- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Sued by Portfolio Recovery

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sued by Portfolio Recovery

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sued by Portfolio Recovery

Alright, so Portfolio tends to come up here quite a bit. Decided to share my recent experience with them, which was me being sued. Buckle up, this is gonna be a long one.

On July 2nd I got a call from my dad that the sheriff just showed up and tried to serve me. I had no idea what it was for and thought it was odd as I haven't lived there in over 15 years. Later when the mail came to my home, I received a letter from an attorney notifying me that I was being sued and they included the docket information, which I immediately looked up. It was Portfolio and they were suing me over a Comenity debt.

On a side note, it took them over 2 weeks to find me and they switched to a normal process server. They were borderline harassing my family, calling them liars because they said I wasn't home and tried to look in all of the windows around the house to see if I was hiding inside. When they finally served me, he called ahead and I was waiting.

Now, I dealt with Portfolio years and years ago so I should have known better and moved them higher on my priority list of charge off, pay offs. They sued me previously and I forgot to answer resulting in a default judgement and them garnishing my wages. This time I wasn't gonna let that happen. I tried reaching out to them and they took a stance. I'm assuming because the lawsuit was filed they expected me to just fold. I did not. There are mixed comments out there where some claim that PRA just sues hoping for a default. In both instances, I found that to not be the case. Both times, they were well prepared and included paperwork in the summons from the original creditor including statements showing first default as well as last statement showing last total before charge off. They dotted their I's and crossed their T's for everything.

I contacted a consumer protection attorney, actually the attorney that mailed me as it turned out he had very good reviews over a long period of time. It was actually rocky at first as I wasn't getting any communication. Once 20 days had passed out of my 30 to answer, I went down to the office to turn in all of my paperwork and ask WTFico is going on. I got a call from my attorney the next day that the case was suspended so that we could negotiate.

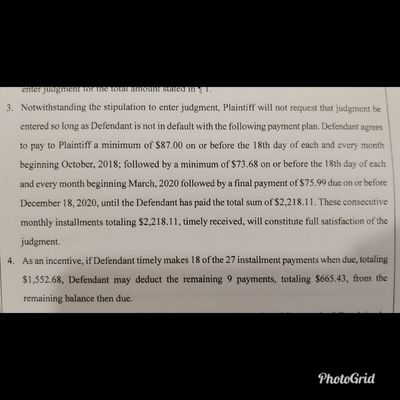

The negotiations lasted until September 18th. Portfolio was extremely difficult to work with. They don't do PFD and refuse to modify comments for the bureaus. They refused a lump sum offer in lieu of a payment plan. I also tried negotiating a shorter payment plan and higher monthly payment which they declined. The plan also changes the total due monthly partway through it, twice. I feel that they are doing this in an effort to get me to default so that they can try and request full judgement rather than the settled amount. It makes no sense to me why they would decline a 6 month payment plan in favor of a 27 month plan, otherwise. Below is the agreed on amounts and payments:

As for cost of the attorney, I don't have the exact total with me, but it was approx. $400. In the end, I saved just under $300. Many people will argue that I could have saved more by doing my own negotiations, and that may be true, but ain't nobody got time for that. My job doesn't have set hours and I normally work from 6am to sometime after 5pm. I wasn't going to take time off to deal with it. In addition, the fee was all inclusive meaning if it went to trial it would all be covered on top of me not having to even show up. For me, the cost was worth it and he'll be starting the negotiation for my largest charge off shortly.

Hope this helps people on what to expect in this type of situation. Let me know if you have any questions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

How old was the debt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

@Anonymous wrote:

Sorry this happened to you

How old was the debt

Less than 2 years which is why I was working on other ones first. Thought I had about another year before this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

Thanks for posting your experience.

My husband and I have several recent collections accounts from them totaling a little over $3000, I figured because they won't do a pfd anyway they would get pushed back to the end of the list. Now I'm rethinking that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

@Anonymous wrote:

Being real, they seem to be unnecessarily hard-bleeped. No other collector I’ve dealt with (I have not dealt with PRC) has been anything other than willing to work in order to resolve things quickly to a mutual satisfaction. Sorry you have to deal with this from them. It seems wholly unnecessary to be that inflexible.

Well, like I said above, they were well prepared so they knew they had a strong case. I really didn't have a choice but to comply with their demands. They definitely didn't need to make it so complicated, so I seriously believe they're stretching it out on purpose to increase the chances of default.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

@Anonymous wrote:Thanks for posting your experience.

My husband and I have several recent collections accounts from them totaling a little over $3000, I figured because they won't do a pfd anyway they would get pushed back to the end of the list. Now I'm rethinking that.

It's the reason I posted it. Everyone is so nonchalant about them on here, but they can be very aggressive. My first lawsuit from them was for a $1200 Cap1 card. I'm sure you're on their radar with a $3k balance. Good luck with your situation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

FICO 8 Exp 609 TransUnion 622 Equifax 617 (8/10/18)

FICO 8 Exp 643 Equifax 641 Transunion 655 (9-10-18)

FICO 8 exp 630 Transunion 646 Equifax 627

Fico 8 Exp 646 Transunion 639 Equifax 640 (11/1/18)

Fico 8 Exp 698 Transunion 716 Equifax 690 (1/8/19)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

Just my personal curiosity, but I would be surprised if they had a legitimate chain of title showing that they were duly authorized to collect on that debt. These debt collectors usually walk into court with, at most, a generic bill of sale that does not list out any specific accounts, and they expect you to take their word for it that they have the proper legal right to collect. The courts, too, will usually not question anything there unless you do.

Personally, I've seen where PRA sued someone, and brought a generic bill of sale for a "certain portfolio of accounts". Then, they had a separate page, with no header on it, no anything, aside from some basic account info for the defendant's account. It was completely separate and something you could have typed up that morning before walking in the courthouse. That one thing right there is what lost PRA's case for them. The defendant challenged their claim of having standing. The court agreed that a "certain portfolio of accounts" does not in any way mean that this one specific account was included within it. Also, the court agreed with the defendant's objection to their typewritten separate page, and said the same thing I did---that anyone can type up a simple list of purported account information. Defendant won on motion to dismiss for lack of standing and that was about 4 years ago....they never refiled.

Unless they have really tightened things up over there, if they brought suitable proof of standing in your case, I would be shocked. And I suspect that they wanted to draw out the settlement to 27 months for two reasons---one, they get more money because that's extra interest. And two, if they can trip you up or youend up defaulting on your own, they get an automatic judgment--and you lose. You would think that they would want their money sooner, but they actually go the opposite way--more money is better even if they have to wait for it. At least, in a case like yours it is, where you are employed and they can always just garnish wages again to get their $$$. Glad you were able to work it out to your satisfaction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sued by Portfolio Recovery

In addition, be careful of that incentive plan they offer. Yes, they will knock some of the cost off. But notice that the amount they would knock off is just over the $600 minimum for a 1099c to be issued. That means that you'll be paying taxes on that money, as a 1099c treats it like it's income for you. Sure, you'd come out paying a bit less in total, but just wanted to make sure you were prepared in case you go that route and they drop that $$ from the total.