- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Settlement offer from B of A

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Settlement offer from B of A

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Settlement offer from B of A

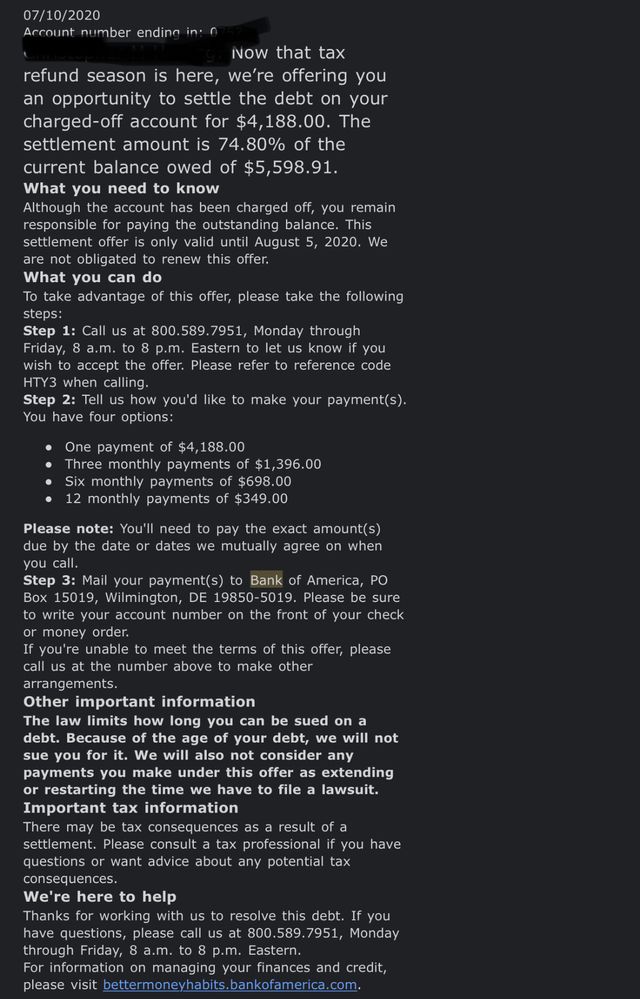

Hi everyone. I'm in the process of settling the last few negative accounts on my report. I recently received this email from Bank of America regarding my charged off credit card. They offered a settlement of 76% which doesn't seem that great at all. Keep in mine Navy Federal just gave me a 20% settlement on a credit card that had an even higher balance. I have the cash to settle it, but obviously want to get it as low as possible. I can't be sued for this so there's no real need for me to pay it other than cleaning my reports up some. Do you think I should ask for as low as 20%?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Settlement offer from B of A

You could probably try to settle for a lot less since you're outside SOL. Try calling and asking.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Settlement offer from B of A

@WarthogWrangler wrote:Hi everyone. I'm in the process of settling the last few negative accounts on my report. I recently received this email from Bank of America regarding my charged off credit card. They offered a settlement of 76% which doesn't seem that great at all. Keep in mine Navy Federal just gave me a 20% settlement on a credit card that had an even higher balance. I have the cash to settle it, but obviously want to get it as low as possible. I can't be sued for this so there's no real need for me to pay it other than cleaning my reports up some. Do you think I should ask for as low as 20%?

Sometimes people get lucky with a huge discount. Best I have gotten is 50% off, most of my derogs otherwise have offered nearly no wiggle room. Even on ones that are just about due to drop off my CRs. So to me, a discount is a discount, as everything is outside the SOL.

Perhaps since it is still with the OC it is not as large of a discount vs. when a debt buyer picks it up for pennies on the dollar?

I would still try for less, it doesn't hurt. Just remember if you are going to deal with them, be prepared to move forward, as you are likely resetting the SOL by acknowledging the debt and making a negotiation to pay it.

Anyway, congrats on the huge discount from NFCU!

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Settlement offer from B of A

Something to keep in mind with BofA and NFCU is they're both relationship based. If you want to get back in with either fully, you'll have to pay them both in full.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Settlement offer from B of A

If you are 100% outside of SOL then use that to your advantage. If they know you know, they`ll settle for less. Right now, if they assume you don't know that, they can try it to use to their advantage. I usually have very good results with 30% over 3-4 payments and im exact to the penny on the settlement amount as not to sound too calculated. So I`ll send a PFD letter as something like the below. If they dont accept the PFD you can retry without the PFD part.

To Whom It May Concern:

This letter is to inform you that the validity of this debt is disputed and it is written without prejudice. Nothing contained in this letter shall be used against me in any legal proceedings.

This letter is in regard to a collection account (or Charge off account) from your company for a total of $5,XXX.

Looking to completely resolve this balance on this account I can provide the sum of $1,355.42 as full payment on the debt if you agree to immediate deletion of this account from and all credit reporting agencies within 10 days of receipt of payment. The acceptance of the payment will serve as a complete discharge of all monies due, and you agree to consider the debt paid infull and agree to not take further action to collect on the alleged debt. The payment shall be made in the form of a cashier'scheck or money order. You agree, in writing, to designate the account as “payment in full” once you are in receipt of the agreed upon payment amount.

This compromise is expressly conditioned upon the payments made in three equal installment payments of $XXX with the first payment being received by or before August 1st, 2020.

If you agree to the above terms, please prepare a letter on your company letterhead explicitly agreeing to the same terms as the above settlement offer and have it signed by an authorized representative of your company. It will be implied that this letter shall constitute a legally binding contract, enforceable under the laws of my state.

Please keep in mind that due to the laws of the state of STATE this debt is considered to be time-barred and is no longer legally enforceable. The purpose of this settlement is merely to have this item removed from my credit files. It is not to be construed as an acknowledgment of liability for this debt in any form.

I’m very thankful for your willingness to work together with me to come up to a solution to this. It’s very difficult with the current job situation and this is ultimately the maximum I can afford.

Please provide a written settlement offer with the aforementioned terms from an authorized representative on your company letterhead so we can finalize this agreement. I look forward to resolving this matter quickly.

Sincerely,