- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Paying collection/charge off

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying collection/charge off

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying collection/charge off

I used the forums to research whether or not to pay off a collection/charge-off and saw conflicting information. Some posts said it would not improve my credit score and others said it would. The collection was a contract end charge from Verizon Wireless that was eventually reported to a collection agency. In the end, I decided to pay as it was a debt I owed and thought others might benefit from experience. My credit scores for all three agencies where all within a few points of each other - low was 653. Background: I have a Chapter 13 bankruptcy that was filed 6.5 years ago and discharged 1.5 years ago. It is due to fall off my credit report in February, so can't wait to see what impact it has. I have one other collection reported for an apartment - disputed amount due upon lease termination, but that is a topic for another day. I have no other negative items other than those two and the Verizon collection. I paid Verizon directly rather than the collection agency since I didn't have anything in writing from them with an address, etc.

My credit reports updated within a couple of weeks starting with Experian. My credit score increased by 7 points. TransUnion updated last and also increased by 7 points. Equifax updated one day in between Experian and TransUnion and increased by 10 points. These are FICO 8 scores, by the way.

Based on everything I read, I wasn't expecting credit score increases, but was pleasantly surprised. Hope this helps others that might be reasearching and trying to determine their best course of action.

EQ-665

TU-663

EX-673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying collection/charge off

I've been paying off a few collections recently and noticed a trend. If the account was still actively reporting, even if charged off I got a score bump when I paid it. If the account was not actively reporting, I took a score hit. Based on that, I've been focusing on the stuff that is reporting every month as I pay off the last few baddies. It may just be coincidence, but so far so good.

Congrats on the score hike! Every point counts.

Current Scores

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying collection/charge off

Shadeestill, you may have found the answer. The reason some see no increase is because the CA/Creditor was no longer reporting. Those that saw an increase had "actively reporting" items. I will pass this along.

Yes, I do realize that scores increase the older a collection/charge off is dated. That may also be why some see a bigger increase (newer deliquent debt vs. older deliquent debt) than others. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying collection/charge off

How can you tell if they're actively reporting? ? ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying collection/charge off

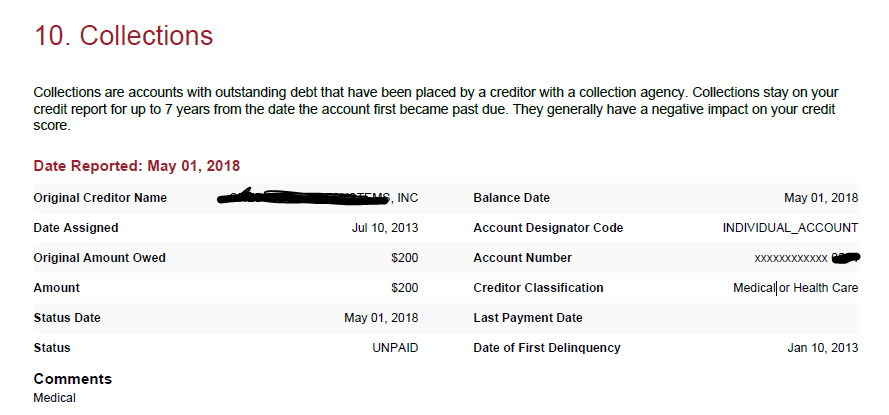

You will see it report every month with a refeshed date. I'll go grab a screenshot so you can see what I mean.

Screenshot from my last actual Equifax CR in 05/2018. They are still reporting and updating it monthly, as you can see from "Date reported" and "balance date." I can still see it on my MyFico subscription too, only reporting to EQ, but I cannot see updated dates there, only in my actual report.