- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Toyota Financial Settlement

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Toyota Financial Settlement

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Toyota Financial Settlement

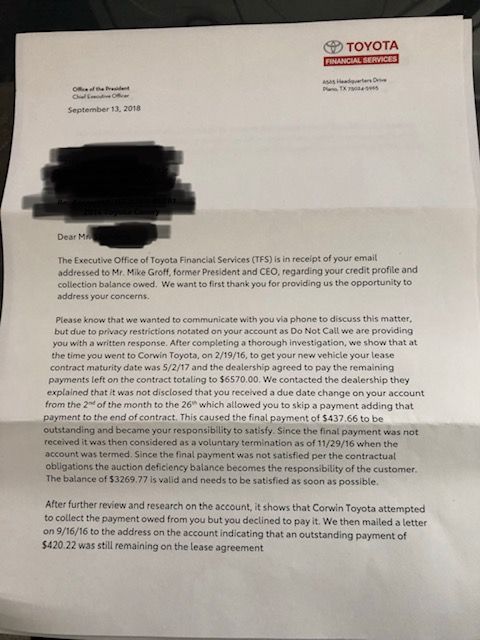

I had a lease trade in about 3 years ago that went into deficiency after the dealership did not pay the balance on the traded in vehicle. The amount is about $3200. About 2 weeks ago I called in and got a settlement offer for around $2100. Went and took money out my 401K to pay it. Called in today and they said that offer is no longer avaialble because the acount status is changed, I asked her what that means and she said its Internal I wont understand. Ok?![]()

I have also countlessly time and time again requested from them how they calculated this charge off amount and they tell me they will send me the verification in the mail, but about a month has passed since my first request for the information. Called last week again to ask and still nothing in the mail.

I am so deadbeat on dealing with TFS and its causing me an unbelievable amount of stress. Im trying to get a mortgage and my lender wants this acount gone. Any help or advice please how do I deal with this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Toyota Financial Settlement

Are you stating that they made a settlement offer, and are now reneging on that offer?

That is bad faith contract negotiation.

I would begin by making a call to their executive office and speaking with a management official with the authority to review the conduct of their employee. They should, at the least, explain the basis for their rescission of their prior written offer.

You could also file a formal complaint with your local BBB of their poor business practice.

Finally, if you have some documentation to support what you consider to be the accurate current balance, you might file a dispute with the CRA contesting the accuracy of their current reporting. That would establish a required 30'ish day reinvestigation period, with compulsory investigation by the creditor. If they verify the current reporting, that will then open the door for your next step,which is the filing of a civil action under FCRA 623(c) contesting the reasonableness of their investigation of the accuracy of their reported balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Toyota Financial Settlement

Thanks for your reply.

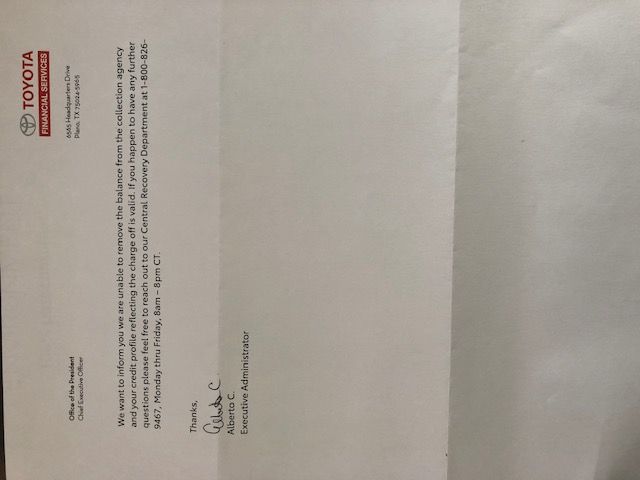

Yes I tried disputing the entry on the credit agencies ( All 3) and everytime they just come back saying its verified as accurate. I know that something went wrong with the account, i messed up or the dealership messed up, but Im not getting any infrotmation as to how everything was calculated or a full payment history on the account. I wrote to Toyota Executive offices and called for a copy of my original lease contract and a full history of payments recieved and got nothing. I have attached photos of a letter I got from TFS executive offices after I emailed the CEO directly. I was so frustrated with arguing over this and just thought id take the settlement offer so took this money out of my 401K now they saying they want the full balance.

For your information I have still my 2016 Camry which I traded this defunct lease for. All payements on time 100%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Toyota Financial Settlement

I want to add in aswell that at no point in time did the dealership ask me about changing my due date on the car. I had done this a few months after I entered the lease contract so it coincided with my paychecks.