- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Paid charge off and score dropped ? So confused.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paid charge off and score dropped ? So confused.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid charge off and score dropped ? So confused.

Hello MyFico fam!

I need to tap into your collective knowledge base!

I had a charge off for Capital one auto as a result of my car being totaled when I was t-boned at the end of 2019. I was injured (TBI and diagnosed w POTS) so I was busy dealing with that but I contacted capone and they told me not to worry about it for now - stuff about insurance. Next thing I know I have a charge off - granted months later. I saw a balance but there was no make a payment option and I was dealing with health issues plus enter covid. You know, life. ![]()

Anyhow I paid this charge off in full about a week ago. I saw a huge jump on Equifax vantage from 691 to 758 - then a drop a couple of days later to 703. More concerning is my Trans score went from 733 to 759 and then down to 705. I got a notification on Exp about Trans having a new account from capital one. It doesnt appear to be a new account though.

I can't seem to figure out why its lower and Im not sure what to do. I hadn't paid it after it became a charge off because I thought it would lower my score by recent activity but I was told that wasnt true... and yet... here I am.

I never had a late payment before the car was totaled. I have a 14k credit card w capone and an 8k walmart card w them, both in good standing w no lates. Would a goodwill attempt make sense? I would appreciate any input or guidance. Thanks for reading. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

@Trinzero wrote:Hello MyFico fam!

I need to tap into your collective knowledge base!

I had a charge off for Capital one auto as a result of my car being totaled when I was t-boned at the end of 2019. I was injured (TBI and diagnosed w POTS) so I was busy dealing with that but I contacted capone and they told me not to worry about it for now - stuff about insurance. Next thing I know I have a charge off - granted months later. I saw a balance but there was no make a payment option and I was dealing with health issues plus enter covid. You know, life.

Anyhow I paid this charge off in full about a week ago. I saw a huge jump on Equifax vantage from 691 to 758 - then a drop a couple of days later to 703. More concerning is my Trans score went from 733 to 759 and then down to 705. I got a notification on Exp about Trans having a new account from capital one. It doesnt appear to be a new account though.

I can't seem to figure out why its lower and Im not sure what to do. I hadn't paid it after it became a charge off because I thought it would lower my score by recent activity but I was told that wasnt true... and yet... here I am.

I never had a late payment before the car was totaled. I have a 14k credit card w capone and an 8k walmart card w them, both in good standing w no lates. Would a goodwill attempt make sense? I would appreciate any input or guidance. Thanks for reading.

So, there are lots of things going on here.

A Charge-Off is an accounting term that the financial institutions use when they have determined - whatever that might mean - that they are just not going to see a payment from you. There is some "science" to this....

You will typically see a 30-day late on your credit report. Then a 60-day late. Then a 90-day late. Then a 120-day late. Then another 120-day late (which is how they report things.....translated this would be the 150-day late) and finally another 120-day late (again, translated, this would be the 180-day late). Once you reach that point, the next month you will see the "CO" on your report.

That "CO" is the Charge-Off.

This is the second worst thing that you can see on your credit report (with a bankruptcy being the worst thing). But, it is not the end of the world.

Often, at some point in this 180-day journey, you will see another account on your credit report - that of a Collections Agency. And there are two possibilities here. The Collections Agency is either acting on behalf of the owner of the Debt (Capital One) or the Collecting Agency is now the legal owner of the Debt.

In the first case, the legal owner of the debt has tasked the CA to attempt to collect the amount owed (which might be significantly more than what showed up on the CC statement due to all of the fees and whatnot) as the legal owner has exhausted all of their internal resources in that attempt. Capital One, however, is still the legal owner of the debt. The CA would collect some percentage of whatever amount that they might collect from you, or they collect a set fee for their efforts....but Capital One is still the legal owner.

In the second case, the legal owner of the debt (Capital One) has given up and is now trying to recoup some monies. In that effort, they agree to sell the debt to a Collections Agengy for either a percentage of the debt or for a fixed some. In this case, it is often pennies on the dollar. The important thing here is, however, that the legal owner of the debt has changed.

So, what is happening here for you is two-fold:

1. The Charge-Off with Capital One is on your credit reports. There are a couple of important dates. The first is the "Date of First Delinquency". This is the first "30-day" late charge.....the one that started the string of six "missed" payments that resulted in the "CO".

2. There is (potentially) a "new" account on your credit report (for the Collections Agency).

In the account that is now the Charge-Off, there are some really important sets of data. I mentioned above the first one (DofD). There are some others:

A. "Last Payment Made" is another one. So are "Date Paid" and "Date Updated". Please note that "Date Updated" can also be "Date Reported"....depending on the CRA (Credit Reporting Agency - either Equifax, Experian, or Transunion)

B. You also - and this is super important - need to see the "Balance" show a $0.

Important things to note - and these are REALLY important - is that once you pay the debt (whether it is "In Full" or "Partial Payment") that the "Balance" reflect $0 and that the "Date Updated" show that month/year (read: the month/year that you made the final payment that brought the "Balance" from whatever it was down to $0). In other words, that the "Date Updated" field does NOT continue to update.

Why do we want to ensure that the "Date Updated" no longer is being updated? Because this tells the world how long ago this happened (well, just go with that) and if the data in this field continues to update then it looks like the "issue" was very recent. This is bad. We want the "issue" to start to age....you will gain some of those lost points back over time.

The "Date for First Delinquency" is sooo important because that starts the clock. A Charge-Off will age off of your credit reports some seven years and six-odd months from the Date of First Delinquency. Why do I say "six-odd months"? Because there is a possibility that this Charge-Off could age off early, on account of the "Early Exclusion" options with each of the three CRAs. So, that is why I say "six-odd months".......

So, let's just say that the first "30-day" entry happened in January, 2020. And let's say that the "CO" appeared in July, 2020. This Charge-Off will show on your credit reports for the next seven years and six months. So, roughly, it will age off in July, 2027.

A Charge-Off - as mentioned - is one of the biggest issues that credit consumers can/will face. Why? It puts you in one of the four "negative" credit profiles and you will stay in that "negative" bucket until it (the C/O) ages off. This is going to limit how high your credit score will reach during that time (and, again, this is going to be different for all of us because each of us has a VERY unique credit profile).

So, not only do you have the Charge-Off, but you likely also have/had the Collections Agency account on your report. Now that you paid this you have - potentially - the possibility of having that Collections Account removed from your credit reports. Well, hopefully. After the fact can be an issue.....potentially. Some CAs will automatically remove this account from your credit reports once it is paid according to the agreement. Some will remove it assuming that whatever stipulations they have in place are met (it seems like the biggest stipulation is that the Collections Account exist for at least two years.....but, there are a number of stipulations). Others - well, they just will not do this at all.

Have you looked at your three credit reports lately?

You can go to https://www.annualcreditreport.com and get a copy of each (one from Equifax, one from Experian, one from Transunion) through December, 2022 every seven days!

I would - if you have not done so - strongly recommend that you do this (go to annualcreditreport.com). That way you see everything that is on your credit reports. Well, as of the moment that you pull them. And we know exactly what is there and what is not there.

We are here to help you.....if you want / need help!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

Hello and thanks for the reply. I so appreciate the effort you put into it! ![]()

I monitor all of my reports through each of the subs from the 3 CRAs. I have no collections or other credit issues. Just this.

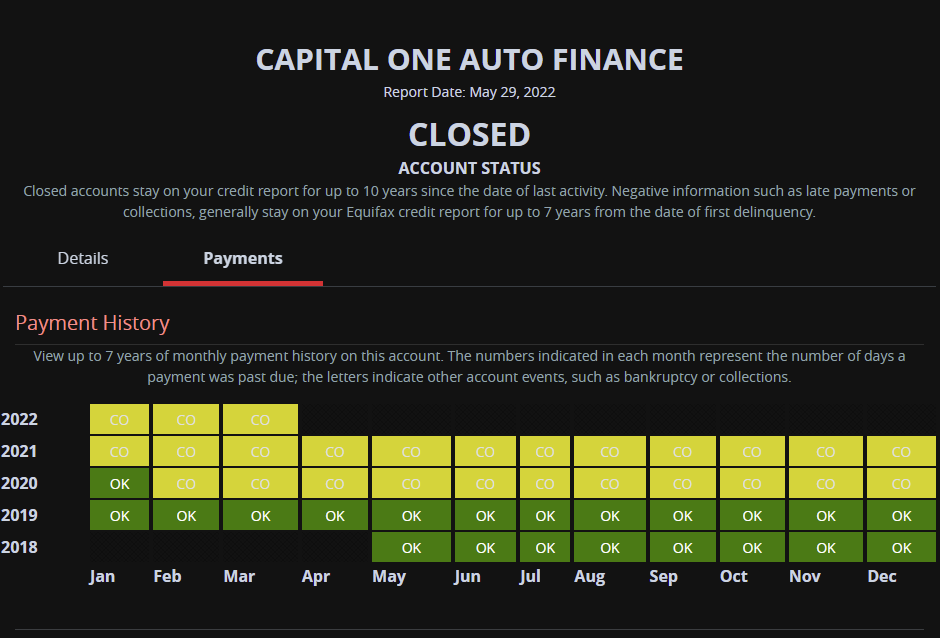

So there was never a late - just right to charge off, as shown in the photo below.

I never missed a payment, the insurance just didnt cover the full payoff. It also never went to a collection agency.

I contacted capital one at some point after the accident, they said it was still resolving insurance. Its been so long and my memory not so great since the TBI so no verbatim =) I was busy with doctors and insurance, FMLA - all the fun things that result from a car accident, and I never heard anything until the charge off.

Im just wondering on Equifax and transunion what would have changed AFTER I paid to cause first an increase but then a big drop? Experian didnt really do anything - up 5 down 2 or something of the sort.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

Looking at Vantage I wouldnt take that into account. Scores dont mean much at all. Its been said with trade-in's and such. Always make your payments until everything is finalized either way. Just because of the MVA. Sorry it happened. It doesnt mean your in the clear to not make payments any longer. Its a great thing you paid the account off. It may have been once paid it reflect $0 balance. But the main thing was the CO status remained quiet until you did pay it off. It updated as a fresh CO. Even though it isnt. Same scenario with disputing CO's and lates. If accurate. They come back verified and there goes the points. Whicever card you have that has a FICO score. Pay attention to that score. It will go away come Feb 2027. Most importanly your ok now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

Was that CO updating regularly? If not, when you paid it off, that triggered an update to the account and made it look "fresh" to the algorithms, even though it obviously wasn't. Granted these are Vantage, not FICO scores, but do you know what happened with your FICO scores? If it's just your Vantagescores being all wonky, I wouldn't really worry about it as no lenders really use those.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

I wouldn't pay any attention to Vantage scores at all. Those scores are not used by any lenders and are practically useless. How did your FICO scores react to this change?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

It looks like it updated regularly by those CO showing monthly. I think thats what that means.

I see Experians Fico, through that sub, dropped 3 points. Actual FICO 08.

Trans, through their service, went up and way down. And Equifax as well through their sub. I figured it would be the same in the actual FICO.

So thats NOT indicative of what the actual FICO would have done? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

Discover should update soon with my Trans Fico.

Penfed shows me Fico9 but it seems to have disappeared this week and its quarterly anyhow.

I will prob just pull it from here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

@Trinzero wrote:It looks like it updated regularly by those CO showing monthly. I think thats what that means.

I see Experians Fico, through that sub, dropped 3 points. Actual FICO 08.

Trans, through their service, went up and way down. And Equifax as well through their sub. I figured it would be the same in the actual FICO.

So thats NOT indicative of what the actual FICO would have done?

Correct. TU and EQ both provide only Vantage 3.0 scores through their paid services. Out of the 3 bureaus, only EX provides all 3 FICO 8s if you sign up for their paid 3 bureau monitoring. Vantagescores are extremely volatile, so large swings aren't that surprising with them. I wouldn't worry. ![]()

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid charge off and score dropped ? So confused.

@HowDoesThisAllWork mad props on this incredible post. Somehow you've managed to make some of the toughest credit knowledge to understand seem easily comprehensive. I am so humbled, literally daily on this forum, to see the vast knowledge and support that peeps just spit out on here for the sole purpose of helping others. Honestly, it amazes me and I am really happy to have stumbled on this forum a few years ago. Well I did not intend to take over this topic....a big thanks to you all!