- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Question about how to proceed, weird collection le...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about how to proceed, weird collection letter

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about how to proceed, weird collection letter

I'm hardly rebuilding, but I got a collection notice out of the blue today that I need some advice on, and when I searched the company name the rebuilding forum came up.

Today I got a letter in my maiden name (I've been married for 10 years) telling me I have a debt in collection with CCI contract Callers Inc, collectiong a debt from At&T. I think maybe it's possible that 15 to 20 years ago I had an account with them, if I did it was one of two things:

1. My late fiance's pager bill that perhaps I signed up for on my fiance's behalf..that it was a pager tells you how old that bill would be

2. I used to work for a telecom company that sold cell phones etc and I believe when I stopped working for them they switched the account to my name. This would have been at LEAST 15, probably 20 years ago.

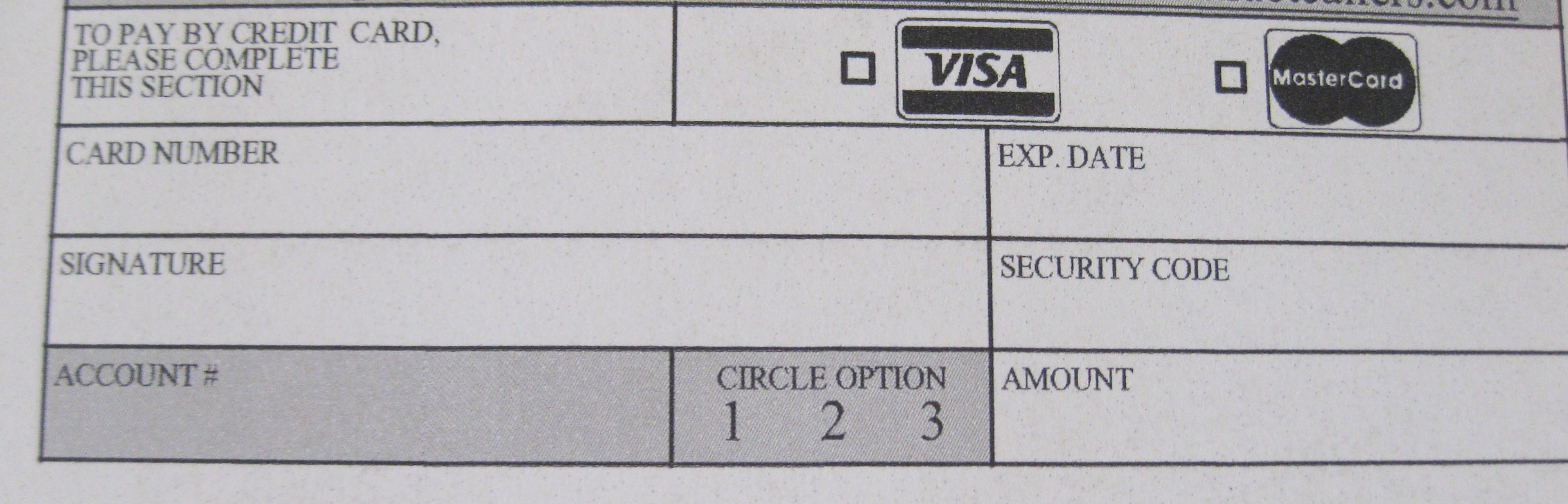

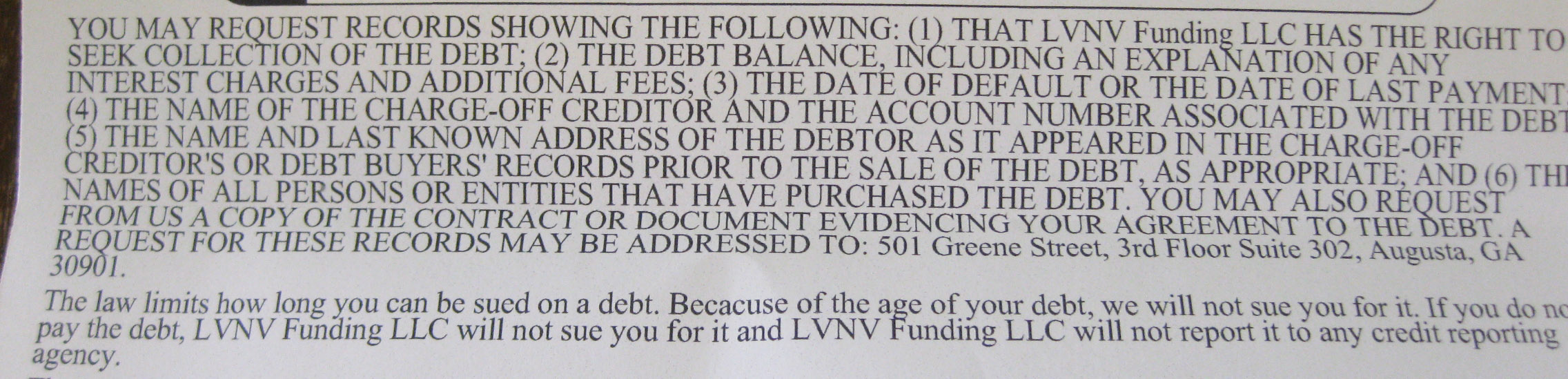

So the letter arrives today in my maiden name, with a collection amount of $1,190, but it says they'll settle the debt for $178. A few thousand things strike me as odd about this, not the least of which that they say I owe so much but they'll settle for so little, also that the letter states if I don't pay they won't pursue me in court and nohing will show up on my credit report. The really weird thing? I've NEVER paid by credit card and had it ask for your security code for your card at the top of the letter.

So, I'm a bit irked, a bit amused and a bit confused. What should I do with this? If it is a debt I owe it's close to 20 years old and was an account ( In my name) for my fiance who died in 2001, or potentially it was a home phone bill from back when I was 23 (I'm 43 now). If this is a legit bill that's all it could be. I have perfect credit and haven't owed a dime in many many years.

If it IS a legit debt, would it then add it to my credit report? The letter says no, but I don't trust that, and being such an old debt I'd hate to dredge it up.

So dear Fico, what do I do with this? Like I said I'm confused, irked and amused by this all at once. I attached images of 2 sections of the letter I find odd. Thanks for any advice!

EDIT TO ADD: Around 2003-2004 my now husband and I were talking marriage but I had some debts. We got all my bills together and called every collection agency and paid everything off and then asked for deletion. During that whole year to 2 year process this NEVER came up.

Am I the only one who has never been asked for a security code as part of a CC payment, or am I just too used to paying online and this is a thing?

The bottom part of this strikes me as strange.

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

Thanks. I paid off EVERY bill I owed and haven't had any problems in ages. I am religious about paying my debts and have been for MANY years as attested by my credit score. If it is a debt I owe its 15-20 years old and I collected up all my bills back then and pulled all my credit reports and paid EVERYTHING off. If this is a legitimate bill why would they only now try to collect it so many years later?

It bugs me because I pay my debts, and it bugs me because we're getting another mortgage in 2 years.

But since they say they won't ding me for it I'm not too concerned. If they reallly wanted to get paid I would've thought they would have tried before now. 15-20 years is a bit ridiculous.

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

This is just zombie debt. There is lots of it floating around being sold and resold over and over on the secondary junk debt market. Just send them a drop dead letter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

If I ask for verification of the debt will that restart a very old clock on the collection? If I genuinely owe it I have no issue with paying it, I just don't see why it took them so many years (and I don't recall a specific At&T account from years ago, but it is possible)

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

@Anonymous wrote:This is just zombie debt. There is lots of it floating around being sold and resold over and over on the secondary junk debt market. Just send them a drop dead letter.

Does this mean if I tell them to drop dead though that they'll just sell it off again to another creditor and I'll keep getting zombie letters from someone else?

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

@wmweeza wrote:

@Anonymous wrote:This is just zombie debt. There is lots of it floating around being sold and resold over and over on the secondary junk debt market. Just send them a drop dead letter.

Does this mean if I tell them to drop dead though that they'll just sell it off again to another creditor and I'll keep getting zombie letters from someone else?

Unfortunately, yes. Even if you don't tell them to drop dead.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

Thank you all. I'll have my attorney contact them to gather information, figure out what the debt is, and pay it if I owe it. I'm sure he can get the letters to stop and help me figure out if the debt exists etc.

This is why I love these forums! I have worked very hard at having great credit, to have this pop up after so many years of a clean file is stressing me and is annoying

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

@wmweeza wrote:Thank you all. I'll have my attorney contact them to gather information, figure out what the debt is, and pay it if I owe it. I'm sure he can get the letters to stop and help me figure out if the debt exists etc.

This is why I love these forums! I have worked very hard at having great credit, to have this pop up after so many years of a clean file is stressing me and is annoying

Even if it is a valid debt that you didnt notice before, it is past the SOL and also past the 7 year mark.

Past the SOL means they cant use the courts to help obtain or enforce payment.

Past the seven year reporting limit means it cant show up on your credit reports. Paying will not change the reporting status.

Being a zombie debt that old, I would wager they paid a tiny amount for the rights to own it and try to collect on it. I would be surprised if paying 170 to settle it was not ten or more times their cost.

When you apply for a mortgage that is above 150k, often the lender pays extra for a 'full and factual' credit report that goes beyond seven years, and I had the impression it would cover around ten years and would show items that had been normally excluded. I would really be surprised if even that report would go back over 15 years.

HTH

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about how to proceed, weird collection letter

@Anonymous wrote:

@wmweeza wrote:Thank you all. I'll have my attorney contact them to gather information, figure out what the debt is, and pay it if I owe it. I'm sure he can get the letters to stop and help me figure out if the debt exists etc.

This is why I love these forums! I have worked very hard at having great credit, to have this pop up after so many years of a clean file is stressing me and is annoying

Even if it is a valid debt that you didnt notice before, it is past the SOL and also past the 7 year mark.

Past the SOL means they cant use the courts to help obtain or enforce payment.

Past the seven year reporting limit means it cant show up on your credit reports. Paying will not change the reporting status.

Being a zombie debt that old, I would wager they paid a tiny amount for the rights to own it and try to collect on it. I would be surprised if paying 170 to settle it was not ten or more times their cost.

When you apply for a mortgage that is above 150k, often the lender pays extra for a 'full and factual' credit report that goes beyond seven years, and I had the impression it would cover around ten years and would show items that had been normally excluded. I would really be surprised if even that report would go back over 15 years.

HTH

Well, I did have a few items (small, I think maybe a total of $3000 for all of them, maybe 4 total) go to collections from 98-2001, we paid all those off, waited for deletion and I've had a pristine report since. I really hope this won't be an issue since I have worked so hard so I hope you are right. We own our current home and I have a pristine report and have for a decade. Hubby bought our current hom long before I met him but when we refinanced it was in both of our names in 2005, so I would have thought if this were an issue it would have come up then, it didn't.

Like I said, I contacted all those I owed and pulled all my reports back then and paid everything reported or that I had bills for, this never came up or was reported. Perhaps this is one of those accounts we paid and somehow there was a glitch and it got dug up, if so I believe we still have all the payment records from when we paid everything off.

I'll do some more digging, not contact anyone at the collection agency but perhaps contact my attorney about getting this to stop. I don't run from my debts, I paid everything so this is a bit perplexing and annoying. If it's a real debt I would have happily paid it years ago, so having them now contact me 15 years later is odd.

I love these forums, thank you all

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k