- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Question about Capital One Pre-Qualification

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about Capital One Pre-Qualification

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Capital One Pre-Qualification

I was bored so I decided to check their pre-qual website and I was congratulated on being pre-qual'd for both the QuickSilver One and the Platinum card.

I already have a QuickSilver card w/ no annual fee. This card was originally the Platinum card which started at $300, and then trough credit-steps graduated to a $500 limit. As soon as this happened I did a product change to QuickSilver. They are being stingy and have only given me a CLI of $100 so far, so my CL on this card is now $600.

I also have a Discover IT that graduated back in Oct w/ a $2,000 limit and then I have my NFCU secured card that I've had for a year already and it's still a secured card w/ a $500 limit.

My scores have improved but I still have baddies. Credit Karma now says I that I have fair approval odds for a PNC CC but I'm not sure I should apply.

I'd love to get some higher limits and this typically doesn't happen until the others see that you can handle higher limits.

Any thoughts about this? It doesn't make sense for me to get QuickSilver One card w/ annual fee does it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

i'm in the same boat as you when it comes to capital one.

i see the exact same prequals.

only been with them since october 2019 with a secured platinum with sl of $200.

hoping to be able to upgrade soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

First off. Dont go by CK odds. Its marketing. PNC isnt an easy bank to get a CC with. They like a relationship with checking/savings. Have you tried a CLI with Disco? Better SL's happen when you apply for a regular card w/Cap1. My first was a Plat at $1200. Had it a year and then got a QS for 10k. Need some FICO scores and what are the baddies that are holding you back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

Agreed. ^^ Don't use Credit Karma to evaluate your approval odds. All it is is marketing for which I believe they receive compensation for. Continue using banks prequal tools. If you want to get a glance of possible approval odds, go to a banks prequal site such as Cap1 and if you receive any offers for a card you want/need, check the Rates & Fees section of that card and locate the APR. If there is a solid APR, showing a single percentage than your chances of approval are greater than that of a card whose APR section shows a range of numbers. However, that does not guarantee approval and that's not to say you won't be approved if showing ranges.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

I was once in a similar situation. Wait until you see a preapproval for the venture card. Once that appears you can get any card you want with them and at a decent limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

@Penjamin_Fedington wrote:I was once in a similar situation. Wait until you see a preapproval for the venture card. Once that appears you can get any card you want with them and at a decent limit.

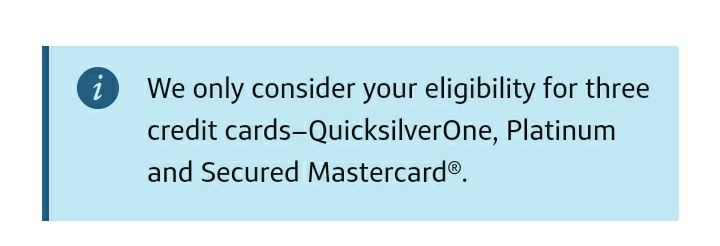

As per the Capital One website, they are only doing pre-quals for their lower end products:

Secured

Platinum

QS1

Took this SS right now:

You currently cannot pre-qual for their prime products. You can only cold app for those rn.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Capital One Pre-Qualification

@DeadlyPersona wrote:

From my previous experience with Capital One, and what I’ve learned here, they like to see you use their card...a lot. I know with the way the economy is now, not many people are swiping. However, keep in mind using your Capital One card for the rewards such as gas, restaurants, etc. could work out for your benefit when it comes to requesting a hire limit. Also, try requesting the higher limit via chat. It always worked for me in the past.

100 percent with this. I have basically sock drawered a Cap1 QuickSilver with a $3500 limit. Barely have used it in the last 5 years. When I was preparing for my home purchase, I was attempting to do CLI with my cards to help drop my UTIL % a bit lower because paying them off wasn't the best option for me at the time (needed to show certain dollar amount in my savings for the home purchase)

Mind you, I have a 14.5k limit with Discover, 14k with Citi...

So I went through and got about 10k more in limits from various cards. Cap1?

Their response was instant. No CLI. My score? 761 at the time. Their justification on their letter was basically "Bro, you don't use your Cap1 card, I ain't gonna help your UTIL" - obviouslly not that but it literally said like of use was the main reason for the limit denial...

-scott

Current FICO Scores:: May 2022: TU: 784 | EQ: 770 | EX: 790