- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Stop making this common mistake during your Credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Stop making this common mistake during your Credit Repair journey!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stop making this common mistake during your Credit Repair journey!

During your credit repair process you have to be laser focused in cleaning up your reports. You have to focus all your energy making sure your credit report is as clean as possible which includes collections, charge offs, late payments, past due balances, open balances, etc but also new accounts and inquiries!

I see this over and over again and I can't emphasize this enough: Stop seeking new credit during your credit repair process! New accounts are not a way to raise your score. While you can argue that the credit limit would help lower utilization, you need to start paying off debt if your goal is to lower utilization. New accounts and inquirires will not help you get there. They will lower your AAOA and the inquiry will hold your credit down for a while.

I know you want the tradelines and it is a good feeling to get an approval but getting a sub-prime approval (Open Sky, Credit One, etc) with a 500 score when you can get much better approvals a couple months down the road is not a good strategy.

If you want to lower utilization, try to focus instead in finding a reliable source (family, close friends) to add you as an Authorized User instead, as many as possible. Or if you lack an installment account try to do something like Self Lender which could actually improve your score.

Unless you have zero credit cards reporting, don't get a secured credit card until you have cleaned as much as possible your report. A lof of these cards require a deposit. Use that deposit to negotiate settlement on your charge offs/collections or to lower your current balances.

The approvals will come, trust me. But in due time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

I’ll just point out that this is your OPINION and should not be taken as gospel. You have some valid points and some may appreciate your opinions, but....

it is certainly possible to rebuild and repair at the same time. In fact, some could argue that doing both simultaneously is an awesome idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

Yep, I'm gonna have to live with a few of those mistakes just cuz I jumped the gun. Patience, patience, patience....and then some.

Great Post! Hope this finds it's way to some fresh eyes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

I'd like to re-read the OP when I get a few minutes, to allow a more thorough response.

For now I want to say that the OP makes some great points, and attempts, I think, to set the tone that seeking subprime credit is not actually a proper habit of building good credit and is not optimal repair strategy. Cleanliness and Time are the most important factors. I agree with those general assertions. I do wish many builders and rebuilders would take that to heart.

Like everything, however, absolutes are rare and there is a nuance to each situation.

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

@Anonymous wrote:During your credit repair process you have to be laser focused in cleaning up your reports. You have to focus all your energy making sure your credit report is as clean as possible which includes collections, charge offs, late payments, past due balances, open balances, etc but also new accounts and inquiries!

Nah, one still needs open and active accounts. The key is moderation and avoidance of certain TLs that can cause more financial harm than benefits

I see this over and over again and I can't emphasize this enough: Stop seeking new credit during your credit repair process! New accounts are not a way to raise your score. While you can argue that the credit limit would help lower utilization, you need to start paying off debt if your goal is to lower utilization. New accounts and inquirires will not help you get there. They will lower your AAOA and the inquiry will hold your credit down for a while.

New accounts are not only meant to raise the score. 2-3 new accounts with good payment history set the stage for later. Again, it's not reasonable credit seeking that's the problem, it's the type of credit that causes more problems.

I know you want the tradelines and it is a good feeling to get an approval but getting a sub-prime approval (Open Sky, Credit One, etc) with a 500 score when you can get much better approvals a couple months down the road is not a good strategy.

Well, you're not going to start with Bank of Dubai. There is something called necessary evil. Short term, perfectly fine.

If you want to lower utilization, try to focus instead in finding a reliable source (family, close friends) to add you as an Authorized User instead, as many as possible. Or if you lack an installment account try to do something like Self Lender which could actually improve your score.

Actually, during the app, most lender's have built in algorithms that will separate AU accounts.

Ever wonder why you cannot get a chase card with 3 month history and 20 year old AU card? That's why. Also, once AU accounts are removed, a lot of lenders will totally remove TL. Then what? You just helped somebody else get rewards.

Unless you have zero credit cards reporting, don't get a secured credit card until you have cleaned as much as possible your report. A lof of these cards require a deposit. Use that deposit to negotiate settlement on your charge offs/collections or to lower your current balances.

Probably the closest thing to the truth but unless someone is contemplating a BK, one month without coffee will pay for deposit on decent secured card. Rebuilding is not just about dealing with present, but also planning the future. A few positive lines will not make your credit perfect or even good, but for some it takes a couple of years to clean up enough. That's too much time to waste

The approvals will come, trust me. But in due time.

I can certainly appreciate the sentiment in your post, but speaking in absolute terms when it comes to rebuilding is a big mistake.

The reason you should not do that is that every situation is different and should be approached from unique point of view

A person could have had financial issues 3 years ago, but be in a much better place today and be able to afford security deposits while simultaneously working on derogs

Why would they wait?

At the same time, somebody drowning in debt probably should not be putting money in deposits.

Someone who's burned all or most major lenders is in a different situation than someone with 10 medical collections, even if amount of debt is same.

I could go on like this, but I merely wanted to illustrate why you dont see many posts like yours.

It's because one size fits all really does not work with credit.

When a poster comes here for help, we pretty much interrogate them to get as much info as we can from them to assure responses are relatively personalized.

Do this! and Dont do this! used as absolute statements are over simplifying

If you want to sum up what to do during rebuild.....Dont miss payments, skip TLs that force you to buy useless trinkets and mind your utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

@BallBounces wrote:I'd like to re-read the OP when I get a few minutes, to allow a more thorough response.

For now I want to say that the OP makes some great points, and attempts, I think, to set the tone that seeking subprime credit is not actually a proper habit of building good credit and is not optimal repair strategy. Cleanliness and Time are the most important factors. I agree with those general assertions. I do wish many builders and rebuilders would take that to heart.

Like everything, however, absolutes are rare and there is a nuance to each situation.

That's a great and valid observation. There are no absolutes in credit, the model varies, YMMV, and nothing is concrete. But there are factors that we know, and those are evident and are acceptable as truth by most and that is that: Adding new revolving accounts will:

Some posible negatives are:

- Inquiry

- Will drop your AAoA

- Will reset your AoYA

- Might change rating in "Amount of new Credit" from Good to Fair.

Some positives might be a very good increase when your first revolving is added but that's normally limited to profiles with no derogs, and since we are dealing with a credit repair we are assuming derogs are present so that's not the case here.

As with everything, your mileage may vary, but more likely than not, adding new accounts during rebuild is not a good idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

I just can't stress patience enough. Read up, ask questions, get a plan and THEN put it into action....sure wish I had.

I waited 7 years, if only I had found myFico sooner. But if others have to wait one second, one week, month or year to app then it is what it is but at least you have other things you can do to clean up and get ready for the party.

So my first move was my worst, jumped the gun by maybe 7 days, but that too will work itself out with time.....I just need to be patient.

I appreciate reading the op and the responses. It's like watching a movie over and over, you realize something new with each viewing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

@Anonymous wrote:

As with everything, your mileage may vary, but more likely than not, adding new accounts during rebuild is not a good idea.

Before with 1 retail card, 1 heloc, 4 derogs; After 1 Credit Card (New) , 1 retail card, 1 heloc, 1 derog. After last derog I gained another 28 pts. about month or so later. Patience (a matter of waiting 7 days) would have gotten me a better card, my only regret.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

@Remedios wrote:

@Anonymous wrote:During your credit repair process you have to be laser focused in cleaning up your reports. You have to focus all your energy making sure your credit report is as clean as possible which includes collections, charge offs, late payments, past due balances, open balances, etc but also new accounts and inquiries!

Nah, one still needs open and active accounts. The key is moderation and avoidance of certain TLs that can cause more financial harm than benefits

Please link me to a few threads where we recommend people to open new accounts as a means to improve their score.

I see this over and over again and I can't emphasize this enough: Stop seeking new credit during your credit repair process! New accounts are not a way to raise your score. While you can argue that the credit limit would help lower utilization, you need to start paying off debt if your goal is to lower utilization. New accounts and inquirires will not help you get there. They will lower your AAOA and the inquiry will hold your credit down for a while.

New accounts are not only meant to raise the score. 2-3 new accounts with good payment history set the stage for later. Again, it's not reasonable credit seeking that's the problem, it's the type of credit that causes more problems.

When someone is seeking to improve their credit score, adding inquiries and accounts should not be the focus. My post clearly specified if the person has no revolvings reporting, then yes, adding new accounts is a wise decision and will more than likely improve their score in the short term. But someone with 3-4 accounts reporting will be minimal to no improvement in their score, usually its a negative impact.

I know you want the tradelines and it is a good feeling to get an approval but getting a sub-prime approval (Open Sky, Credit One, etc) with a 500 score when you can get much better approvals a couple months down the road is not a good strategy.

Well, you're not going to start with Bank of Dubai. There is something called necessary evil. Short term, perfectly fine.

If you would like to recommend someone to apply for Credit One, you are welcome to do so. I`ll always advice to improve their credit first, and go for a Capital One instead. I did not start my credit journey with Credit One. Neither did my wife. Neither did anyone I have helped.

If you want to lower utilization, try to focus instead in finding a reliable source (family, close friends) to add you as an Authorized User instead, as many as possible. Or if you lack an installment account try to do something like Self Lender which could actually improve your score.

Actually, during the app, most lender's have built in algorithms that will separate AU accounts.

Ever wonder why you cannot get a chase card with 3 month history and 20 year old AU card? That's why. Also, once AU accounts are removed, a lot of lenders will totally remove TL. Then what? You just helped somebody else get rewards.

You are pointing out so obvious and narrowed down examples that I really don't see the point of your reply? If you want to suggest never adding an AU tradeline to your file then you are welcome to do that. That would be really bad advice on your behalf.

Unless you have zero credit cards reporting, don't get a secured credit card until you have cleaned as much as possible your report. A lof of these cards require a deposit. Use that deposit to negotiate settlement on your charge offs/collections or to lower your current balances.

Probably the closest thing to the truth but unless someone is contemplating a BK, one month without coffee will pay for deposit on decent secured card. Rebuilding is not just about dealing with present, but also planning the future. A few positive lines will not make your credit perfect or even good, but for some it takes a couple of years to clean up enough. That's too much time to waste

The approvals will come, trust me. But in due time.

Again, a very narrowed down example. If you would like to suggest people to open new accounts as a way to improve their credit score, you are welcome to do that.

I can certainly appreciate the sentiment in your post, but speaking in absolute terms when it comes to rebuilding is a big mistake.

The reason you should not do that is that every situation is different and should be approached from unique point of view

A person could have had financial issues 3 years ago, but be in a much better place today and be able to afford security deposits while simultaneously working on derogs

Why would they wait?

Another narrowed down example.

At the same time, somebody drowning in debt probably should not be putting money in deposits.

Someone who's burned all or most major lenders is in a different situation than someone with 10 medical collections, even if amount of debt is same.

I could go on like this, but I merely wanted to illustrate why you dont see many posts like yours.

It's because one size fits all really does not work with credit.

When a poster comes here for help, we pretty much interrogate them to get as much info as we can from them to assure responses are relatively personalized.

Do this! and Dont do this! used as absolute statements are over simplifying

If you want to sum up what to do during rebuild.....Dont miss payments, skip TLs that force you to buy useless trinkets and mind your utilization.

Essentially your post took very valid concepts and adviced and diluted it to a couple of narrowed down specific examples. Don't see the point of your reply.

With credit YMMV, but if you want to see the most absolute and best result of your credit repair process, give yourself the opportunity for your credit to improve before you go out seeking new credit. If anyone wants to go out and seek new credit as means to improve their credit and if you want to tell them that's a good approach, you are welcome to.

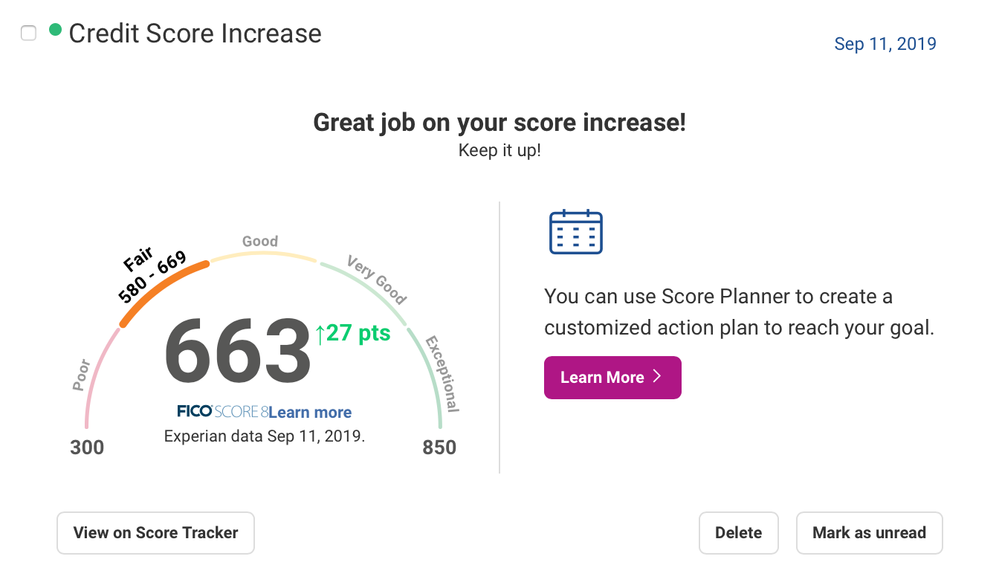

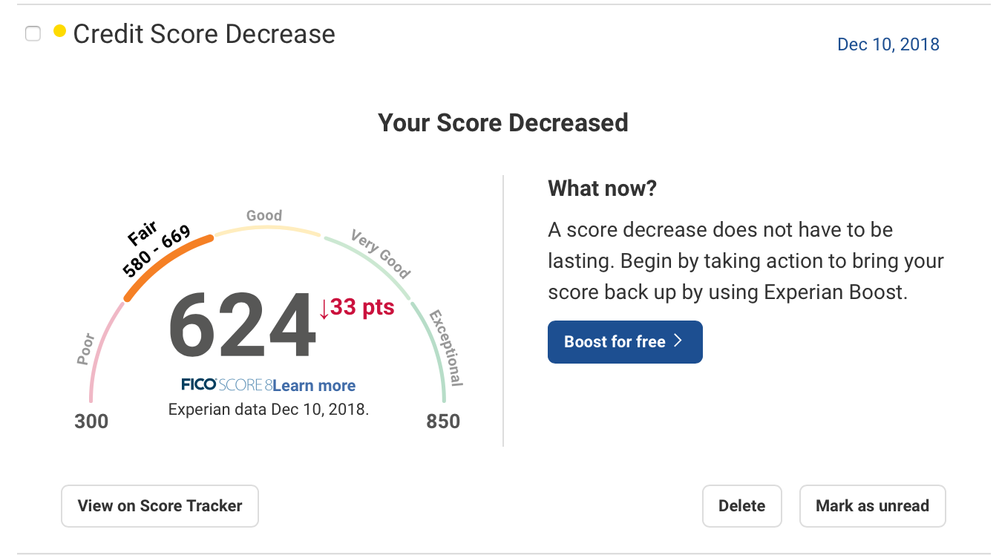

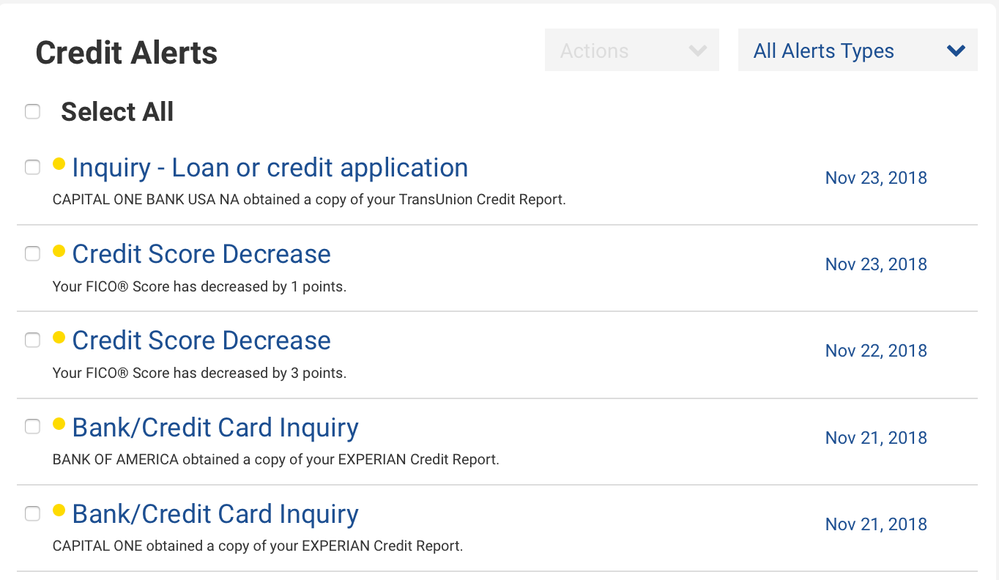

This is my wife's credit over the last 30 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Stop making this common mistake during your Credit Repair journey!

This is my wife's credit after applying for Capital One and BOA.