- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Question about Sold mortgage loans

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about Sold mortgage loans

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Sold mortgage loans

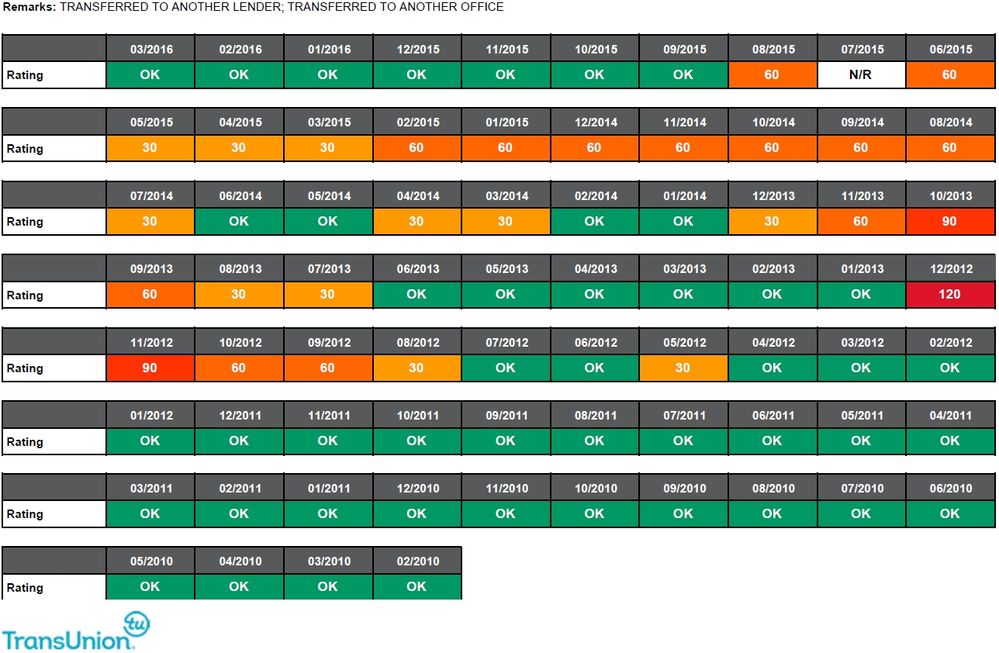

DW and I have a principal home + mortgage, and an investment property + mortgage. Both loans got into deep water in 2012 to 2014. We managed to bail out enough water and right the boats in 2017. BofA and Chase, respectively, sold the loans right away, to mortgage servicers I'd never heard of.

Since then, we have four adverse / derogatory tradelines reporting. Will the Transfer / Sold tradelines be removed at some point, or are they permanently tethered to the open accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Sold mortgage loans

Any adverse items of information reported under either the original creditor account or the new account are subject to the same credit report exclusion provisions set forth under FCRA 605(a).

More specifically, and monthly delinquencies become excluded no later than 7 years after initial delinquency, and any charge-off or collection become excluded no later than 7 years plus 180 days from your date of first delinquency.

Stated differently, the OC account could continue to be included for up to ten years after it was closed, but adverse reporting under the account must be excluded when each item reaches its statutory exclusion date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Sold mortgage loans

RobertEG, thank you for the response.

Given the tradelines aren't tethered to each other then, shouldn't the original tradelines (Chase and BofA) have DoFD? Could I call those lenders for that info?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Sold mortgage loans

The use of DOFD for calculation of exclusion of derogs is only required under the FCRA for charge-offs and collections. See FCRA 605(c), which clarifies the exclusion provisions of FCRA 605(a)(4), which applies only to charge-offs and collections.

More specifically, exclusion must occur no later than 7 years plus 180 days from the DOFD.

To that end, creditors or debt collectors are required to separately and explicitly report the DOFD to the CRA no later than 90 days after reporting of a charge-off or collection. See FCRA 623(A)(5).

The use of DOFD for calculation of the exclusion of monthly delinquencies is not explicitly required under the FCRA, but rather is an interpretaiton made by the CRAs of the delinquency exclusion section, which is FCRA 605(a)(5).

More specifically, all monthly delinquencies occuring within the same chain of delinquency become excluded after 7 years from the date of the initial delinquency in that chain.

Thus, the separate reporting and storage of the DOFD is not required under the FCRA.

While the common credit reporting manual used by the big-4 CRAs permits reporting of DOFD after monthly delinquencies, it is not explicitly required, and thus may not be of record in your credit file.

If a DOFD is reported, it is stored under its own reporting code under the General Segment, Field Code 25, and is titled the "FCRA Compliance Date/DAte of First Delinquency."

Many commercial credit reports choose to omit showing of the DOFD, even if it has been reported.

You can usually find it in a report ordered from annualcreditreport.com.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Sold mortgage loans

Ok, gosh I guess I get to live with this baddie for a while. Until Feb 2023?