- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Should I accept a tiny CLI from Capital One?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I accept a tiny CLI from Capital One?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I accept a tiny CLI from Capital One?

Yes, accept anything you can. You are not going to get reconsidered even if you call in. Tried many times. Even with 5x the limit on my card via monthly spend on their card, I couldn't get it to go higher. If you're bucketed, you're bucketed. Get a new card is all I can say. My Venture is getting a lot of love with the spend amount but my original bucketed card is only getting a hundred dollar increases.

Some say that too many people were calling in about reconsiderations and Cap 1 decided to make it all based on a computer algo so no amount of pleading with CSRs will change the limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I accept a tiny CLI from Capital One?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I accept a tiny CLI from Capital One?

I would recommend waiting at minimum 6 months if you are doing a new card altogether but if you are staying in the Cap One fam 3 months I think would be a good minimum to wait since you accepted increase ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I accept a tiny CLI from Capital One?

@TheCity wrote:

How did you know about the automated CLI? A rep?

I use the card very heavily usually and pay it off in full before the statement date... And still nothing... It's a Quicksilver card too. Smh

You every look at the Discover It card? It's been pretty good for me over this past year.

Re: Discover It, I tried Discover's prequalification system, and it said I wasn't prequalified for anything. But at the time, I had just applied and been approved for several revolvers, so I assume that's why. I will check again in a few months.

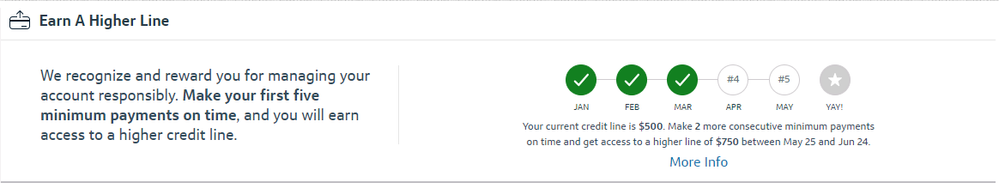

Re: Capital One, they have a section in the online portal...if you click on your balance right after you login, it's at the very top of the screen when you look at it on a desktop machine. In their mobile app, it's on the first screen but you have to scroll down.