- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Rebuilding my credit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilding my credit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rebuilding my credit

Hey All!

I am finally buckling down and starting to rebuild my credit! In my early 20's I haven't been great at paying on time and just never really looked into building or keeping good credit until now.... sad story is I've opened and co-signed my ex spouse in trying to help him and not myself. No wonder why he's my ex now! lol! Anyways long story short I was never taught the value of having great credit and now I'm obsessed in rebuilding my credit in order to buy a home in the future and to be financially free of being in debt for soo long. I have been reading success stories and I am now ready to be an adult now that I'm 31. Thank you in advance for all the advice and support in this long journey to being debt free!

Here is my current profile... It's embarassing but we all have to start somewhere, please let me know your advice or suggestions (I am open to hearing the hard truth... I won't be butt hurt! )

EXP - 536 / TU - 557 / EQ - 571

My GOAL is to get into the 600-650 range by the end of this year 2019 (crossing my fingers... is it possible?)

I currently have a high utl... I am now trying to pay off the debt using the Dave Ramsey method, also trying to pay at least twice a month on the lowest credit limit accounts first.

Open Accounts

Cap One Auto - $15,280/$23k (30/60/90 day Lates - opened Sept '14 ... repo and then got my car back paying on time in the last 11 months ![]() )

)

Cap One Journey CC - $46/$300 (recently opened Jun '19)

Credit One Visa - $366/$400 (recently opened Mar '19)

OpenSky - $255/$300 (opened Oct '17)

Fingerhut - $28/$400 (Recently opened Jun '19)

AU on these Accounts

Cap One QS1 - $1477/$1500

Best Buy Citi - $1400/$1500

Credit One Visa - $882/$900

Credit One MC - $458/$500

Collections

Port. Rec. - $968 (Charge off Cap One) drops in Apr '25 shows on TU/EQ/EXP

Enhanced Rec. - $655 (Charge off Sprint ) drops May '24 shows on TU/EXP

The Bureau - $649 (Charge off Cap One) drops Sep '23 shows on TU/EQ /EXP

Wells Fargo Secured - $158 (closed) drops Oct '20 shows on EXP

Trojan Prof - $0 (paid off closed)

I recently applied for these most denied but it was a try anyways... planning on just gardening... but how long is the gardening process?

Avant - denied (did prequal first)

Milestone - denied (did prequal first)

Firestone - denied

Kohls - denied

VS - waiting for a response

Target RedCard - denied (called after getting the 7-10 day wait and then got denied ![]() )

)

Macys - waiting for a response

Please give any advice, suggestions, opinions... it is all welcomed! ![]()

Montana

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

Thank you soo much. Can anyone get approved for MJC? I'm going to stop applying after MJC tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

I am the AU on those accounts, is it better to remove it or keep it on there to show I have credit lines?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

Get yourself off those AU acvounts, that utilization is dreadful😯

Your balance on your current cards are low , try to get them paid down , let them all report 0 except one and let thst one report a few dollars. Then your utilization will look very good and you don't need a "junk" jewelry tradeline.

Start working on your baddies and see if you can't get any pay for deletes going.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

I'm new but I'd personally pay off all the balances on the open accounts and work on getting back in good standing with the auto loan, than I'd take care of the collections one by one (if they won't do pfd be prepared to quickly pay it off or they can ding your credit again), not sure if being an AU on those open accounts affects your score negatively but I'd weigh that against the upside of having longer AAOA which I think accounts for around 15% of your score and then if it is affecting negatively I'd remove myself from all or maybe all but the oldest one and then get on the owner of the account about paying the balance off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding my credit

@Anonymous wrote:

Open Accounts

Cap One Auto - $15,280/$23k (30/60/90 day Lates - opened Sept '14 ... repo and then got my car back paying on time in the last 11 months

)

Cap One Journey CC - $46/$300 (recently opened Jun '19) 15.3% UTIL

Credit One Visa - $366/$400 (recently opened Mar '19) 91.5% UTIL

OpenSky - $255/$300 (opened Oct '17) 85% UTIL

Fingerhut - $28/$400 (Recently opened Jun '19) 7% UTIL

AU on these Accounts

Cap One QS1 - $1477/$1500 98%UTIL!

Best Buy Citi - $1400/$1500 93.3% UTIL!

Credit One Visa - $882/$900 98% UTIL!

Credit One MC - $458/$500 91.6% UTIL!

Collections

Port. Rec. - $968 (Charge off Cap One) drops in Apr '25 shows on TU/EQ/EXP

Enhanced Rec. - $655 (Charge off Sprint ) drops May '24 shows on TU/EXP

The Bureau - $649 (Charge off Cap One) drops Sep '23 shows on TU/EQ /EXP

Wells Fargo Secured - $158 (closed) drops Oct '20 shows on EXP

Trojan Prof - $0 (paid off closed)

Here's the first thing you need to do: GET REMOVED AS AU ON ALL OF THOSE ACCOUNTS! I've put the utilization percentages by all of your accounts & the AU accounts. AU UTIL figures into your overall UTIL, so it is hurting your scores big time. Anything over 88.9% is considered maxed out & will ding you maximum points.Call up each company & tell them you want to be removed from these accounts. Then watch your score go up. You have enough accounts on your own to get your scores growing. You DO NOT need the My Jeweler account!

Next, get your Credit1 & OpenSky accounts below 88.9% ASAP- the more the better.

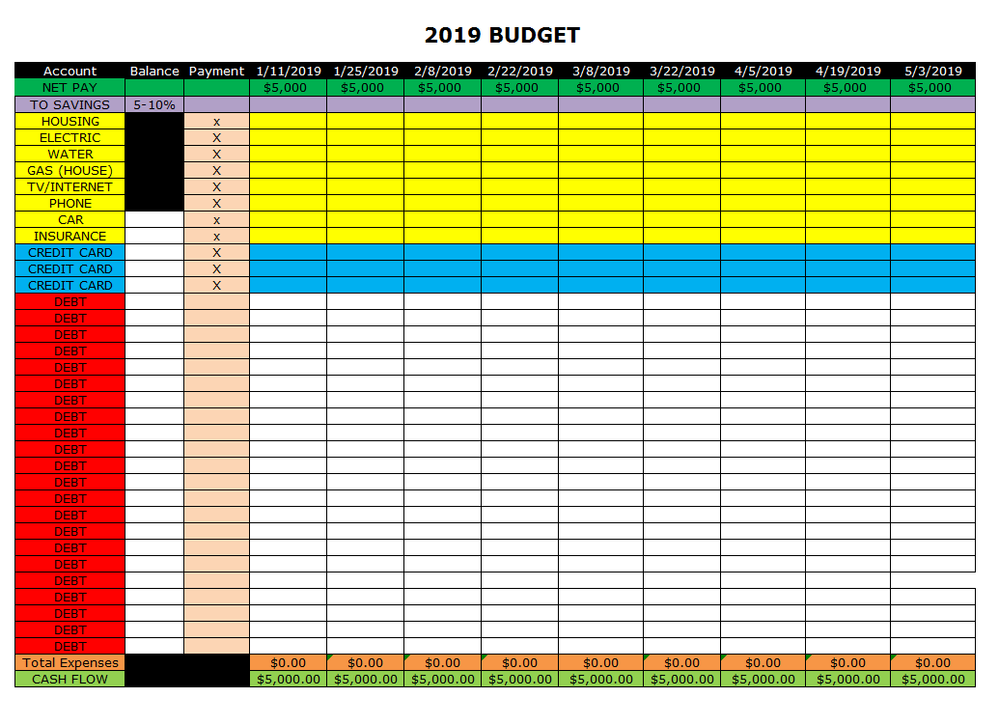

Here's the big thing, and I know I sound like a broken record because I always tell everyone this, is you MUST have a written budget where you can track all of your spending, down to the penny! Right now as you are getting on track it's important that you start to build a solid foundation that starts with sound financial discipline. Put down your income & all your expenses, then divide & budget those expenses by how many times you get paid in a month. If you get paid weekly, then divide them by 4; bi-weekly divide by 2. List all of your credit cards & your collections, and make sure you are writing down EVERYTHING you spend money on, even if it's a drink at a convenience store. You want to see where your money is going & identify your spending habits. From there, you'll be able to trim unnecessary spending & create cash flow, which will help you pay off your debt. You also want to start saving part of your paycheck EVERYTIME you get paid.

Learn & understand that credit cards should not be used to buy things that you don't have the money for yet- that is how people get in debt. Use your credit cards as a convenient alternative to carrying cash with you, & pay them off every month, using the AZEO method. It will take some getting used to, but once you have your finances under control you will be amazed at how much more money you actually have!

Your budget should look something like this: