- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Rebuilding After Divorce

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilding After Divorce

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rebuilding After Divorce

Hi FicoForum family-

I am new to this forum but have been coming and reading articles for several years. I am in the process of rebuilding my credit and it is going slowly but surely. I am maybe hoping that some others that have been in my shoes have some helpful advice that maybe I am missing that could help me further along my journey to credit repair.

I spent the last several years going through a seperation and divorce. My credit took some BIG hits because I was struggling to make payments on time. But I started 2019 off on a really great note, and have gotten everything back together....but now to repair my credit. Below is how my credit report is viewed right now. Just hoping to get some tips or tricks to help raise my score up a but quicker. Any questions, please feel free to ask!

Current scores: 548 Transunion 552 Equifax and 559 Experian

Hard Inquiries: I have a total of 4 inquiries - 2 that should fall of between July and September of this year

Total Accounts: I have a total of 25 accounts- 20 Closed and 5 open

- 2 Student loan accounts- Both Current; totalling $7,709

- $1,305 open credit card debt- with a $1,600 limit (working on decreasing this) But my score shows %25 usage because of an old Discover card account that I had with my ex-husband but I am not a user on the card anymore.

- Have a Credit One Card that I am working on reinstating.

- I have several credit cards that are closed but I owe balances totaling about $5,400. I am still making the monthly payments on these cards even though they are cancelled/Closed, and they are all current.

- 2 Installment loans totalling about $6,500 dollars- both current

- 1 active collection for $1,023 dollars. Making Payments

- There are 2 closed collections also showing. One for Time Warner Cable and One medical bill, both paid in full.

- Payment History- Currently at 82% with 19 missed or late payments. All from my Target Credit card (13) and a One Main Finacical Loan (6).

Credit Age: 7 years and 5 months

Please feel free to ask for any other information. Thanks for any tips!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

Hi and welcome to the forums ![]()

I have one question, do you have any open CC in your name right now (other than Discover you mentioned)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

Yes- I have a Target CC and and Indigo Platinum MasterCard. The Target Card is almost Maxed out but i am working on reducing the balance and the indigo card has a $0 balance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

It would be helpful if you could list out the name of each card (both open & closed accounts), the balance/credit limit, and the APR.

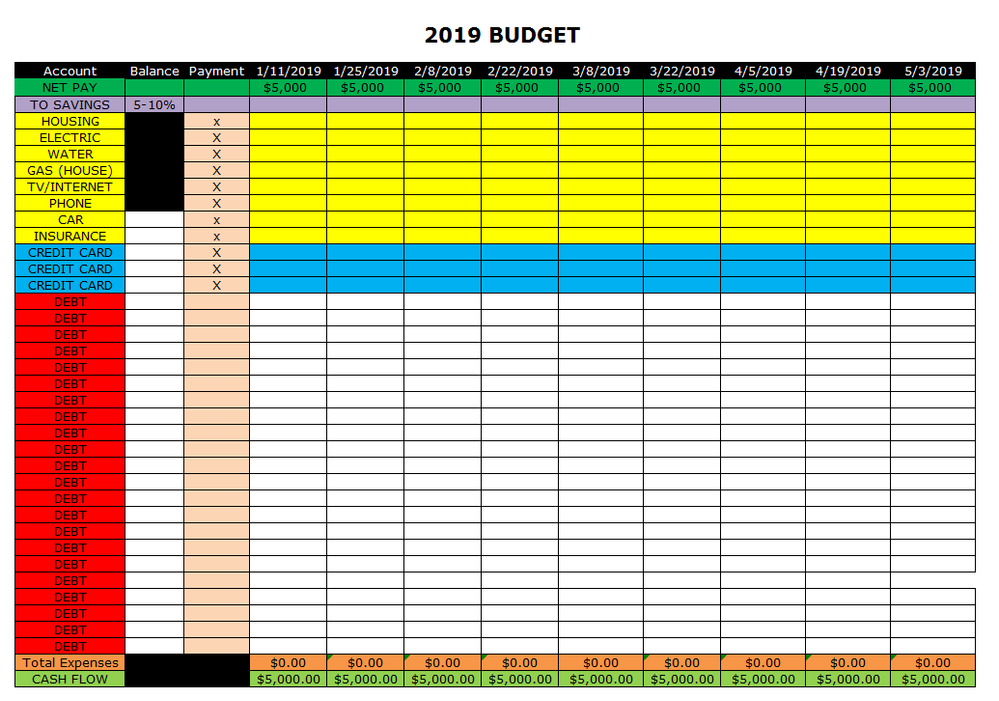

Do you have a written budget where you can track your spending & progress paying each item down, or are you winging it? I will say having a written budget allows you to visualize your progress and keeps you motivated, since you can see your debt decreasing and you can she where every penny goes, possibly helping you indentify spending habits that might need to be changed. Here is an example of my budget workesheet that I use for myself:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

I religiously use the Mint.com program to manage bills and spending.

But I do also maintain a personal spreadsheet with bills, to make sure that I don't miss any payments or make any late payments.

Here are the Credit Cards Open and Closed with Balances and Interest Rates:

- Target Card (Open) $1268.42 balance; $1300 limit 25.15% Interest

- Indigo MasterCard (Open) I just opened this card - $300 limit - no balance Unsure of % Interest as of yet

- Credit One Card (currently Closed but am working to reinstate) $495.84 26.15% Interest & $9 annual Fee

- Discover Card (Closed) - $987.85 balance 25.24% Interest

- Capital One Card (Closed) - $1595 balance; 0% interest- payment plan

- Kohls Credit Card (Closed) - $1,424.27 balance, 26.24% Interest

- Walmart Credit Card (Closed)- $751 balance, 0% interest- payment plan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

@Anonymous wrote:I religiously use the Mint.com program to manage bills and spending.

But I do also maintain a personal spreadsheet with bills, to make sure that I don't miss any payments or make any late payments.

Here are the Credit Cards Open and Closed with Balances and Interest Rates:

- Target Card (Open) $1268.42 balance; $1300 limit 25.15% Interest

- Indigo MasterCard (Open) I just opened this card - $300 limit - no balance Unsure of % Interest as of yet

- Credit One Card (currently Closed but am working to reinstate) $495.84 26.15% Interest & $9 annual Fee

- Discover Card (Closed) - $987.85 balance 25.24% Interest

- Capital One Card (Closed) - $1595 balance; 0% interest- payment plan

- Kohls Credit Card (Closed) - $1,424.27 balance, 26.24% Interest

- Walmart Credit Card (Closed)- $751 balance, 0% interest- payment plan

I would get that Target card down ASAP, as you are at 97.6%, & anything above 88.9% is considered maxed out & dinging your scores. You'll need to pay down roughly $113 PLUS any interest accrued to get it to 88.9%.

I would pay off Credit One, but I and others on here would advise against getting it re-instated. Credit One is a predatory lender & they will charge you any chance they get. I'm guessing that $9 is a MONTHLY fee, not an AF, correct? There are other cards you can get that will grow with you that are much better than Credit One.

After Credit One I would start using the snowball method to start paying off your smallest debts first. Make sure you make your min payments to all other obligations and throw as much funds as possible to paying the first debt down (Discover, in your case). Once that is paid off, then toss the money you were paying to Discover and add it to your next debt (normally I would say this would be your Walmart balance, but since you stated it has 0%, you might want to skip this for now & pay off Capital One, since they would probably work with you again after you pay them off).

GL!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

@Anonymous wrote:I religiously use the Mint.com program to manage bills and spending.

But I do also maintain a personal spreadsheet with bills, to make sure that I don't miss any payments or make any late payments.

Here are the Credit Cards Open and Closed with Balances and Interest Rates:

- Target Card (Open) $1268.42 balance; $1300 limit 25.15% Interest

- Indigo MasterCard (Open) I just opened this card - $300 limit - no balance Unsure of % Interest as of yet

- Credit One Card (currently Closed but am working to reinstate) $495.84 26.15% Interest & $9 annual Fee

- Discover Card (Closed) - $987.85 balance 25.24% Interest

- Capital One Card (Closed) - $1595 balance; 0% interest- payment plan

- Kohls Credit Card (Closed) - $1,424.27 balance, 26.24% Interest

- Walmart Credit Card (Closed)- $751 balance, 0% interest- payment plan

These closed cards are killing your utilization along with the Target that is essentially maxed out. Getting the closed ones paid off and the target balance down below 47% will help a good bit. Target may balance chase you with that many lates as you pay it down, but you will just have to see what happens on that.

How old are the lates? And what are they 30 days, 60, 90, etc?? You may can try and goodwill them, but not sure that will do any good or not. If you search for goodwill and target you may find others who have had success.

If you could negotiate a pay for delete with the collection that is still open and try to goodwill the ones that are closed, that will help also.

Have you figured out how much longer these are on your reports? If you do not know then you can find these dates from the reports on annualcreditreport.com and that will give you an idea of which ones to try and do something with or if it may just be best to wait out the 7 years for them to fall.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding After Divorce

Hi FICO Family-

I appreciated your input, and I just wanted to post a little update and see if you have any other ideas or suggestions as I continue on this credit repair journey.

Current FICO8 scores: Transunion- 662; Equifax- 647; Experian- 646

Credit Age: 4 years and 8 months

Hard Inquiries:

- Experian - (3) total inquiries – (2) mortgage and (1) Credit Card

- Transunion – (5) total inquiries – (2) mortgage, (1) Bank account, (1) personal loan and (1) Credit Card

- Equifax – (3) total inquires – (2) mortgage and (1) credit card

Total Accounts: I have a total of 31 accounts- 21 Closed and 10 open

- 2 Student loan accounts- Both Current; totaling $6,812

- No late payments

- $1,212 open credit card debt- with a $4,150 limit

- Target Credit card - $200 Balance; $1300 Limit – 24.4% Interest

- 13 Late Payments – 2 – 30 days, 5 – 60 days and 6- over 90 days, no late payments in over 1 year.

- Credit One Card - $300 Balance; $650 Limit - 25.4% Interest

- 5 Late Payments – 3-30 days, 2-60 days, no late payments in over a year.

- Credit One Card - $300 Balance; $500 Limit- 24.4% Interest

- No late payments

- Fortiva Credit Card - $200 Balance; $700 Limit- 36% Interest

- No Late Payments

- Indigo Credit Card - $40 Balance, $300 Limit – 24.9% Interest

- No Late Payments

- Kohl’s Credit Card - $0 Balance, $700 Limit- 26.4% Interest

- Authorized user- no late payments

- I have (2) credit cards that are closed but I owe balances totaling about $1,875. I am still making the monthly payments on these cards even though they are cancelled/Closed, and they are all current.

- Kohl’s Credit Card - $1075 Balance – 25.4% Interest

- Discover Card- $800 Balance – 22.9% Interest

- 2 Installment loans totaling about $6,500 dollars- both current

- One Main – Balance : $4,754

- 9 late payments – 3- 30 days, 3- 60 days, 3 90 days

- Opportunity Financial – Balance $724

- No Late payments