- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- *UPDATED* Happy day in adulting and quick question...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

*UPDATED* Happy day in adulting and quick questions on possible score changes?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

*UPDATED* Happy day in adulting and quick questions on possible score changes?

My credit union gave me a loan today. I've posted about this previously but I'm curious as to what I should expect. FICO is a fickle and moody system. I did the right things but I hope it changes my score the right way.

I paid a 5 year, 8 month old collection for $4303 with Cach LLC. They agreed to a pay for delete but it will take 30 days to reflect it. Yes I could have waited a year and a half and had it fall off, but I'm honestly sick of looking at it and I want to get a different car (used) later in the year.

Cap One originally told me that they would do a PFD and dragged their feet on that. Instead, they said they would change a 4 year old from a settled charge off to as Paid in Full/as agreed.

I paid off a credit building loan with Avant I took out a year and a half ago. I was current but 35% interest is stupid when my score has gone up 60 points since then.

My CC utilization went from 45% to about 15% with the remaining amount of the loan. (I was wasn't worried about my CCs).

The Cach LLC was the final unattended to baddie left on my credit report.

The only thing left now is there are missed payments I can't do anything about (goodwill letters were a no) from 2015/2016. Can't do much about that at this point.

I can't figure out for my life what to expect here.

PFD: good

New loan (new line of credit): good

Changing settled charge off to paid as agreed: good...ish? But it's from 2017 so?

Paying off high interest loan (losing a line of credit): prolly bad

Even if it doesn't do anything to my score... this is a huge monkey off my back and I feel liberated.

Can anyone walk me through this so I don't have my expectations in the wrong place? I'm dying to get to the 700 club and I've been stuck at 670 for 9 months.

Will tending to these things increase my odds of CLIs with existing CCs?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

Hard to say with the information given. But, if you don't have any other collections, I think the deletion of your last collection plus the status change from Capital One could be enough to boost you over 700.

Adding the new loan could temporarily cause a small(ish) hit since it's a new account and presumably a credit pull. But I think the good outweighs the bad here and it will be a net positive when the dust settles.

I'd continue to pay down the credit cards and perhaps look into AZEO once you get them close to 0%.

First goal (December 2020): 580 (TU)

Second goal (August 2021): 670 (TU)

Current scores: 679 (TU), 665 (EQ), 658 (EX)

Current goal: All three bureaus over 670

Declined credit cards: First Premier Bank, Verve, Self, Credit One, Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

@Anonymous wrote:My credit union gave me a loan today. I've posted about this previously but I'm curious as to what I should expect. FICO is a fickle and moody system. I did the right things but I hope it changes my score the right way.

I paid a 5 year, 8 month old collection for $4303 with Cach LLC. They agreed to a pay for delete but it will take 30 days to reflect it. Yes I could have waited a year and a half and had it fall off, but I'm honestly sick of looking at it and I want to get a different car (used) later in the year. ✅

Cap One originally told me that they would do a PFD and dragged their feet on that. Instead, they said they would change a 4 year old from a settled charge off to as Paid in Full/as agreed. ✅

I paid off a credit building loan with Avant I took out a year and a half ago. I was current but 35% interest is stupid when my score has gone up 60 points since then. ✅💥

My CC utilization went from 45% to about 15% with the remaining amount of the loan. (I was wasn't worried about my CCs). ✅ 🥳

The Cach LLC was the final unattended to baddie left on my credit report.

The only thing left now is there are missed payments I can't do anything about (goodwill letters were a no) from 2015/2016. Can't do much about that at this point.✅

I can't figure out for my life what to expect here.

PFD: good

New loan (new line of credit): good ✅

Changing settled charge off to paid as agreed: good...ish? But it's from 2017 so?

Paying off high interest loan (losing a line of credit): prolly bad

Even if it doesn't do anything to my score... this is a huge monkey off my back and I feel liberated.

Can anyone walk me through this so I don't have my expectations in the wrong place? I'm dying to get to the 700 club and I've been stuck at 670 for 9 months.

Will tending to these things increase my odds of CLIs with existing CCs?

Congratulations on getting those monkeys off your back! 🥳 Feels great, doesn't it? And good job for ditching the 35% interest as soon as you were able. Very smart and financially mature of you.

That said, I'm not sure about how much each of these will be worth in terms of credit score points increase.

The large CA pay off removal, is that your final derog? If yes, it could be 30-55 points. But the Cap1 lie might diminish that. If I'm understanding you correctly, that was a neggie which now shows paid not deleted. So it may not benefit you at all in points but it does mean you can get auto and mortgage loans. Did you get the PFD agreement in writing? If yes, you have legal recourse.

While you paid off one loan at high interest, if I understood you correctly, you have another loan in there. So long as you have one loan in your mix, you're already benefiting from that and I wouldn't expect a Mix ding. The Credit Utilization reduction should yield maybe 10-15 points. You're already close to 700, so maybe fewer points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

+1 for Removal of Collection

I think you will see the biggest uptick from this final collection item being removed so that your slate is clean for this section of your report.

My experience was 25-30 point uplift back when I cleared the last collection during my rebuild. YMMV

Don't believe there would be any score impact for a change from settled to paid in full. FICO doesn't care about comments only that the balance is 0. Unsure if the status date for the account would update with the comment change which might make a small ding.

New account for loan may take few points away when it first reports but that can be offset if you have no other installment loan accounts for the credit mix.

That's what the magic eight ball has to say from my side of the fence.

Congratulations on taking charge of your situation which will continue to spawn further score growth as time passes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

Yes, this collection was my final negative item. I have been rebuilding my credit for a few years and I'm at 100% on payments, etc.

Very much hoping for the kind of boost you're talking about!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

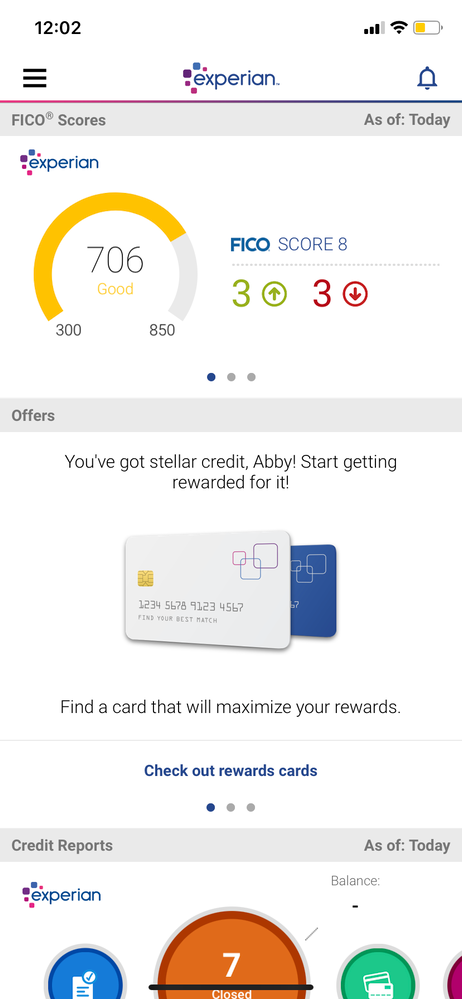

*Update*

I have been waiting on pins and needles for my scores to update.

My collection was removed! My original loan with Prosper is still showing as an outstanding chargeoff and that status hasn't updated yet.

A few more changes haven't hit yet... but I'm FINALLY in the 700 club!!!! 35 point increase!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

Congrats! Not terribly surprising to see this - a CA is next-worst to a BK and ridding yourself definitely is worth a pile of points as you have seen. Keep after those lates though, you may get lucky ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

@Anonymous wrote:Congrats! Not terribly surprising to see this - a CA is next-worst to a BK and ridding yourself definitely is worth a pile of points as you have seen. Keep after those lates though, you may get lucky

Thank you!

Will my score go up again once the original creditor changes the account status from "Derogatory" to "paid"?

I'm waiting for Cap One to update that old account notes too and see what I can do about those old late payments. If not, the lates will fall off in the next year.

I would imagine once everything updates, getting a healthy CLI will be possible on my existing CCs since the rejection reason is often that there was a collection present.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Happy day in adulting and quick questions on possible score changes?

Further update:

No idea why, but the original loan that I paid off in March completely deleted off all my reports! It wasn't supposed to fall off until October 2022!

All that's left for baddies now are 4 late payments with Capital One from 2015.