- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Strategy for Closing Recently Opened Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strategy for Closing Recently Opened Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy for Closing Recently Opened Cards

@ForwardLooking wrote:

@GZG wrote:

@ForwardLooking wrote:

@Horseshoez wrote:@ForwardLooking, maybe its just me, but I don't see the benefit of waiting for 11 months to close those two cards. Three years ago I closed a card after less than 7 weeks; it still shows up as a positive on my credit reports, and probably will do so for another 7 years.

Did you have any negative impacts from lenders later? I want to close them, but I don't want to look like a card churner which can spook some banks. I am assuming I could ask for a recon if that was an issue -- simply explaining I was moving away from ultra sub-prime lenders. Obvisouly I am out of guidelines for banks like Chase with their 5/24 rule, but I don't want to rock the boat with my chances at Navy Federal as I am due for a review on my nRewards card soon to hopefully graduate it.

owing $1800 in an unpaid CO is way more spooky than closing two never late $300 subprime cards a month later

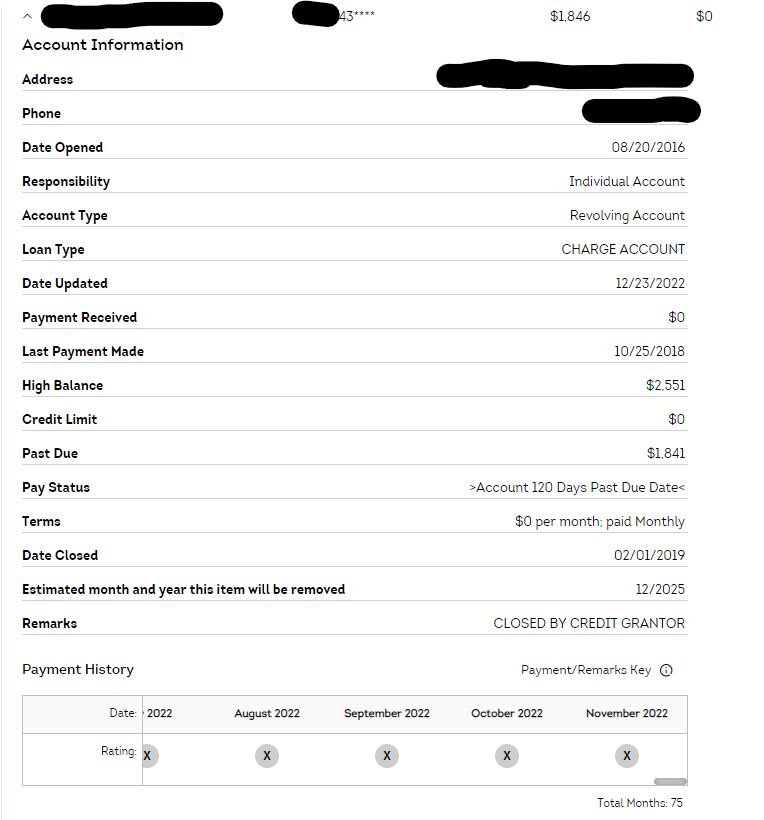

closing the two cards will just end being a blip all things considered regardless if you close them now or in ~10-11 monthsGood point. But it has never been reported as a CO / charge off. Last update was 2019 as 120 days late and no updates since then. Wierd part is is shows good payment status after 2019, but I have not paid anything towards it. Perhaps they just can't get their act together on reporting?

that's bizarre

how do each of your three individual reports actually show it?

If you do contact them again for them to adjust the balance, consider they might end up "reporting accurately" when they fix it which may or may not cause your score to drop

3/6, 5/12, 14/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy for Closing Recently Opened Cards

It reports similar on each CRA too. Just shows a pay status as 120 days late, never a charge off. Record itself gets updated monthly, but they never update the payment history. I am guessing the no update in payment history counts as a green "good" mark in myFico. Either way, I have reached out to them multiple times in good faith to take care of the account and have done my part to get right with them. If they approach me, I am ready. Last thing I want is a dispute to backfire and change this to an unpaid charge-off considering how many times I have tried to pay it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy for Closing Recently Opened Cards

I'd probably just leave it alone if I were you.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy for Closing Recently Opened Cards

Just an Update. I closed my Avant and Destiny cards today. I also closed a CreditStrong Revolv account. Every one of them was nice and helpful during the process and understood. Only Destiny tried to get me to reconsider keeping it as an "Emergency" card, and my only responce was that if I had an emergency, $300 was probably not going to help.

I was recently approved for Navy Federal's Flagship, so I may go ahead and close my Navy Federal nRewards secured card to get my $2000 deposit back as I really don't need the secured card anymore. If I do, it will be after I have my card in hand and activated, it is in the mail now.

Overall, if I close the secured card, my revolving credit limit has gone from $6,550 to $13,150 in the past 6 months and I have cut down on most annual fees saving just under $300 per year. I still have 2 CreditOne cards (Amex and Visa) with decent limits and history (4+ years) so I will probably keep them a little longer more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy for Closing Recently Opened Cards

So, the CreditStrong Revolve account was marked closed on all 3 CRA's. The other two accounts (Avant and Destiny) still show open. My Fico 8 score has dropped between 9 to 18 points on the 3 bureaus. I am not complaining as I am saving annual fees and I am sure my score will recover as I continue my rebuild, but I was a little shocked having one closed account drop my score so much.

I'll post a final update after the other two accounts close.