn't work in his favor to split "marital" debt as she has more than him. Just a super complicated situation.

As said, we are fortunate to have the ability to pay a lot of these accounts off, just wondering best way to go about doing it.

Thank you again. Please let me know if I missed any of your questions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

@Anonymous wrote:My spouse has baddies. A lot. His Vantage score is at a 431 and lowering by the week. I am unsure of his FICO at the moment. He has no open lines of credit minus student loans (payments not due yet) and I added him as an AU on my one of my decent accounts. There are many excuses for his debt load: deployment, wife didn't pay bills she said she was paying, ran up credit accounts, and served him with divorce papers, had a lawer and he couldn't afford one, debt remained solely his, etc. I could go on and on but I will refrain. He is trying to work on credit, but unfortunately it is hard to know what to even start with in this case. We'd really like a house at the end of this year, early next year, but VA said we won't get close to qualifying for the home loan if he doesn't have at least a 650. We currently pay a little over a grand a month for our apartment so finances are a bit tight. We are both working to clean up his credit in 2017 and establish healthy, responsible credit habits.

I have the ability to pay off nost of his baddies, but I am wondering which agencies I should try for a PFD, which I should settle for vs. paid in full, etc. ANY advice you have is HELPFUL.

Good lines of credit

Student Loans (not due yet)

Added as an AU on my 2 year old credit account (didn't help him much with score according to CK)

Possibly wondering if I should add him as an AU to my new QS1 card, 3,000 SL? Advice?

Baddies

Comneity/Zales $895.02- In Collections

WOW- $924.00 Collections (equipment was lost in a previous house they had to abruptly move from)

Capital One- $389.33 Collections, Offered us settlement for $155.74 but eventually i'd like to get him a secured card so idk about the settlement offer

Verizon- $583.86 (this is with a 89.06 added collection charge) wonder if we paid verizon off, if it would be cheaper?

Department of Defense- $801.00 (I guess they overpaid him?- not yet reporting to bureaus but will be soon- submitting payment plan info)

Progressive- $216.00 Collections

He also had a car repossessed during divorce a couple years ago for $10,406.00 but there is probably little we can do about that at the moment. The rest of the accounts can be paid off within the next thirty days, with the exception of WOW which would be 60 days.

There are probably no credit options for him at this point I am thinking, even secured... am I right?

I agree, dates would help. I can't make comments on all the military related information but I will give you my 2 cents on what to do if you have to deal with this stuff the way the rest of us civilians have to deal with collections. I would definately look into Deployed Service Members Relief Act. Way back when I used to work for a large banking insitution and military pulls on the heart strings and we did a lot of things we said we wouldn't.

Zales: Who's the collection agency? DOFD? PFD? (check the forums to see if there is any success with the CA)

WOW: CA? DOFD? PFD? ""

Capital One: Capital One is pretty chill about letting you back in. If it's been over a year since the charge off and the collection is paid you can apply. Considering his low scores secured is the only way you will be able to go. I'm guessing the collection ageny is Portfolio Recovery Management. They do not PFD, FYI.

Verizon: If the account is still with Verizon, pay it. They will not PFD. If it is with a CA maybe they will PFD that line but the orginal charge off will stay. Look up the CA on the foum.

DOD: I don't know anyting about this. If you think this is accurate, set up the payment plan and make sure that they will not report as long as you are on a payment plan.

Progressive: Credit Collection Services (CA I assume is on this) will PFD. Look around the forums.

The only thing I would be worried about when doing a settlement vs. PIF is when you are doing a mortgage app is if going under a manual UW that doing a "settled for less less than debt owed" will be looked at negatively. Something to think about.

Depending if these collections are updating monthly, it could keep your credit score down.

New Credit:

I would highly suggest you run his credit through CCT for $1. If you would like to continue to track his progress (which I still do with mine) I would suggest you sign up for myfico. I did CCT but they didn't update as quickly as myFico. CK (FAKO) scores were below 500, in reality they were at 500 (as of september 2015). It will give you a better idea of where his scores are really and what is reporting on which CR. At least run his credit report on free annual credit report . com, that way you have all the best information including DOFD and dates expected to fall off.

Secured will be the way to go. As mentioned previously, keep away from guys like Credit One and First Premier. Scum bags with annual credit fees that take up most of your credit line. If I were him (and hey I was!), start with a secured Capital One (sorry, does not unsecure usually) and Finger Hut. Finger Hut will give credit to anyone that has a pulse. Capital One is a triple pull. Finger Hut, I don't remember. I woul also consider doing Discover. Discover may or may not unsecure. Best case scenario is to have 3 revolvers and one installment loan. I know he has the student loans but they arent showing payment history yet ( and I don't know when they will), so he may want to do a secured installment loan, pull the loan money to do a deposit on a secured CC deposit. I would add him as an AU to your account in the meantime.

Once he has the CC open, make sure that he PIF and is at zero balance on all accounts except for 1 when the statement closes. That should still be at less than 10%. The statement close date is usually a few days after the due date. After that it's just on time payments and time.

I started with 500 credit scores and 15 negative tradelines and no credit in September 2015. Now I have 2 closed negatives and 2 lates from 2 years ago. I have late 600's credit scores and about 15K in available credit including AMEX. It's possible, it just takes work.

Good luck.

Current Scores: October 2017 EQ: 715 TU: 710 EX: 716

In My Wallet:

Cap1 QS: $4.8K - AMEX BCP: $4.2K - Old Navy Visa: $7K - Nordstrom $3.8K - VS $500 (FTW!)

BofA AU: $12K AMEX AU: $25K

Business: AMEX BCP $15K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

Socialworkersalary2017

Happy to help anyway I can…everyone here has or has had problems and get just as overwhelmed.

You said honorably discharged, so I assume he did not retire. This still makes him eligible for the Post-9/11 GI bill so why is he taking out student loans? And I hope to hell you are getting the monthly stipend. If not RUN to the VA and get this going that stipend is between 1500 and 2k a month depending on your zip code and could help. If you need it this is a link to the info

http://benefits.va.gov/GIBILL/resources/benefits_resources/rates/ch33/ch33rates080116.asp#HOUSING

Okay on the DoD, just make sure it is legit and not a military F.Up.

As to the car loan in his name, was she awarded the car with him ordered to pay for it? Or was she awarded the car with a requirement she pay the note instead of refinancing? There is a difference and it should be spelled out in the divorce decree. If the decree says she is to pay, then sue her. Then take that judgement and the divorce decree to the lender and get it put onto her.

The lender won’t like it and will repo the car but in that circumstance, it would be on her not his record. Additionally, if she is failing to make divorce decree ordered payments, then get a hearing with the judge, screw the lawyers, and ask for permission to repo the car yourselves and then turn it back in if you don’t want it or sell it for the balance owed. You really need better lawyers.

You used the word “partner” here, are you legally married at this time? If not then your options change and in fact change for the better for you. If you are married and are not a strict traditionalist, consider a divorce for convenience. Depends on your state of course, but right now his credit can drag yours down.

I was afraid that it was the case he is on your accounts. It would be better if he had had a banking relationship on his own but it is what is.

Verizon- from what you say Convergent is acting as their agent and NOT a debt buyer. Contact Verizon directly, speak to their Credit and Collections department. Offer the PFD there. They can pull it back from the agent and vacate the collection off your record. Here you need to check your reports and see if both Verizon and Convergent are reporting you in collection or one of them is.

FirstSource seems to be an agent instead of a debt buyer. Try getting through to Cap 1 Collections and have them pull the account back. Same thing as with Verizon, make sure that both of them are not reporting to the CRA that you are in collections, they are not supposed to do that. Then if they pull it back Firstsource has to remove their collection reporting, and you have a window to PIF without needing a PFD. Then do a Good Will campaign to remove the lates.

Progressive—Find out the Date of First Delinquency. If the account is outside the SOL in your state (or the state the contract was made in) then request PFD based on not being able to be sued over the account. What this means is a tiny amount of leverage for you. The most they can do is keep the account on your reports for 7 years. If it is past the SOL, then it is likely you have less than 3 year before it drops off (depends on your state and the SOL.). Quite frankly at that point the would most likely want to have the money instead of just trying to harm you.

Additionally if the front line people are the ones saying no, try finding an executive level contact, maybe investor relations or board member emails. Reach out to them, play the Military Service when this happened, bad press, twitter, blah blah blah cards to get them to PFD for PIF.

The energy company action falls under the SCRA and as such can be liable for that refusal if he was on deployment when the default happened. There can be healthy fines if they screw a military person, so it might help get it PFD’d. This one may need a lawyer to deal with. Try contacting the American Legion and other Vets orgs nearby to get them onto the case.

The letter dates you mention don’t help us understand the timings needed.

There is number on each account called the DoFD which is the date of first delinquency. This is the date that caused the account to go to collections. Now this is where it gets complicated.

To see the proper DoFD you need the credit report and in fact what you want (and really need) is the printed report from each CRA. DO NOT USE THE ONLINE REPORTS! They mask information that you really need to know.

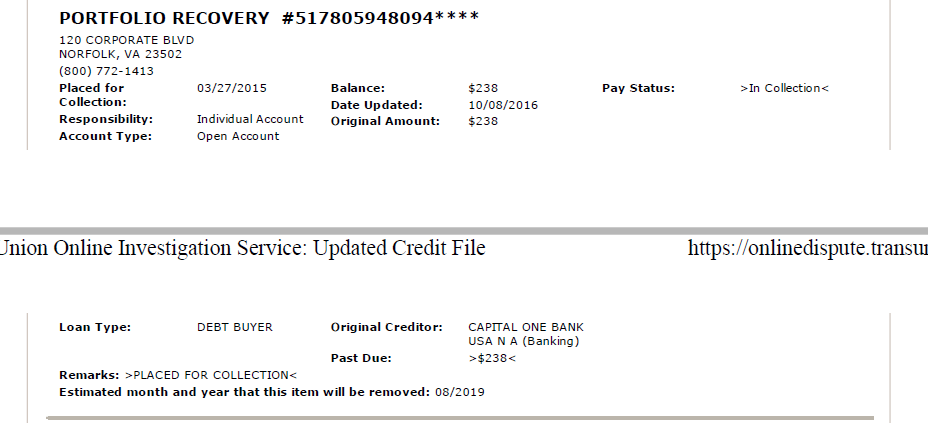

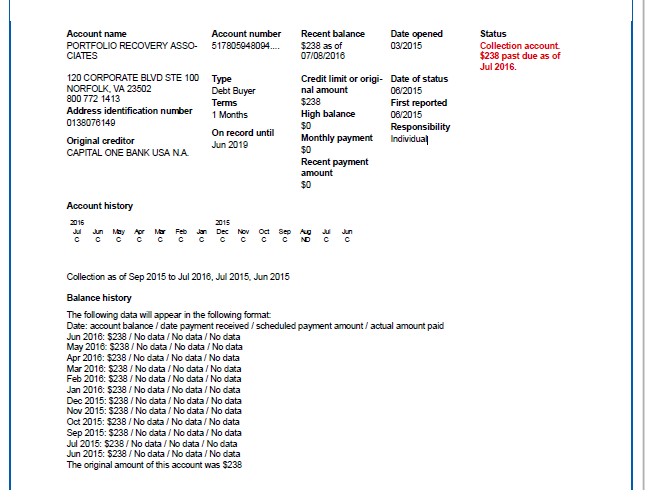

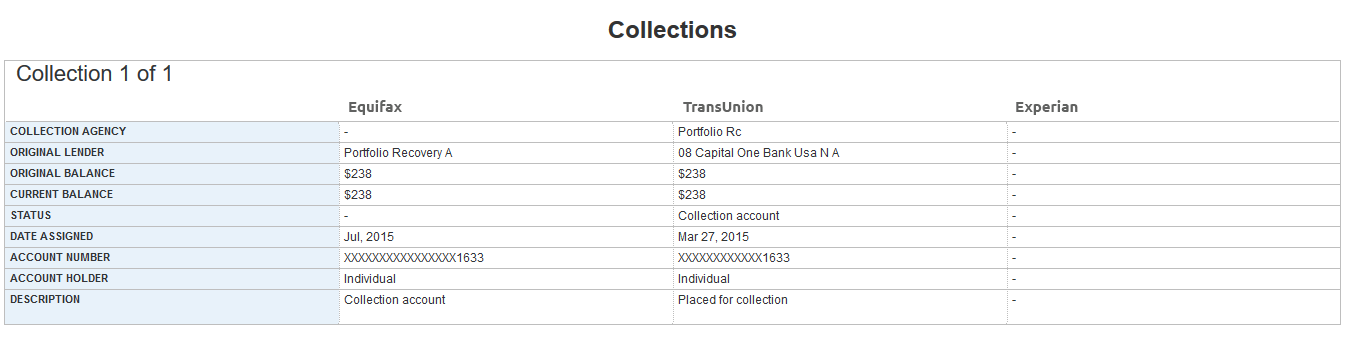

See the below images:

TU online report through freeannualcreditreport.com

Exp printed report for same account

This is how MyFICO 3B report shows the same account

In the top one (TU) you will see a line that says “Estimated month and year that this item will be removed” then look at the second one it says “On record until”. These dates are supposed to be the DoFD or close and they must be the same from report to report. And EQ shows it in yet a third different way. Now look at the third one and notice the PRA is telling EQ that they are the Original Lender which is a fact they know to be false. It means they are reporting the account as if they are a Lender which a Collection Agent can never legally be.

Besides a half dozen other problems with the reporting, one is that they are reporting the dates differently to each the CRA’s. however, if you look at MyFico (paid) you will not see all this data in the 3B they show you on line. That is why you need the printed report. It is a pain in the neck but worth it when you are rebuilding and fixing things.

The DoFD NEVER changes and is set by the Original Creditor (OC). However, debt collectors frequently try to misrepresent the DoFD in their reporting and in communication with you. This is illegal to do, but since most don’t know what the DoFD is or that it exists, the vultures get away with it way too often.

The DoFD has two very important functions. The SOL and the date the account will fall off your report are tied to the DoFD. Knowing the DoFD on any account gives you knowledge and some leverage on accounts past their SOL.

In your situation the plan to get PFD’s is a good idea, just be aware that without knowing the DoFD you are giving up some power you might otherwise have to convince recalcitrant companies to give you one.

Fico 8 12/22/16: EQ 658 | TU 682 | EXP 721

Next Goal: 700's across the board

Credit Karma: EQ 554 | TU 551

CK 12/22/2016: EQ 637 | TU 637

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

SocialWorkerSalary2017

I need to correct something I said ... it is Open Sky not Blue Sky that offers secure credit cards but doesnt do hard pull credit checks.

sorry about that mix up.

Mike

Fico 8 12/22/16: EQ 658 | TU 682 | EXP 721

Next Goal: 700's across the board

Credit Karma: EQ 554 | TU 551

CK 12/22/2016: EQ 637 | TU 637

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overwhelming Rebuild Questions

Thank you all so much.

We are going to sit down together this weekend, start researching and drafting letters/emails, and get things in motion. Your feedback has been extremely helpful. He is not currently getting the GI bill because he is not enrolled in school. He will resume in the fall. He is going to send in the payment plan letter to DOD tomorrow and contact VA for assistance regarding what he owes for failing that class. Hopefully, this is a step in the right direction for him.

I am going to sign him up for my fico this weekend when I have some spare time to check what is reporting, dates, etc.

I am always going to look at Open Sky.

Edit: We are also not married. He is not impacting my credit. We are both on an apartment lease and car insurance account, and he is on my CU accounts.