- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Paid and Closed CC, score dropped

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paid and Closed CC, score dropped

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid and Closed CC, score dropped

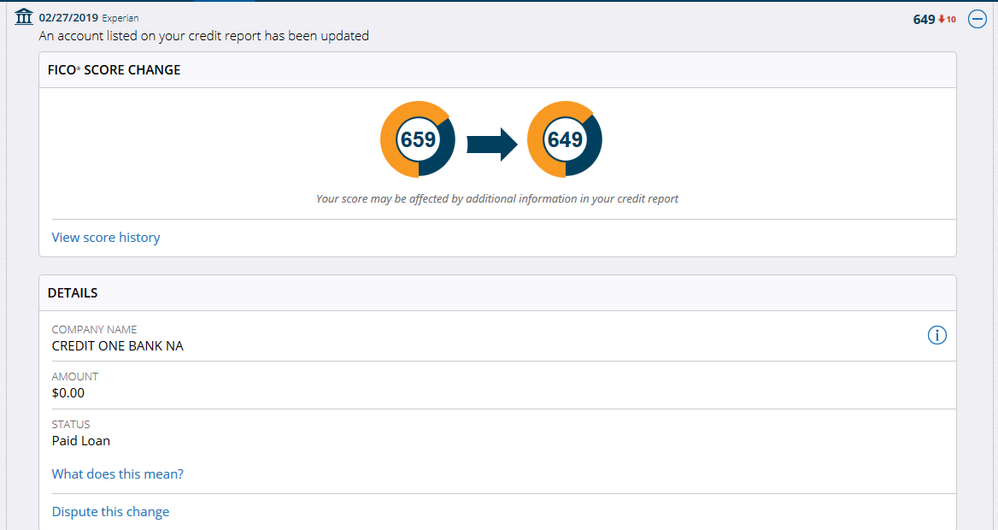

Hey everyone - I closed my Credit One card last month, and it reported a $2 balance due to interest or something like that. No score change last month. This month it reported closed and $0 as I paid the interest from the last time I had a balance. My score dropped 10 points from this, and as you can see below the remarks said "paid loan".

This should not have happened, correct? Why on earth would I lose 10 points for paying off revolving debt?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

@thornback wrote:

When you closed the account, bringing the credit limit to $0, how much did that drop your total amount of available credit? Closing a card reduces your total available credit limit - affecting utilization. Did your util increase with the closing? Also closing can affect the number of accounts showing a balance. For example, if prior to closing, you had 1 out of 3 showing a balance, you would now have 1 out of 2 - possibly dinging you for 'too many accounts with balances' Can you tell us about your other accounts?

Sorry, I've been around here long enough to know to include data points lol.

My current reported utilization is 3% (354/12500)

Revolving accounts with balances - 1/5

All open accounts w/ balances - 4/8 (1 card reporting balance, mortgage, auto loan, personal loan)

Let me know if you need anything else - AAoA from my credit reports is like 2 years or so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

I'm assuming you already triple checked to make sure nothing else, unrelated, changed prior that may have caused the drop in score; meaning the report of a closed account simply triggered the alert / score update reflecting a decrease that resulted from some other alertable event?

Is it just one bureau that updated so far?

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

@thornback wrote:

Yea, with those stats, a 10pt. score drop due to closing seems quite odd.

I'm assuming you already triple checked to make sure nothing else, unrelated, changed prior that may have caused the drop in score; meaning the report of a closed account simply triggered the alert / score update reflecting a decrease that resulted from some other alertable event?

Is it just one bureau that updated so far?

Yea I find it odd as well, if anything I expected to maybe gain a point or two. I have checked my Experian report and do not see any other credit alerts. No new inquiries (although I have a ton lol), no missed payments, etc.

So far I have only seen this change on Experian. Do you think it's weird that there is a comment on the alert that says "paid loan"? Maybe Experian is reporting the account type incorrect?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

Disregard the part about the account type. Checked my report and it's showing Revolving. So that must be a MyFICO deal.

I'm baffled, I guess I will wait to see what happens to TU and EQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

Scores - All bureaus 770 +

TCL - Est. $410K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid and Closed CC, score dropped

@xaximus wrote:

OP - if you can - when was that TL opened? SL/CL on the card? Can you list out your other cards with SL/CL, when opened, etc.

Closed Credit One Card - Opened 11/2017, SL 300, CL 700

Blue Nile Card - Opened 6/2018, SL 1000, CL 4200

Kohl's Card - Opened 5/2018, SL 300, CL 700

Wayfair Card - Opened 9/2018, SL I think 250?, CL 3700

Capital One - Opened 9/2018, SL 300, CL 800 (combined another CapOne Card)

Military Star - Opened 10/2018 , SL/CL 2950

So my Credit One card was the oldest of these cards, but that shouldn't matter as it will be counted for 10 years correct?