- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- UPDATED: Rebuilding credit; next steps

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UPDATED: Rebuilding credit; next steps

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding credit; next steps

I hope that your 2sday (02/22/2022, aka 2/22/22) was fantastic. And, of course, there is indeed a whole lot of "stuff" to know about this Credit game (and, to be clear, not using the term "game" in a derogatory term....I am really truly enjoying learning how credit works, from what components comprise a credit score, how many credit profiles there are and how they work, how the different Financial Institutions do busines, what "hype" is out there, what is not so clear, and and and).

This forum has been a God-send. Not only for me, but for many many many people.

Capital One is one of those Financial Institutions that is confusing. What do I mean by that?

They have a long history of being VERY forgiving. They also have a long history of "bucketing" a credit card.

This (the bucketing) would be where you qualify for a credit card with Cap1 and you find out that there is a $300 Credit Limit. This Credit Limit will either never increase or will only increase slightly after a really really long time. Usually this is a Platinum credit card.

And I totally understand and appreciate your comments about "pay it forward". I am a huge fan of "pay it forward". So, props to you for that!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding credit; next steps

@HowDoesThisAllWork wrote:

I hope that your 2sday (02/22/2022, aka 2/22/22) was fantastic. And, of course, there is indeed a whole lot of "stuff" to know about this Credit game (and, to be clear, not using the term "game" in a derogatory term....I am really truly enjoying learning how credit works, from what components comprise a credit score, how many credit profiles there are and how they work, how the different Financial Institutions do busines, what "hype" is out there, what is not so clear, and and and).

This forum has been a God-send. Not only for me, but for many many many people.

Capital One is one of those Financial Institutions that is confusing. What do I mean by that?

They have a long history of being VERY forgiving. They also have a long history of "bucketing" a credit card.

This (the bucketing) would be where you qualify for a credit card with Cap1 and you find out that there is a $300 Credit Limit. This Credit Limit will either never increase or will only increase slightly after a really really long time. Usually this is a Platinum credit card.

And I totally understand and appreciate your comments about "pay it forward". I am a huge fan of "pay it forward". So, props to you for that!

Taco Tuesday was great! It was the only Taco 2/22/22 Tuesday that we will have for a really long time!

as for Cap1, yes I agree with them being a confusing bank to do business with. I am only looking at them for to eventually get the travel card and have been trying to figure out the best path for that. But, if a better alternative comes up for a travel card, I will replace Cap1 with whatever is best at the time. My goal is 5 major and 1 store card - AmEx, Discover, NFCU Visa, Cap1 Venture, Home Depot, and a good MasterCard. I'm researching the best MC for my situation. I want to have 1 card on each network in case I have an issue with the other cards being accepted because I am planning quite a bit of international travel for the next 2 years. I have 2 out of 5 and hope to obtain 2 more cards next year around this time and then one more towards the end of 2023 to close it all out. I just opened PenFed and NFCU accounts and diverted some of my funds from USAA to those 2 banks and will be setting up auto-transfers twice a month.

These forums are really helpful and I don't think I'd be where I am without them because I had been paying a credit repair service and recently broke up with them because they we're advising me not to get a credit card and were telling me that my scores were too low to get anything at this time and that it just wasn't a good idea. I realized they were trying to keep me in a box so that I would continue to need their services, so I cut the cord and ended services.

On another note, I almost applied for a USAA card and then did some reading and found out that they are difficult and the cards just don't compare to other banks when it comes to benefits offered. I've been with USAA for about 15 years now and have 3 accounts, insurance (home & auto), and my kids and ex also have accounts, so I thought the relationship would help, but the posts I've seen on the forums indicate they don't really take relationships into account. So, I opened the NFCU account to be able to get a card with them next year and hope to use PenFed for a new auto loan when I need it in the future and if things change and I need another card. Since I have a really old truck I'm trying to cultivate the relationship long before I need to request an auto loan or a credit card.

In the meantime, I've created a spreadsheet on each bank and the credit cards I want (comparing them) and will update it once every 30-60 days so I can stay on top of things before I apply next year. I've read where some people say they apply for a new card every 6 months, but I'm afraid that may be too soon with my "Fair/Good" scores right now, so I'm thinking I will stick with a year, keep utilization low, pay on time and alternately pay off, and see how that works for me. If you run across some "must know" info, please feel free to message me.

Again, thanks a million and wishing you the best on your journey to more/better credit!

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding credit; next steps

I'm curious as to why you are ignoring Chase and embracing a Cap 1 Venture? You could knock out both your MC requirement and get a better travel card in going with a Chase Sapphire Preferred and a Freedom Flex. For the same annual fee you get better benefits from Chase and a more usable points currency. Points earned from the Freedom Flex can be transferred to the CSP. Personally the only Cap1 card that is worthwhile is a Venture X, which is a long ways off for both you and me.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding credit; next steps

@EAJuggalo this is why I love this board! You are correct about Chase. I took some time to look at the Chase products and compare them to Citi & Cap1 and agree with your assessment. I hadn't reviewed their offerings and think this may be the answer for me, but I've also learned a valuable lesson b/c I've spent the past month reading this site and checking all of the info and realized that by the time I'm ready to apply next year, there may be a better product or a revision to one that I've dismissed, so the best thing to do is wait until I'm just about ready to apply and do a comparison and check SUBs and pre-qual before I apply. Thank you so much for that nugget!

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

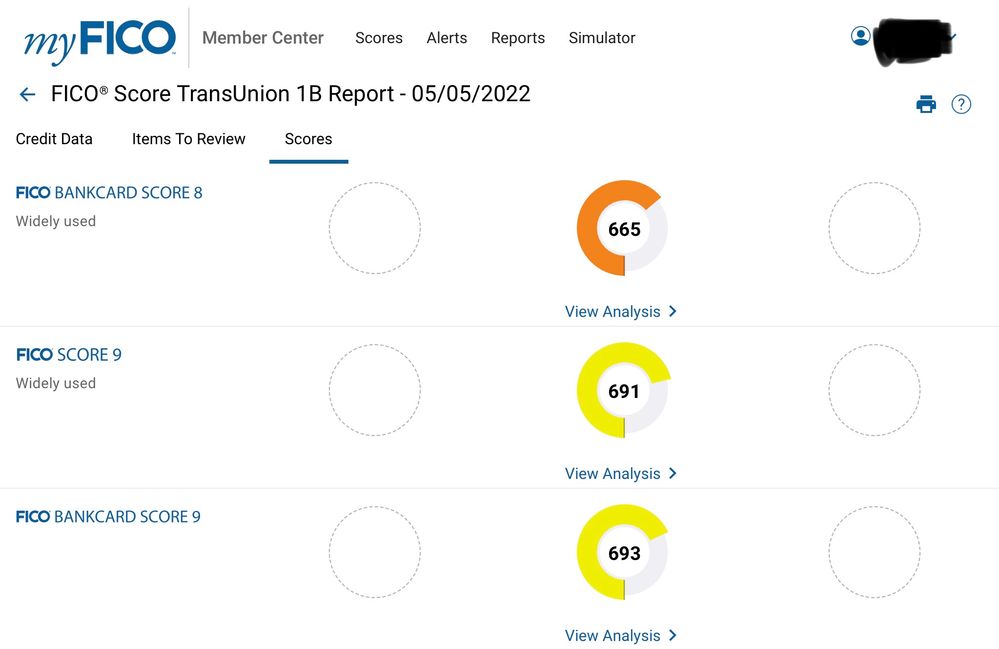

Still updating my journey everyone! Checked my TU Scores and they are not too bad based on where I started! TU Fico 9 = 691 /TU Fico 9 Bankcard = 693 / TU Fico 8 Bankcard = 665 / TU Fico 8 = 674. ![]()

![]() I'm amazed & thrilled. Just got keep on track to get to my goal.

I'm amazed & thrilled. Just got keep on track to get to my goal.

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

UPDATE - TL![]() R So, here I am 3 months after originally posting this and taking the leap to get a couple of new credit cards in my file (AmExp BCP w/$8K SL & Discover it Cash Back w/$10K SL). The good news is that the new cards and gardening are paying off. My FICO 8's dropped down to the 650's in March & 640's in April, but I'm in the 670's now (677 EX / 679 EQ / 674 TU)!!!

R So, here I am 3 months after originally posting this and taking the leap to get a couple of new credit cards in my file (AmExp BCP w/$8K SL & Discover it Cash Back w/$10K SL). The good news is that the new cards and gardening are paying off. My FICO 8's dropped down to the 650's in March & 640's in April, but I'm in the 670's now (677 EX / 679 EQ / 674 TU)!!! ![]() Also, I'm at 4% Total Utilization (I allowed my AmEx to show a balance @ statement cut and then PIF before the end of the billing period), DTI is at 22% (AmEx balance contributed to this and my mortgage went up due to a big property tax increase, so my escrow account is requiring a higher monthly payment), no more student loan baddies accumulated (I moved the bulk of my loans over to a new servicer and put them on autopay which will start whenever the Govt pause stops and the ones @ the original servicer are now actively on auto pay since they are still requiring a monthly call to keep the payments paused (too much hassle to remember to do this which is how I got those baddies last fall). I wish it would've made sense to move all my loans from the original servicer (they leave a lot to be desired - and that's putting it very kindly), but a small portion was at significantly lower interest rate below what the current rate is and it would've meant I was paying a whole lot more money. And finally, I've paid off the medical charge off ($124) as of yesterday to get it off my file now; they offered to do PFD without me asking. Wish I didn't have to pay it at all since it was a coding error according to the insurance company which is why they didn't pay it and the provider insisted they were right, which put me in the middle - I was so mad about it I walked away which was a bad idea b/c look where that got me (face palm); it was the principal of it all that bothered me. So anyway, here I am now ... I'm already feeling and looking better

Also, I'm at 4% Total Utilization (I allowed my AmEx to show a balance @ statement cut and then PIF before the end of the billing period), DTI is at 22% (AmEx balance contributed to this and my mortgage went up due to a big property tax increase, so my escrow account is requiring a higher monthly payment), no more student loan baddies accumulated (I moved the bulk of my loans over to a new servicer and put them on autopay which will start whenever the Govt pause stops and the ones @ the original servicer are now actively on auto pay since they are still requiring a monthly call to keep the payments paused (too much hassle to remember to do this which is how I got those baddies last fall). I wish it would've made sense to move all my loans from the original servicer (they leave a lot to be desired - and that's putting it very kindly), but a small portion was at significantly lower interest rate below what the current rate is and it would've meant I was paying a whole lot more money. And finally, I've paid off the medical charge off ($124) as of yesterday to get it off my file now; they offered to do PFD without me asking. Wish I didn't have to pay it at all since it was a coding error according to the insurance company which is why they didn't pay it and the provider insisted they were right, which put me in the middle - I was so mad about it I walked away which was a bad idea b/c look where that got me (face palm); it was the principal of it all that bothered me. So anyway, here I am now ... I'm already feeling and looking better ![]()

I see how the difference of positive payment history in trade lines can make in pushing a thin file with my kind of history & stats into a better scoring range. I was planning to garden until Feb of next year but am now wondering if a new trade line in July or August would be better for me. If I do make the leap, I was thinking about a card with either NFCU or PenFed. I don't think I'll be ready for Chase because I feel like I won't be qualified for the card I'd like (CSP) and I don't think they have a prequalify site (it wasn't on the thread that lists them).

I know @FireMedic1 advised me not to rush my rebuild b/c it's takes time, so I guess I need to figure out the timeliness of each next step and when to take it. I am so thankful for the feedback and info on this site BTW. So, does anyone have any thoughts or recommendations on my next steps? Thanks so much if you contribute with words of wisdom and recommendations!

TLDR: Got 2 unsecured cards in Feb., scores dipped quite a bit, scores have risen to the 670's. I'm trying to figure out the best time for me to app for my next card. Thought I would garden for 1 year, but I'm reconsidering this because I want to apply the right timing for my situation without rushing it. I have a good DTI, credit mix, low utilization and income, but my scores need to increase enough to secure the new TL's I'd like to have (1 Visa, 1 MC, and one travel card that meets my needs) so this is why I'm wondering if a year of gardening is right for me. BTW a travel card would be best as my next step b/c I have a lot of travel starting in November of this year and am basically taking 1 trip every 3 months. I know I won't qualify for most travel cards by July, but maybe there's something out there I can get if I make it to the 700's in August. So, advice is greatly appreciated!

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

***disappointment***

Was just reading the boards and saw a thread discussing that Chase requires at least 1 year of positive other card history and a score >=740 before they will consider you; especially if you don't have a banking relationship with them. I was considering apping with them for the CSP in Aug or Sept if it hit 700, but it looks like I might need to wait until Feb 2023. Pinching myself for closing the OpenSky last month even though I did it at what I thought was a strategic time (giving my new cards time to post and also avoiding the annual fee - I didn't take other new cards into consideration ... lesson learned and hope someone sees this for their journey).

Anyway, I've been reading the threads looking for DP's and it's tough b/c a lot of people don't post DP's. IDK, I'm starting to think my 1 year gardening plan may have been the right choice after all. Silver lining: this was a good exercise in credit critical thinking and reviewing my options.

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

@Binbinimiwi wrote:***disappointment***

Was just reading the boards and saw a thread discussing that Chase requires at least 1 year of positive other card history and a score >=740 before they will consider you; especially if you don't have a banking relationship with them. I was considering apping with them for the CSP in Aug or Sept if it hit 700, but it looks like I might need to wait until Feb 2023. Pinching myself for closing the OpenSky last month even though I did it at what I thought was a strategic time (giving my new cards time to post and also avoiding the annual fee - I didn't take other new cards into consideration ... lesson learned and hope someone sees this for their journey).

Anyway, I've been reading the threads looking for DP's and it's tough b/c a lot of people don't post DP's. IDK, I'm starting to think my 1 year gardening plan may have been the right choice after all. Silver lining: this was a good exercise in credit critical thinking and reviewing my options.

I don't think your score needs to be *that* high for a Chase CSP. What's more important is the 1 year history, good income, and, at least for the CSP, another credit line near, at, or above $5k. If none of your credit limits are anywhere near that, it may be tough to get approved for a CSP for that reason alone.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

@OmarGB9 Thank you for that tidbit! I have what I believe is a good income (>$100K) and both of the cards I have are $8K and $10K respectively. My only handicap at this time appear to be the newness of both accounts. So, maybe I'll try after they've been open for about 9 months ... maybe they will be a little lenient. I'll have to scour the boards to see if there are any reports about people getting in with less than 1 year of activity of another credit card. My AAOA is 11.5 years and my AOOA is 18 years, so I'm thinking maybe that will do the trick.

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UPDATED: Rebuilding credit; next steps

Apply for the Freedom Flex first, then after a few months you'd probably be eligible for a CSP. When I got my Freedom, now Freedom Flex in 2016 the only thing on my credit report was a 14 year old car loan with Chase, I had no credit score. Within a 18 months I had a Freedom Unlimited and CSP. In that time my score was never above 700. The 740 recommendation and long history is for the CSR, not the CSP.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000