- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Re-aging?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re-aging?

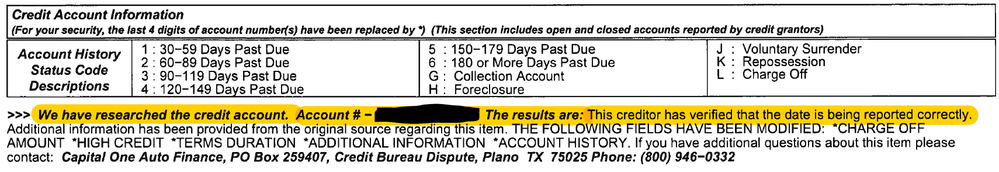

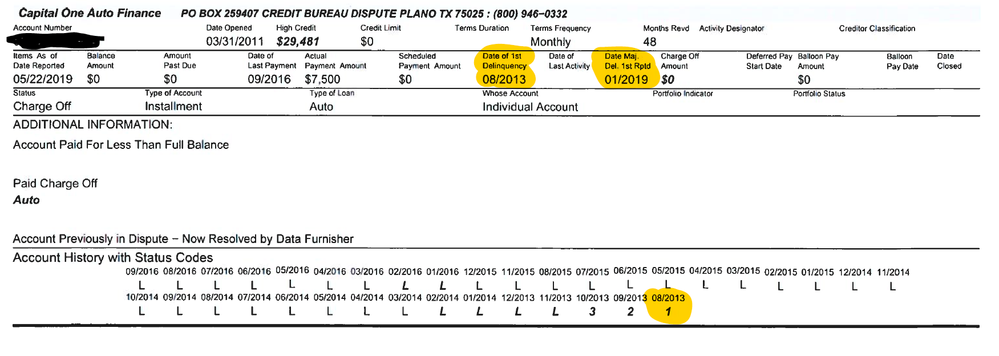

While I was typing away on another board about something completely different, I started wondering how it could be legal for a company to update a $0 balance account that has a date of first delinquency in 2013 to having a new DOFD of January 2019 after asking for a goodwill removal. DH was deployed and it has been so many years so we tried our luck with Cap One's generosity. We have current capital one products that have never been late and have perfect payment history. The auto loan problem was a one time issue that would have never happened if he had not been deployed and had pay issues during the deployment.

So that brings me to this... Would this account be considered "re-aging"? I checked trusty google and it sure seems like this account falls under re-aging but I thought I would take it to the Myfico experts. DH disputed the dates a few weeks ago and this is what was returned to us as being verified and accurate. I called Capital One Auto myself about it and they said if they do an internal look at it again then Equifax might update the DOFD as May 2019 and that leaving it showing January was probably better. Its keeping DH's Eq score down well below what it should be because it looks like the last date we were delinquent was January 2019 on an account that is well on its way to being obsolete soon. What do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

That's not re aging. It's only a date when delinquency was reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

Well bummer, but thank you for helping clarify!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

When you attempted goodwill deletion, it was treated as a dispute.

My advice would be to just leave it alone. It will be gone soon enough.

COs tend to keep score relatively suppressed the entire time they are on CR.

Does he have any revolving accounts, other than your new US Bank one?

Also, if utilization is high, that can keep the scores depressed till paid down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

Yep! This is what is currently showing on his Exp. Exp score is 707 and TU score is 715. Eq is the booger at 670 today.

So we have the joint US Bank ($1200) that will be on there soon and an Amex BCP ($2000) that he applied for same day as US Bank but Amex pulled Ex and Barclay card that all came from this month's spree but that is already reporting and they pulled TU.

You can kind of tell we started rebuilding around 2015/16 with smaller cards and started working our way up to now. We were able to buy 2 homes and 3 vehicles in that time span, though so the Capital One account isn't keeping us completely down. I'll just be glad when it is gone. We have a couple of other small 0 balance negatives from the same time period 2013/14 but nothing major (HSN card that was $400 at one point but now 0 balance - we paid it, utility bill - paid 0 balance and a verizon bill we paid 0 balance).

COMENITY PB | $0 | $5,000 | 0% | Revolving | Current | Aug 2016 |

WMart | $147 | $4,000 | 4% | Revolving | Current | Dec 2016 |

CITI | $1,887 | $4,000 | 47% | Revolving | Current | Aug 2018 |

Aafes | $0 | $3,900 | 0% | Revolving | Current | Sep 1997 |

CFNA | $0 | $3,200 | 0% | Revolving | Current | Feb 2018 |

CAPOne | $207 | $3,000 | 7% | Revolving | Current | Jun 2011 |

BARCLAY | $0 | $2,500 | 0% | Revolving | Current | May 2019 |

DISCOVER | $9 | $1,600 | 1% | Revolving | Current | Oct 2017 |

MFCU | $0 | $1,500 | 0% | Revolving | Current | Aug 2007 |

USAA | $0 | $1,000 | 0% | Revolving | Current | Sep 2016 |

USAA | $0 | $1,000 | 0% | Revolving | Current | Feb 2017 |

Ikea | $0 | $750 | 0% | Revolving | Current | Jan 2019 |

CAPone | $0 | $750 | 0% | Revolving | Current | Aug 2016 |

KOHLS | $0 | $700 | 0% | Revolving | Current | Dec 2015 |

USAA | $0 | $500 | 0% | Revolving | Current | Aug 2016 |

Menards | $0 | $500 | 0% | Revolving | Current | Jan 2016 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

@Anonymous His scores are not bad at all. Once the utilization on that citi cards goes down below 28.9%, or 8.9% (ideal prior to important apps), he would get some points. If that card is in 0% promotional apr, I would not worry about it.

Congrats on successful rebuild. You guys are doing great!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

Thank you! It has been a long long road but we are getting there! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging?

Re-aging is not per se improper.

Used broadly, any reporting of continued or increased level of delinquency updates your credit report and score by extending the period since initial delinquency, which has negative scoring impact. Reporting that the debt has increased in period of delinquency is totally proper.

The term "improper re-aging" is normally used to refer to the reporting of a new, and later, incorrect date of first delinquency, which then extends the exclusion date of a reported collection or charge-off.

The DOFD is required to be separately reported for any charge-off or collection, and then becomes the single, date-certain used to determine the ultimate exclusion of the reported collection or charge-off. The CRA must exclude no later than 7 years plus 180 days from the reported DOFD, and will normally exclude at approx 7 years from DOFD.

It does not appear that they have updated the reported DOFD, so there does not appear to be any improper re-aging for the credit report exclusion date.

Updating by reporting subsequent derogs does "re-age" your score, but is not improper re-aging.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content