- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Rebuilding Log - Lets go! OMW to 700!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilding Log - Lets go! OMW to 700!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

@lamplight2012 wrote:

@Anonymous wrote:I would suggest the Platinum card with no annual fee. After the second statement go online and open a chat and requesr them to upgrade the card to reward status. They will upgrade it to QS.

NormanFH,

I was kinda impatient after reading through the forums

I applied for the Capital One Platinum after I pre-qualified. I got the following message.

We attempt to provide an application decision in 60 seconds or less. On occasion, system availability affects our ability to make a credit decision or, in some cases, we need to collect additional information. Unfortunately, we need more time to look into this for you.

Keep an eye out for additional details regarding your application via email or mail within 7-10 business days.

Until we contact you, please do not submit another application

I called Capital One and spoke to a CSR and they wanted me to fax a copy of my ID, SS card, & W2. I just faxed everything to them. This is what happened on the Cap One Secured card. I'm positive I'll get approved.

What do you think?

Probably good to go...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

@Anonymous wrote:

@lamplight2012 wrote:

@Anonymous wrote:I would suggest the Platinum card with no annual fee. After the second statement go online and open a chat and requesr them to upgrade the card to reward status. They will upgrade it to QS.

NormanFH,

I was kinda impatient after reading through the forums

I applied for the Capital One Platinum after I pre-qualified. I got the following message.

We attempt to provide an application decision in 60 seconds or less. On occasion, system availability affects our ability to make a credit decision or, in some cases, we need to collect additional information. Unfortunately, we need more time to look into this for you.

Keep an eye out for additional details regarding your application via email or mail within 7-10 business days.

Until we contact you, please do not submit another application

I called Capital One and spoke to a CSR and they wanted me to fax a copy of my ID, SS card, & W2. I just faxed everything to them. This is what happened on the Cap One Secured card. I'm positive I'll get approved.

What do you think?

Probably good to go...

Thanks, sir!

We'll see in the coming days.

Next, I want to get in with a Credit Union. Any recommendations?

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

SDFCU is a great CU.

If you can pay off that 82 from that old US Bank and have it paid on the Chex system, I would recommend going there next, after giving the 'paid' item a chance to post, like 3 to 7 days would be my estimate..

You can get a secured loan and also a secured CC with the same 250 after membership. You can join SDFCU by first becoming a member of American Consumer Council (use the link in the SDFCU 'who can join') and use the coupon code 'consumer' to get it for free. You can get the membership and the loan and the CC with no HP. First, join SDFCU and open a shared deposit account. Then call them and ask them to set up a secured loan for 36 months for as low as 250 at something like 3.9 APR. Then take the proceeds of the loan and use it to fund the secured CC. Then use the CC and let it report for a month or two and you should see a good score bump. the secured loan will also help satisfy the 'credit mix' portion of the Fico scoring, for another samll bump.

HTH

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

Current Scores

TU 615 EX 648 EQ 579

Goal 650 across all 3

Current Score: 800

Goal Score: 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

@Anonymous wrote:SDFCU is a great CU.

If you can pay off that 82 from that old US Bank and have it paid on the Chex system, I would recommend going there next, after giving the 'paid' item a chance to post, like 3 to 7 days would be my estimate..

You can get a secured loan and also a secured CC with the same 250 after membership. You can join SDFCU by first becoming a member of American Consumer Council (use the link in the SDFCU 'who can join') and use the coupon code 'consumer' to get it for free. You can get the membership and the loan and the CC with no HP. First, join SDFCU and open a shared deposit account. Then call them and ask them to set up a secured loan for 36 months for as low as 250 at something like 3.9 APR. Then take the proceeds of the loan and use it to fund the secured CC. Then use the CC and let it report for a month or two and you should see a good score bump. the secured loan will also help satisfy the 'credit mix' portion of the Fico scoring, for another samll bump.

HTH

Thanks for the guidance, ASBinJax!

This is the route I'll probally go. SDFCU seems solid all around. When I was looking into joining SDFCU(before finding out I was in ChexSystems) I signed up for the ACC using the 'consumer' code, so I'm already eligible.

There is a CA now trying to collect for US Bank. It's not on my CRA's, but I wonder how I should handle this. Should I go ahead and pay the CA before they add it to my CR? Or send a letter proposing I'll pay but not to put it on my reports?

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

lamplight2012

you said:

There is a CA now trying to collect for US Bank. It's not on my CRA's, but I wonder how I should handle this. Should I go ahead and pay the CA before they add it to my CR? Or send a letter proposing I'll pay but not to put it on my reports?

------------------------------------------------------------------------------------------------

IMO, it is better to get it in writing that they will not report it as a collection before making the payment. That would eliminate any bad marks from this CA and minimize the bad effect on your CRs.

If you can afford it, eliminate the bad things before they show up. Much easier than getting a GW deletion after the fact.

I still recommend keeping SDFCU close in your plans.

hth

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

@Anonymous wrote:lamplight2012

you said:

There is a CA now trying to collect for US Bank. It's not on my CRA's, but I wonder how I should handle this. Should I go ahead and pay the CA before they add it to my CR? Or send a letter proposing I'll pay but not to put it on my reports?

------------------------------------------------------------------------------------------------

IMO, it is better to get it in writing that they will not report it as a collection before making the payment. That would eliminate any bad marks from this CA and minimize the bad effect on your CRs.

If you can afford it, eliminate the bad things before they show up. Much easier than getting a GW deletion after the fact.

I still recommend keeping SDFCU close in your plans.

hth

Thank you!

I've prepped a letter, and will send it out in the AM.

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

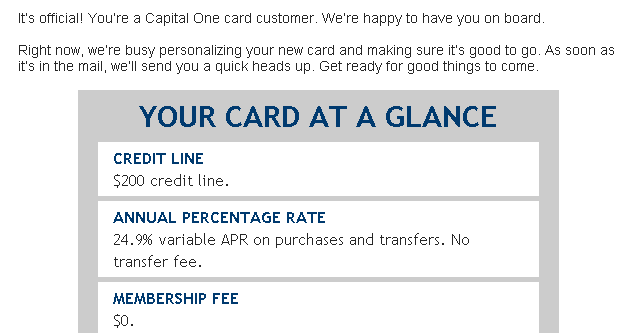

Secured or not; This feels good! ![]()

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

More good news!

I was approved with a $300 limit for the Capital One Platinum ![]()

![]()

Edit: PFD letter was sent to Capital Management Services for a US Bank Collection.

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Log - Lets go!

Since I've started there hasn't been much of a score change, mostly on TU/EQ. Once the two Capital One TL's report I should get a score bump.

Starting Scores- EXP: 602, TU: 584, EQ: 604

Currently- EXP: 604 | TU: 609 | EQ: 624

--

Just to update what I'm working on now:

Medical Collections via WhyChat process: All three Pre-HIPPA letters have been sent(to CRA's) & accounts are being investigated.

Focus Receivables/TWC Collection: PFD letter has been sent & received by FR.

Capital Management Services/US Bank(Not on CR): PFD letter has been sent & received by CMS; Once this is cleared up, my ChexSystem report will be updated to 'paid' & I can move forward with SDFCU.

Accounts Listed

Experian: 693 | Transunion: 700 | Equifax: 690 | Utilization 4 %

EX: 5 | TU: 8 | EQ: 7