- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Transunion kept late report, Experian and Equf...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Transunion kept late report, Experian and Equfax are clear!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

@Anonymous wrote:thank you so much for your notes. I was wondering how can we involve @RobertEG to this issue?

@FireMedic1 wrote:Time for Consumer finance attorney to clear it up possibly. Apparently TU is violating FRCA by reporting inaccurate info. @RobertEG can elaborate more when he signs in on this matter better than I can. Good Luck!

He pops in every other day or so. No worries he'll see my ping to him. Then we'll get a clear and precise answer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

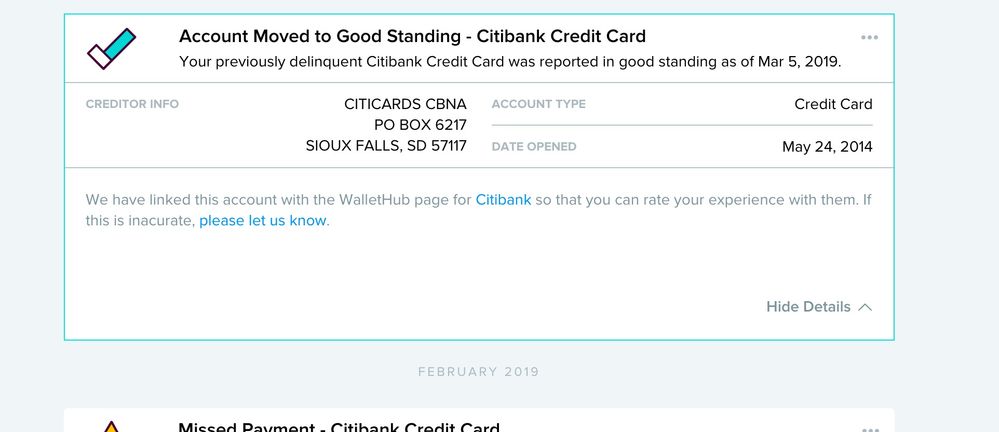

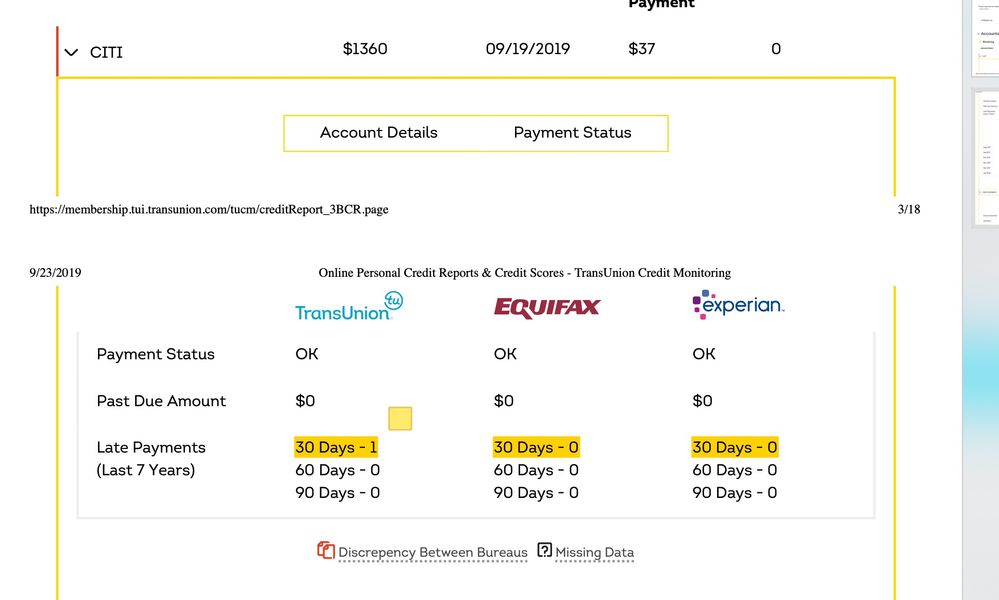

and this might help to support my case.

wallethub shows how they changed delinquent to good standing on march, (after my mail, sent to citibank and they stepped by and cleared from equifax)

as well as the recent 3 bueureo report which shows that only TU cares that late.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

Creditors will often choose to subjectively report delinquencies to only one or two CRAs, and not to all three.

While a consumer can technically dispute either or both the accuracy or completeness of reporting, and thus could dispute the lack of a complete payment history profile if an actual late is removed from that individual CRA, as a practical matter, consumers rarely choose to dispute the accuracy or completeness that results only in the addition of a delinquency to their report, and thus do not normally file a dispute asserting the lack of reporting of a delinquency for a given month under payment history profile.

If you do choose to dispute, the lack of accuracy or completeness would be the lack of reportng with a given CRA, and NOT the required deletion of an accurate delinquency with one CRA based on its deletion with another CRA.

The only exception would be if you had filed a dispute with a CRA, and the creditor, upon their investigation, had made an explicit finding in the dispute that the delinquency was per se inaccurate, and thus was deleted by the creditor for that reason (i.e., it was inaccurate, and could not be verified or corrected so as to overcome the inaccuracy, and thus was deleted as unverifiable).

When information is corrected or deleted with any one CRA as a result of finding of the creditor in a dispute that it is unverifiable/uncorrectible, then they are also required to report that deletion/correction with any and all other CRAs to which they have also reported the disputed information. Correction or deletion only of the reporting with the single CRA with which the dispute was filed is not sufficient if there is an actual determination of unverifiability. See FCRA 623(b)(1)(D),

It does not appear that the posted scenario resulted in a decision by the creditor that the reporting of the delinquency to any CRA was factually inaccurate, and thus their decision to delete with only one or two CRAs, and not with TU, was improper, and imposed any requirement to delete the TU reporting.

If there were a specific determination by the creditor that the delinquency was not per se accurate, you would have received that specific finding in a Notice of Results of Investigation of the dispute.

I assume that you did not receive an specific Notice of Results that shows that the reported delinquency was not verifiable by the creditor, and thus deleted by the CRA as a formal result of a prior dispute?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

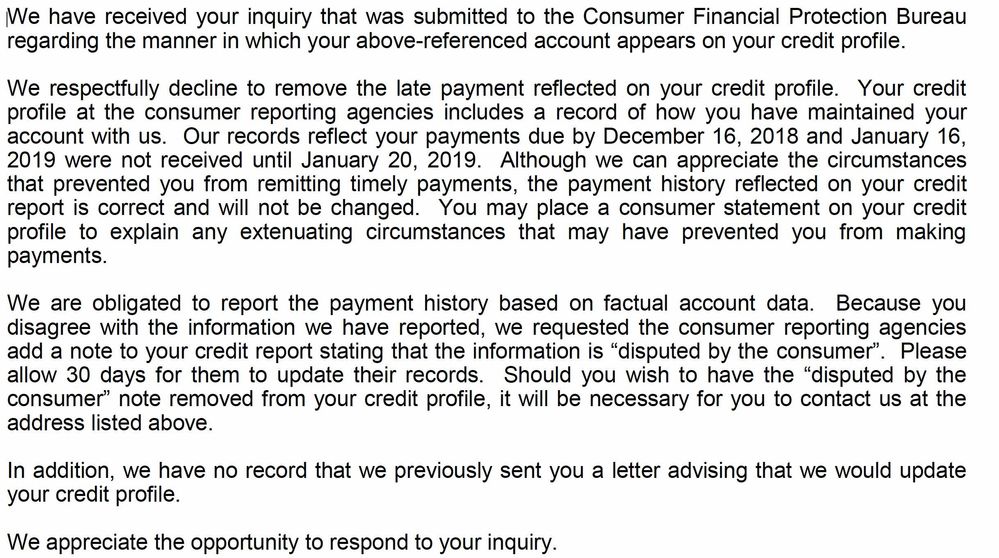

when i was reading your email, just received the final decision from CFPB.

can you please interpret this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion kept late report, Experian and Equfax are clear!

You could file a dispute with EX and EQ asserting that the lack of reporting of the delinquency results in an incomplete payment history profile, and thus get the accurate delinquency re-added to their reports.

The reporing by TU is not inaccurate per se based only on the deletion of the delinquency by EX and EQ, and is not a disputable inaccuracy on the TU report.

Your best path may be to request the creditor to grant a good-will deletion of the TU reporting, but that is voluntary on their part.

The contentious prior dispute history may not have built much good-will on their part to now grant deletion, but that is likely your best path.

I would not suggest a renewed dispute with TU, as the asserted inaccuracy that would be the basis for the dispute is not the validity per se of the reported delinquency. The fact that they voluntarily chose to delete with other CRAs does not make the TU reporting incomplete or inaccurate.

Any renewed dispute is more likely to lessen chances of grant of good-will by the creditor, and can be summarily dismissed as being "frivolous or irrelevant."

I suggest that you pursue good-will from the creditor rather than continued disputes or complaints to the CFPB that lack any statutory basis for required deletion.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content