- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Should I just try to get this tradeline removed?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I just try to get this tradeline removed?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I just try to get this tradeline removed?

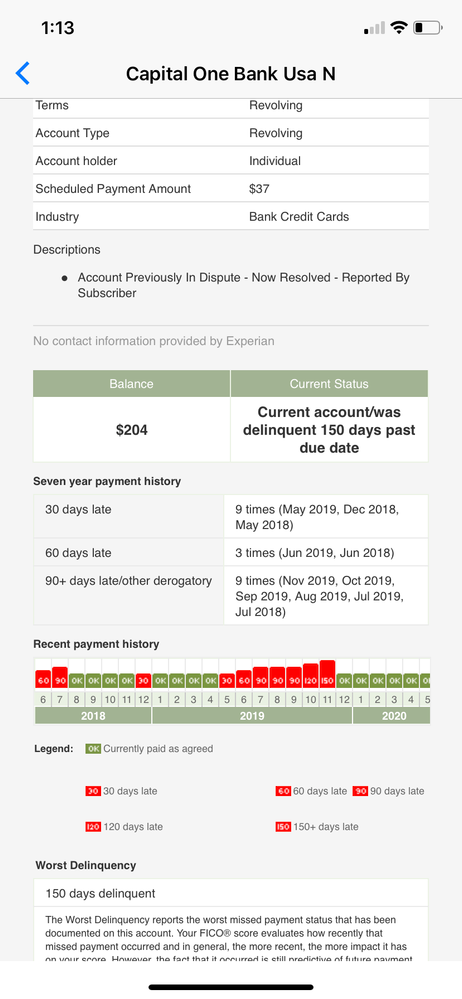

Should I just try to get this tradeline removed? It's the only credit card I have buy the history is terrible. Maybe it's best that it be removed if possible. I've had it for a long time. Should i just start over with it off my report? This is the only credit card I have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

I think you are going to need to get some more tradelines in your credit file.

Open Sky secured card

Discover secured card

Fingerhut approves almost anybody

Self lender with $25 per month

Then work on getting that credit paid off, and send some GW letters to have the lates removed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

@HighGoals wrote:Should I just try to get this tradeline removed? It's the only credit card I have buy the history is terrible. Maybe it's best that it be removed if possible. I've had it for a long time. Should i just start over with it off my report? This is the only credit card I have.

I hate to break it to you but your odds of getting capital one to remove a tradeline (especially since it appears still open) is about as close to 0 as it gets.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

You can't just remove a tradeline from your CR just because it is depressing your score. And CapOne certainly won't remove it. CRs are used by creditors to determine someone's credit worthiness. If people could just remove tradelines any time they had negative information, a creditor would never be able to tell is a person was a good vs poor credit risk. My suggestion is to start paying your CCs on time and keep paying on time. If you are unable to make timely payments, then that means you are not ready for credit yet. Quit using the card if you can't make monthly payments on it. Let's just say that those 90, 120, and 150 day lates will negatively affect your score for the next 6 1/2 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

I paid off another card and had it removed via a mailed in dispute and it hasnt back on my report -and it was Capital One. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

How long ago was that? What was the reason you gave for them in the dispute?

12/22 - EX 794 | EQ 799 | TU 741

9/20 - EX 726 | EQ 710 | TU 720

8/20 - EX 686 | EQ 678 | TU 675

7/20 - EX 671 | EQ 657 | TU 659

04/20 - EX 649 | EQ 645 | TU 661

11/17 - EX 614 | EQ 626 | TU 612

Goal - EX 750 | EX 750 | TU 750

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

I thought the same until I had another removed about a year ago. It was paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

Thanks for the reply. I was just waiting around for the credit to go up but I think I do need another revolving line of credit. I did self lender a few months ago and it hasn't updated since almost February. I need to contact them today. I have it on auto

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

I don't remember. It was about a year ago. I would have to go back and search through my files for the account. I still has about 3 years until the account fell off. I'm glad it's gone though.

@nmk94 wrote:How long ago was that? What was the reason you gave for them in the dispute?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I just try to get this tradeline removed?

Then you got very lucky. CapOne is notorious for only very rarely removing COs/lates/etc. If you had a valid reason for the dispute, that may have been why the account was removed, but they are not likely to just remove the account simply because it is hurting your score.