- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- UPDATE #3!!! Sister called with panic attack over...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UPDATE #3!!! Sister called with panic attack over "Account is deemed as uncollectible"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

Both the original creditor or a debt collector cannot re-age a negative account. No matter how many times a delinquent account is transferred or sold from one debt collector to another, the date of first delinquency should not change. Section 623(5)(A) says: “In general. A person who furnishes information to a consumer reporting agency regarding a delinquent account being placed for collection, charged to profit or loss, or subjected to any similar action shall, not later than 90 days after furnishing the information, notify the agency of the date of delinquency on the account, which shall be the month and year of the commencement of the delinquency on the account that immediately preceded the action.” Both entries should fall off at the same time.

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:Just a note - disputing items that you know are valid as "I have no knowledge of this account" is heavily frowned upon.

I doubt they inserted two lines on purpose, the "new" one only has February 2017 in its historical data. Speak to Experian and let them know there should be one tradeline. This is probably because of the frivilous dispute.

Yeah, you are correct. Except she didn'the enter that comment until this morning, after this showed up. She'said human and frustrated and Experian not open on weekends. How does thar explain two different account numbers?

I didn't mean by the general public, I meant by the credit bureaus. She can call them Monday morning.

Actually, looking at it again there are also two different addresses for the creditor. It was likely transferred to their own internal collections department at another office, as opposed to a third party collection agency.

Yepper, that is our thought as well. Which means she will have to be on the phone at 7am CST with Experian to get them to understand that and hopefully remove the 2nd one and thus result in her score readjusting itself and hope they do it quickly before any credit card companies take AA, thinking they might not given her score is still in the good range, but one never knows given that it is probably all automated and once Amex, Chase, CAP1 get the CR/FICO update their system will automatically flag it. So guessing time is of the essence and of course all depends on who she gets on the phone at Experian and whether they are in agreement and how long it takes. Very frustrating. Of course as that still leaves Equifax to deal with should they do the same **bleep** thing. Equifax says it is "charged off" already, but so did Experian until this showed up today.

Sorry, I wasn't really clear. I meant that the second tradeline is probably valid, as it looks like the debt was transferred to another office, and thus is being reported accurately. They aren't going to be deleted as duplicate accounts because the account numbers are different and one appears to be the creditor, and the other a debt collector.

I strongly recommend trying to pay to delete the collection account, and then contact the original office and ask if they will remove their tradeline as well once it is paid.

Ok, appreciate the update. How is that not double dipping so to speak? Two dings for the same trade? Makes it look like twice as much owed and twice as many lates? So they are trying to turn up the pressure on her to pay as I suspected

It's not if they are their own debt collector. It's no different if they sold the debt to a third party debt collector and that collection agency added a collection account to your report for the charged off debt. You'd still have two negative tradelines. However, I think the second one's type is incorrect, it should not be reporting as a 'note loan' as your sister did not get a second loan. That is a basis for dispute, so if I were her I would call Monday morning and explain the sitution to a rep, because it will get verified and hurt any chances of actually fixing the problem. I will say though, if she tries to pay for delete after the investigation, it probably won't go over to well, so she needs to do that before it gets that far.

And while the actual charged off account will fall off in a year, the collection account will have its own expiration in 7 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

@Anonymous wrote:Both the original creditor or a debt collector cannot re-age a negative account. No matter how many times a delinquent account is transferred or sold from one debt collector to another, the date of first delinquency should not change. Section 623(5)(A) says: “In general. A person who furnishes information to a consumer reporting agency regarding a delinquent account being placed for collection, charged to profit or loss, or subjected to any similar action shall, not later than 90 days after furnishing the information, notify the agency of the date of delinquency on the account, which shall be the month and year of the commencement of the delinquency on the account that immediately preceded the action.” Both entries should fall off at the same time.

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:Just a note - disputing items that you know are valid as "I have no knowledge of this account" is heavily frowned upon.

I doubt they inserted two lines on purpose, the "new" one only has February 2017 in its historical data. Speak to Experian and let them know there should be one tradeline. This is probably because of the frivilous dispute.

Yeah, you are correct. Except she didn'the enter that comment until this morning, after this showed up. She'said human and frustrated and Experian not open on weekends. How does thar explain two different account numbers?

I didn't mean by the general public, I meant by the credit bureaus. She can call them Monday morning.

Actually, looking at it again there are also two different addresses for the creditor. It was likely transferred to their own internal collections department at another office, as opposed to a third party collection agency.

Yepper, that is our thought as well. Which means she will have to be on the phone at 7am CST with Experian to get them to understand that and hopefully remove the 2nd one and thus result in her score readjusting itself and hope they do it quickly before any credit card companies take AA, thinking they might not given her score is still in the good range, but one never knows given that it is probably all automated and once Amex, Chase, CAP1 get the CR/FICO update their system will automatically flag it. So guessing time is of the essence and of course all depends on who she gets on the phone at Experian and whether they are in agreement and how long it takes. Very frustrating. Of course as that still leaves Equifax to deal with should they do the same **bleep** thing. Equifax says it is "charged off" already, but so did Experian until this showed up today.

Sorry, I wasn't really clear. I meant that the second tradeline is probably valid, as it looks like the debt was transferred to another office, and thus is being reported accurately. They aren't going to be deleted as duplicate accounts because the account numbers are different and one appears to be the creditor, and the other a debt collector.

I strongly recommend trying to pay to delete the collection account, and then contact the original office and ask if they will remove their tradeline as well once it is paid.

Ok, appreciate the update. How is that not double dipping so to speak? Two dings for the same trade? Makes it look like twice as much owed and twice as many lates? So they are trying to turn up the pressure on her to pay as I suspected

It's not if they are their own debt collector. It's no different if they sold the debt to a third party debt collector and that collection agency added a collection account to your report for the charged off debt. You'd still have two negative tradelines. However, I think the second one's type is incorrect, it should not be reporting as a 'note loan' as your sister did not get a second loan. That is a basis for dispute, so if I were her I would call Monday morning and explain the sitution to a rep, because it will get verified and hurt any chances of actually fixing the problem. I will say though, if she tries to pay for delete after the investigation, it probably won't go over to well, so she needs to do that before it gets that far.

And while the actual charged off account will fall off in a year, the collection account will have its own expiration in 7 years.

Thank you for the correction, good information to have. I need to look back at my old student loans with this information, as they all have different expiry dates listed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

@Anonymous wrote:

@Anonymous wrote:Both the original creditor or a debt collector cannot re-age a negative account. No matter how many times a delinquent account is transferred or sold from one debt collector to another, the date of first delinquency should not change. Section 623(5)(A) says: “In general. A person who furnishes information to a consumer reporting agency regarding a delinquent account being placed for collection, charged to profit or loss, or subjected to any similar action shall, not later than 90 days after furnishing the information, notify the agency of the date of delinquency on the account, which shall be the month and year of the commencement of the delinquency on the account that immediately preceded the action.” Both entries should fall off at the same time.

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:

@merlinflex wrote:

@Anonymous wrote:Just a note - disputing items that you know are valid as "I have no knowledge of this account" is heavily frowned upon.

I doubt they inserted two lines on purpose, the "new" one only has February 2017 in its historical data. Speak to Experian and let them know there should be one tradeline. This is probably because of the frivilous dispute.

Yeah, you are correct. Except she didn'the enter that comment until this morning, after this showed up. She'said human and frustrated and Experian not open on weekends. How does thar explain two different account numbers?

I didn't mean by the general public, I meant by the credit bureaus. She can call them Monday morning.

Actually, looking at it again there are also two different addresses for the creditor. It was likely transferred to their own internal collections department at another office, as opposed to a third party collection agency.

Yepper, that is our thought as well. Which means she will have to be on the phone at 7am CST with Experian to get them to understand that and hopefully remove the 2nd one and thus result in her score readjusting itself and hope they do it quickly before any credit card companies take AA, thinking they might not given her score is still in the good range, but one never knows given that it is probably all automated and once Amex, Chase, CAP1 get the CR/FICO update their system will automatically flag it. So guessing time is of the essence and of course all depends on who she gets on the phone at Experian and whether they are in agreement and how long it takes. Very frustrating. Of course as that still leaves Equifax to deal with should they do the same **bleep** thing. Equifax says it is "charged off" already, but so did Experian until this showed up today.

Sorry, I wasn't really clear. I meant that the second tradeline is probably valid, as it looks like the debt was transferred to another office, and thus is being reported accurately. They aren't going to be deleted as duplicate accounts because the account numbers are different and one appears to be the creditor, and the other a debt collector.

I strongly recommend trying to pay to delete the collection account, and then contact the original office and ask if they will remove their tradeline as well once it is paid.

Ok, appreciate the update. How is that not double dipping so to speak? Two dings for the same trade? Makes it look like twice as much owed and twice as many lates? So they are trying to turn up the pressure on her to pay as I suspected

It's not if they are their own debt collector. It's no different if they sold the debt to a third party debt collector and that collection agency added a collection account to your report for the charged off debt. You'd still have two negative tradelines. However, I think the second one's type is incorrect, it should not be reporting as a 'note loan' as your sister did not get a second loan. That is a basis for dispute, so if I were her I would call Monday morning and explain the sitution to a rep, because it will get verified and hurt any chances of actually fixing the problem. I will say though, if she tries to pay for delete after the investigation, it probably won't go over to well, so she needs to do that before it gets that far.

And while the actual charged off account will fall off in a year, the collection account will have its own expiration in 7 years.

Thank you for the correction, good information to have. I need to look back at my old student loans with this information, as they all have different expiry dates listed.

Yeah, was not sure about that last part either based on what we found on Experian website: http://www.experian.com/blogs/ask-experian/why-an-original-account-and-collection-account-both-appear-on-your-credit-report-for-the-same-debt/

Because a collection account is treated as a continuation of the original debt, it will be deleted at the same time as the original account. The original account and subsequent collection accounts will be deleted seven years from the original delinquency date. The original delinquency date is the date of the first missed payment after which the account was never again current.

The collection agency is required by law to carry over that original delinquency date from the first account and report it to the credit reporting company. That ensures the collection account is deleted at the correct time.

In any event, spoke to her last night and this morning. Leaning towards calling Experian first thing in the morning to remove the dispute on the "charge off"one that has been there for a bit. Then to modify the one that just came in yesterday day as the dispute should not be reading a new note loan account and incorrect end date. Once she gets that done then she can call OneMain and simply say she has never rec'd any info regarding this and is willing to pay it for removal of the collection account information for the CRs and that should be that. She can split her loses and be done with it. The original "charge off" will stay there and the collection that was added will not, her score should go back to 723 or so shortly and the charge off will fall off in April 2018 or so.

Only remains is will paying the charge off and zeroing out the balance have a negative affect on her credit reports/score/FICO? Anyone?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

Yep - was my error for thinking my student loan charge off tradelines were accurate. Turns out, they aren't.

Let us know if she makes any progress with OneMain, hopefully they are willing to negotiate a removal for payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

@Anonymous wrote:Yep - was my error for thinking my student loan charge off tradelines were accurate. Turns out, they aren't.

Let us know if she makes any progress with OneMain, hopefully they are willing to negotiate a removal for payment.

No problemo. Hope she does. She is just going to call EX in the early morning and back out the one dispute and modify the other based on incorrect info that makes it look like a new loan and incorrect fall off date. Then call OneMain and pay of the whole thing if they agree to bring it out of collections and remove the collections derog info. I think they will agree to that. Not asking for to remove the charge off info or anything else, just the recent going to collections derog info. Thinking that would send everything back to where it has been for years and then 12 mos from now, it all goes away. Just hoping paying off the charge off doesn't negatively impact her credit scores.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sister called with panice attack over "Account is deemed as uncollectible by the creditor&a

So heard from the sister just a bit ago. She called OneMain and got a bit of a run around and finally got connected to the Credit Dispute dept who had a some difficutly finding her records as things were a bit of mess with a new system. It appears that they are combining with another company called Springleaf financial and new account numbers are being generated and that is the reason that her CR was recently updated with that collections information (not sure how much sense/truth there is to that) and gave her a 3rd new account number that don't match any of the other ones. So now that makes her think there is a potential for another third item to pop up on her CR???

They told her to fax a letter in to dispute the account and they would open an investigation into it and it could take 30-45 days. They also gave her the number to the collections dept as well to speak with.

She then called out to EX (EX cust serv was not open at the time she was calling this morning) and got a rep who went over the two items on her report who agreed that they looked the same and transferred her to a specialist and she spoke to him who said that he saw the items in dispute and agreed and they look the same and that he would let it run its course and that One Main had 30 days to respond.

He was actually not the specialist it is assigned to as that specialist is out of the office right now, or at least that is what he told my sister. In any event, he said that if they cannot prove it was two seperate accounts at least the newer one will have to be remoed and there are additional steps that my sister can take afterwards as well, but he did not outline what they were.

She decided to go ahead and let it go this way as both reps with EX agreed that it was suspicious that both entries were the same and agreed that it needed to be looked into and that One Main needed to provide info.

She is still ready to pay the d**n bill and be done with it, but wants the collection thing removed and given how hard it was for One Main to even find that info this morning, she is wondering if they will even be able to track it down and remove it by the correct account number!! She said it took a good 2hrs on the phone this morning to get to this point and of course this is all while she is trying to work.

She tried checking her EQ report today, but of course, the system is down for her (not me, mine worked) and giving her an error and saying try again in 24hrs.

So not a lot of real progress IMO and still she is worried about potential AA by her credit cards, so she made big payments to all her cards across the board last night to bring them all down. So at the least, her UI will look good.

One thing she did find on the internet, is that while it is under dispute, EX says that none of her other credit card lenders will be able to see that disputed item in her report and her FICO score will not be affected until resolved one way or another or 30 days passes. Anyone know otherwise??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UPDATE! Sister called with panic attack over "Account is deemed as uncollectible by the creditor&a

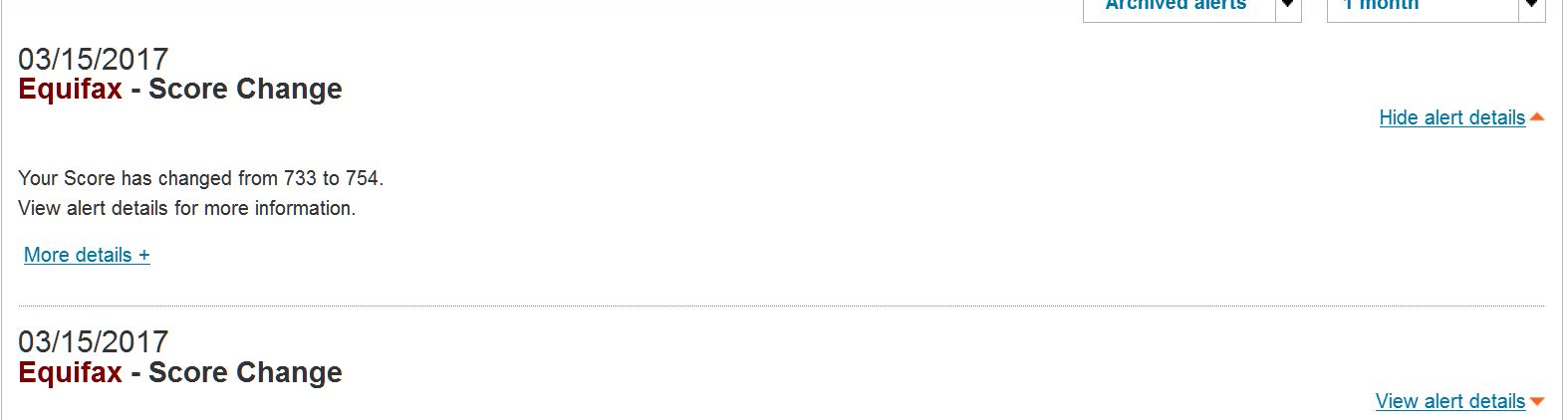

So her EX FICO score dropped another 9pts yesterday even with the collection in dispute for that error. Found out that collections in dispute are not execluded from FICO scoring like others are saying, only certain aspects. EX told her it does look like she is correct, but there are not enough data points for them to make the final decision yet and are waiting to see OMF response. She is mulling around going to consumer financial protection bureau to lodge complain against OMF on that one collection issue and screw up and then another one against EX for the same thing as she heard CFPB will move faster. Thoughts?

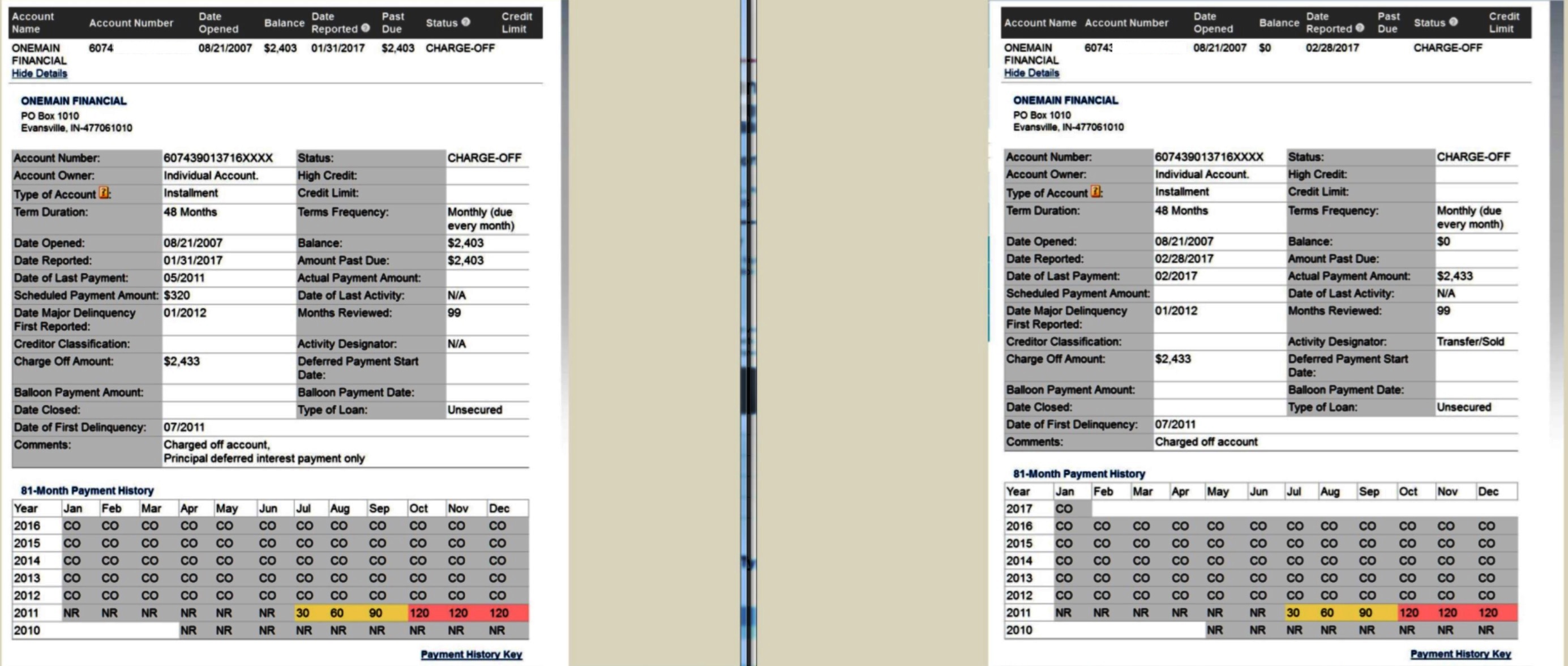

Today she got an alert about changes in her EQ credit report and logged in, now I told her that her that the score there is not a FICO score but a EQ Score Watch which is a FAKO score, but nonetheless it went up, even with the changes to her EQ credit report. And of course they are OMF. They did almost the same thing, but instead of opening another account, they just updated the current account and making it look like the last payment was 2/2017. She did a pull early this month and then another this morning after receiving alert and then side-by-side comparison. And her score, at least on EQ ScoreWatch (FAKO) went up, but nothing on MyFico..yet...but sure something will pop up in the next 24-72 hours..good or bad.

Told her not to dispute or do anything just yet and see what happens. Since she has some sort of premier paid account with EQ she can dispute and get a real person on the phone to and upload docs and plead her case, so that might help.

Start to get really pissed with OMF with this, has to be done on purpose to turn the screws on her and know they can just f**k with her.....

Left is early March 2017 pull and right is today pull. You can see where OMF updated changes in the date reported, date of last payment, balance, etc.

Thoughts anyone? Just sit back and wait and do nothing? Contacting them went nowhere...suggestion door is wide open...TIA!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATE! Sister called with panic attack over "Account is deemed as uncollectible by the cre

EQ fako excludes disputed accounts, that's the reason for the bump.

If I were her, I would ask OMF for all of this in writing and send it to the credit bureaus as evidence. You guys are probably going to have to wait this one out, but give EVERYTHING you get from OMF to the bureaus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATE! Sister called with panic attack over "Account is deemed as uncollectible by the cre

@Anonymous wrote:EQ fako excludes disputed accounts, that's the reason for the bump.

If I were her, I would ask OMF for all of this in writing and send it to the credit bureaus as evidence. You guys are probably going to have to wait this one out, but give EVERYTHING you get from OMF to the bureaus.

Ok, thing is, she has not disputed with EQ yet. So why the bump if not disputed with EQ? She only disputed with EQ so far. Nothing on TU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATE! Sister called with panic attack over "Account is deemed as uncollectible by the cre

@merlinflex wrote:

@Anonymous wrote:EQ fako excludes disputed accounts, that's the reason for the bump.

If I were her, I would ask OMF for all of this in writing and send it to the credit bureaus as evidence. You guys are probably going to have to wait this one out, but give EVERYTHING you get from OMF to the bureaus.

Ok, thing is, she has not disputed with EQ yet. So why the bump if not disputed with EQ? She only disputed with EQ so far. Nothing on TU.

Balance was updated to 0. This just supports that it was charged off and considered uncollectable.

No idea what to expect here.