- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Personal Loan

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Personal Loan

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal Loan

Ok so here's my plan. I have worked hard to bounce back from credit in the gutter, survived BK, and have been

gainfully employed and continuing to work hard.

Like most Americans I still have credit card debt. Only in a total amount of $7K. Have 1 collection of $450.00 that

will be paid off in April. Three charge offs for small amounts, 2 First Premier CC and 1 from Credit One. Credit One

has a balance of 0. All 3 last payment was in early 2015.

Not sure what to do on these 3 "charge offs". Collection as I said will be paid off in April. SO I want to get a personal loan

to pay off the remaining CC balances. I want just 1 payment. I don't want a debt consolodation loan that reports as such and

hurts my score. I'm currently sitting at a 590 credit score. All of my payments are on time.

I've bounced back in a large way and now want this pestering problem of CC debt behind me. Any suggestions of what to do

or who to look for in a legit, reasonable interest rate personal loan?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

You could take a look at BestEgg they don't list it as debt consolidation. It will just show as a regular personal loan on your credit report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@Anonymous wrote:You could take a look at BestEgg they don't list it as debt consolidation. It will just show as a regular personal loan on your credit report.

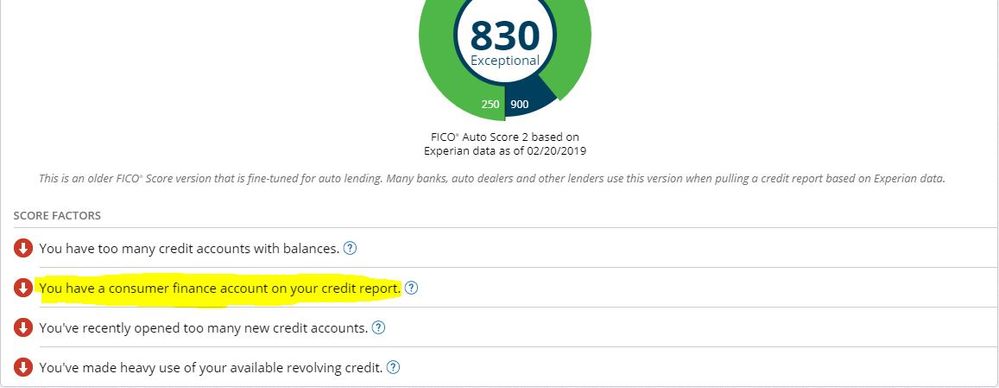

They may not list it as debt consolidation but the credit bureaus may list it as a Consumer Finance Account(CFA). There was a recent thread on this and certainly isn't something you would volunteer to have on your report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@hpertrain wrote:Ok so here's my plan. I have worked hard to bounce back from credit in the gutter, survived BK, and have been

gainfully employed and continuing to work hard.

Like most Americans I still have credit card debt. Only in a total amount of $7K. Have 1 collection of $450.00 that

will be paid off in April. Three charge offs for small amounts, 2 First Premier CC and 1 from Credit One. Credit One

has a balance of 0. All 3 last payment was in early 2015.

Not sure what to do on these 3 "charge offs". Collection as I said will be paid off in April. SO I want to get a personal loan

to pay off the remaining CC balances. I want just 1 payment. I don't want a debt consolodation loan that reports as such and

hurts my score. I'm currently sitting at a 590 credit score. All of my payments are on time.

I've bounced back in a large way and now want this pestering problem of CC debt behind me. Any suggestions of what to do

or who to look for in a legit, reasonable interest rate personal loan?

With a 590 which includes collections and chargeoffs, you're going to have a problem finding a loan. If you get offered a loan, there will be nothing reasonable about the interest rate. You may be able to try a local credit union as they would probably give you better rates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@Anonymous wrote:

@hpertrain wrote:Ok so here's my plan. I have worked hard to bounce back from credit in the gutter, survived BK, and have been

gainfully employed and continuing to work hard.

Like most Americans I still have credit card debt. Only in a total amount of $7K. Have 1 collection of $450.00 that

will be paid off in April. Three charge offs for small amounts, 2 First Premier CC and 1 from Credit One. Credit One

has a balance of 0. All 3 last payment was in early 2015.

Not sure what to do on these 3 "charge offs". Collection as I said will be paid off in April. SO I want to get a personal loan

to pay off the remaining CC balances. I want just 1 payment. I don't want a debt consolodation loan that reports as such and

hurts my score. I'm currently sitting at a 590 credit score. All of my payments are on time.

I've bounced back in a large way and now want this pestering problem of CC debt behind me. Any suggestions of what to do

or who to look for in a legit, reasonable interest rate personal loan?

With a 590 which includes collections and chargeoffs, you're going to have a problem finding a loan. If you get offered a loan, there will be nothing reasonable about the interest rate. You may be able to try a local credit union as they would probably give you better rates.

Agreed with a current 590 score and the collections & chargeoffs it's going to be difficult. However as I mentioned I will have

the collections paid off and removed next month. I'm always on time with my CC payments. The chargeoffs are from 2015

with 2 with First Premier and 1 with Credit One. I have no idea how to get those removed.

I'm always reveiving "pre-approved" letters and emails from Lending Club. If when my score goes up and I were to get a loan

from them is it listed as "debt consolodation" on my credit report?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@Anonymous wrote:

@Anonymous wrote:You could take a look at BestEgg they don't list it as debt consolidation. It will just show as a regular personal loan on your credit report.

They may not list it as debt consolidation but the credit bureaus may list it as a Consumer Finance Account(CFA). There was a recent thread on this and certainly isn't something you would volunteer to have on your report.

Will it show like this? I looked at mine and it just comes up as an installment loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:You could take a look at BestEgg they don't list it as debt consolidation. It will just show as a regular personal loan on your credit report.

They may not list it as debt consolidation but the credit bureaus may list it as a Consumer Finance Account(CFA). There was a recent thread on this and certainly isn't something you would volunteer to have on your report.

Will it show like this? I looked at mine and it just comes up as an installment loan.

You'll only know that it is listed as a CFA on your credit reports by reading the negative reason codes associated with why your score isn't higher. Some people don't even know they have one and even experienced people may have trouble picking out exactly what loan is causing the CFA code. There are no revolving accounts that are considered CFAs. CFAs are 100% installment loans.

So yes, your loan would certainly have to be reporting as an installment to be considered a CFA. I have one because I didn't know any better at the time. My car loan through ALLY(GMAC) that I bought at the dealership codes as a CFA for me. So Best Egg, Prosper, Lending Club are known to trigger this code, some car loans, and other kinds of installment type loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

So are you advising against using any of these lending services i.e. Best Egg,etc. as they will show as a CFA on ones

report?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Personal Loan

@Wizard10 wrote:

I just got a credit one charge off removed from my account. I got the email today stating they will remove it for me you could try emailing them and seeing if they are willing to remove it. They said since they sold my account they will just remove it. I’ll pm you the email I used you just have to craft up a nice goodwill letter explaining why you’d like to have the tradeline removed.

Got it! Thanks so much!!