- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Sons Car was reposed, Im puzzled

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sons Car was reposed, Im puzzled

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sons Car was reposed, Im puzzled

When does this fall off?

Car was involuntarliy reposed on 3/22/12 while he was at work. He was past due at that point and told by repo guy he could get it back for 350.00 ( his mo. payment plus fee's)

Fast forward, no payments, or contact has been made by my son to them.

They have pulled his credit back in 2018 ( assuming seeing if he is employed any where)

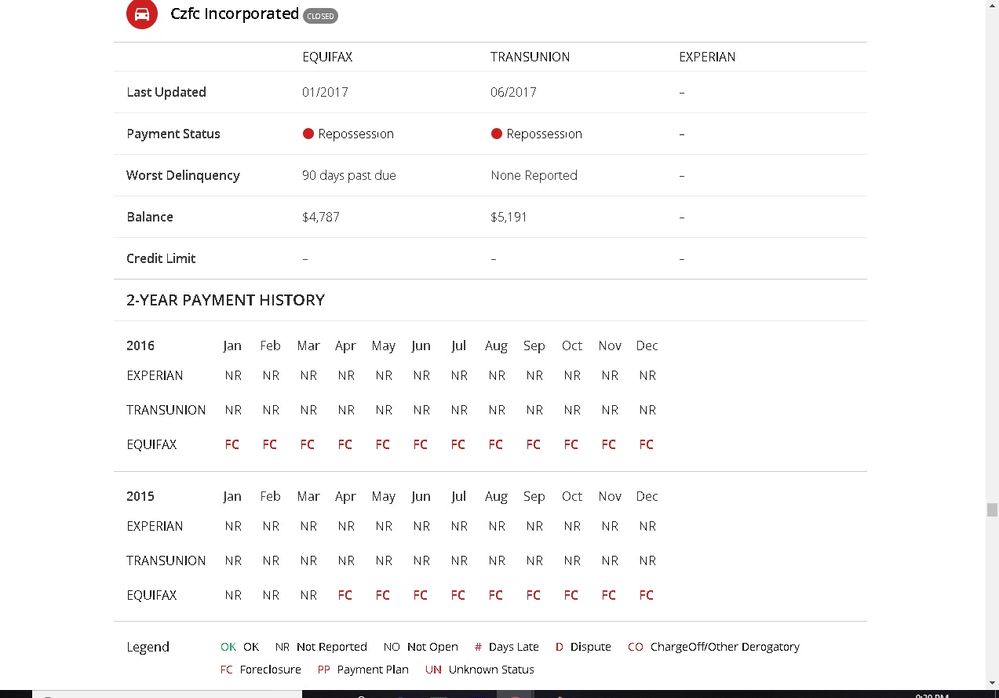

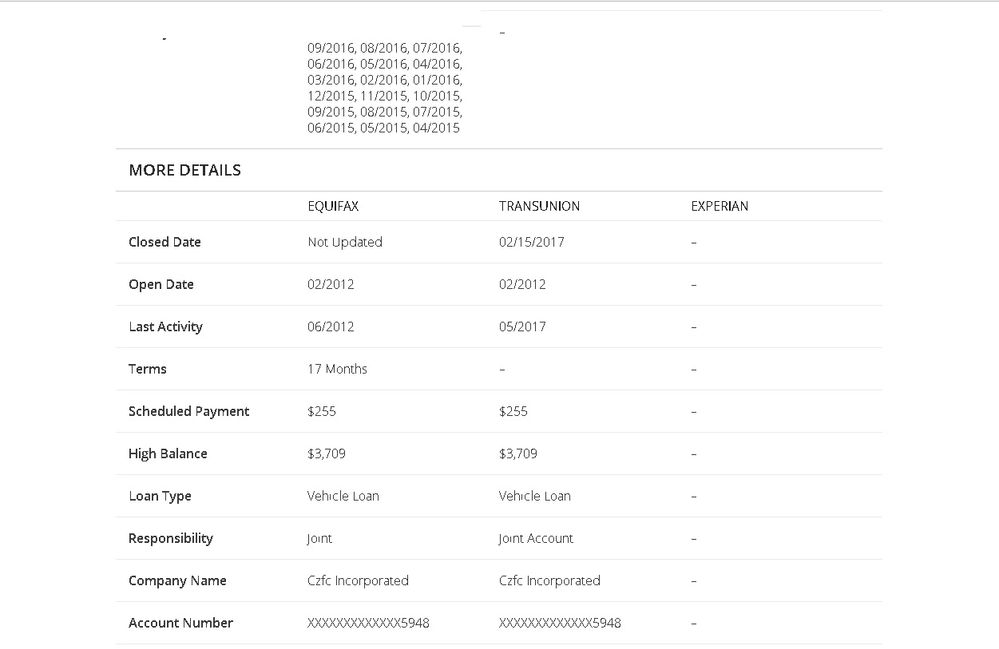

I have attached a couple pages from his fico report.

Date of last activity is not any activity from my son. How do I help him tackle this one?

And how can this list it as a forclosure?

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sons Car was reposed, Im puzzled

I am no expert here and will let others comment on this it appears he owes them some money, yet they last reported in 2016 from what I am seeing..Also repo I assume goes off of DOFD although unsure on those in comments it says report, back in day i could of sworn there was a listing for repo vs. forclosure, but they could be one in the same. Weird they are showing it dofd as of 2016 unless it was disputed possibly prior or payments were made? they are SP'ing his credit to see what the chances are they can collect on said repo balance.. about all i can offer, see what others say.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sons Car was reposed, Im puzzled

A foreclosure should only be reported on a cr for a mortgage account.It's an error and you have to file a dispute with Equifax as it pertains to all of the inaccurate reporting.Before you file a dispute be sure to get a hard copy of all three cr 's from anaulcreditreport.com.Some cr's from any other that or Fico website might be inaccurate.GOOD LUCK...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sons Car was reposed, Im puzzled

The reported payment history profile is clearly incomplete, but that is not, in my opinion, the most substantive issue.

It is not asserted that the account was not delinquent, so correction of the payment history profile can clearly be accomplished by addition of each monthly derog status. The substantive issue is credit report exclusion, which when it occurs will wipe the payment history derogs, making the monthly completeness kinda moot.

As for when it falls off, when did you first become delinquent on the account, and thereafter the account has remained delinquent?

That defnes the date of initial delinquency that then determines the exclusion of adverse delinquency information.

As for a repo, did the creditor take a net loss upon sale of the vehicle, or did the sale price discharge the remaining balance on the loan?

That will determine whehter the repo was equivalent and subject to a charge-off of the loss, or whether it was simply a delinquency.

Monthly delinquencies in a common chain of delinquency each have an exclusion date of 7 years from initial date of delinquency in that chain, and a charge-off or repo, if the repo resulted in a charge to profit and loss being taken by the creditor, requires exclusion no later than 7 years plus 180 days from the reported DOFD.

The payment history profile could properly show a level/type of delinquency status for each and every month since initial delinquency.

That could alternately, at the discretion of the creditor, be reported as a degree of monthly delinquency, such as 60/90/120/150/180+ days late, as Repo, as CO if they have taken a charge to profit and loss.

It is impossible to determine what the creditor actually reported to the CRA, as the commercial credit report may have lumped any repo into a common category called FC.

I would order a complete, non-commerical report from annualcreditreport.com for a clear showing of what the creditor actually reported.

Dispute of the reporting of forceclosure as an accurate monthly delinqency status can be disputed, but wont require any removal of reporting of derog status or any removal of the account. It will more likely result in the addition of a monthly adverse status for each and every month since initial delinquency.

Yes, you can dispute and get it corrected, but you may not like the results....

I would concentrate on getting the DOFD before disputing the inaccurate but incomplete payment history profile, and if the debt has continually remained delinquent since that date, asserting credit report exclusion if the DOFD was more than 7 years plus 180 days ago.

If repossessed in 3/2012, the DOFD was likely several months prior, which would be the latter part of 2011.

That would now be almost exactly 7 1/2 years ago....