- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Update: Capital Accounts, Unpaid Medical & PFD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Update: Capital Accounts, Unpaid Medical & PFD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Update: Capital Accounts, Unpaid Medical & PFD

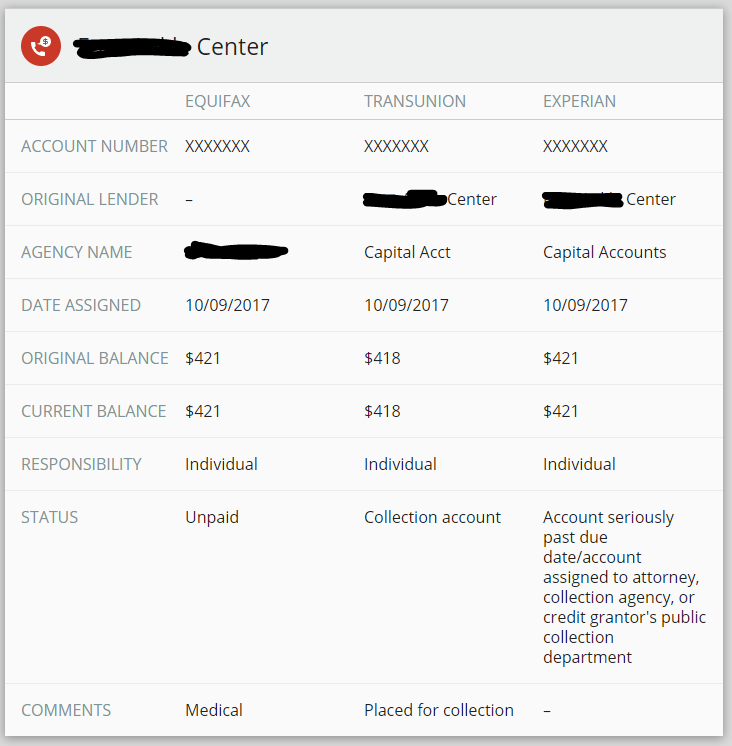

DH has an unpaid medical that we are addressing. We can PIF, but I don't exactly know how to PFD. It has been placed with Capital Accounts for collection of the debt, but his CR still has the OC as the tradeline and not reporting with Capital Accounts as the TL. Basically I can't tell if the OC still owns the debt or if Capital Accounts owns the debt.

Do we pick up the phone and call the OC? Or should we send a letter with a money order for the amount in full? I think I'm blurring the lines a bit with the hipaa method and pfd. Looking for someone to help us with advice on how to address for a better likelihood of a positive outcome.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Adding: The debt is valid and accurate, so we won't be disputing it. We have the statements so we know what the the services was for, so no DV is needed. Basically we know what the bill is for and we know it needs to be paid by us. We just need help with the approach so it is hopefully removed from his reports too.

I know the alternative is that it is paid and not removed. Paid looks better than unpaid.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

I’ve had many medical accounts removed in that exact way. But, if the OC states you need to deal with the CA then I would send a PFD letter(there are many floating around on this Forum) and see what reply you receive, if any(?) OR you can just call CA if you are ready to pay and ask if they will PFD...I’ve done it that way as well. It’s a 50/50 either way you go BUT, medical accounts are pretty easy to have removed. Also, if and when it is PAID, you can go the HIPAA route to have it removed once paid. ETA: If all the above fail.

Good Luck

😊

Goal Score: 600(within a year)**MET MY GOAL** | Goal Score: 700**MET MY GOAL** | Goal score: 800

Take the myFICO Fitness Challenge

I❤️NY

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Thanks! I've been digging on the forums and sifting through tons of posts just like mine. I appreciate the input! I have been leaning to have DH call the OC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Before you do anything google the HIPAA Letter Process follow it exactly as laid out. If you have problems finding the website or any questions PM me.

@radfam wrote:Thanks! I've been digging on the forums and sifting through tons of posts just like mine. I appreciate the input! I have been leaning to have DH call the OC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

There are two approaches, both of which could result in removal of the collection.

First, since only the party who reported a collection can thereafter report its deletion to the CRA, the direct approach is to offer a pay for deletion to the reporting debt collector. If they accept, you both discharge the debt and have a contract agreement that the debt collector will report deletion of their collection.

That is the direct approach, and does not require any contact with the creditor. It can be used regardless of whether the creditor still owns the debt.

The second approach is more indirect, and involves contacting the original creditor and requesting to make payment directly to them.

If you simply pay the original creditor, there is no associated requirement that the debt collector must delete their reported collection. They are only required to update the collection to show paid, closed, $0 balance.

However, CRA reporting procedures, as set forth in the common credit reporting manual used by the big-3 CRAs, requires debt collectors to delete their reported collection if their collection authority is teminated with the debt remaining unpaid. That is only CRA reporting policy, and is not required under either the FCRA or any federal regulations.

Thus, the second and indirect approach is to contact the creditor and offer to pay provided they first terminate their assigned collection authority to the reporting debt collector. That will then, as a matter of compliance with CRA policy, mandate reporting of deletion by the debt collector.

That, or course, requires that the creditor still owns the debt, and thus the debt collector only has assigned collection authority.

If the creditor has sold the debt to the debt collector, then the second procedure no longer applies.

The rub with the indirect process of first getting the creditor to terminate their reporting agreement is that they may not wish to do so, as they usually hire a debt collector because the dont wish to be involved with the hassle of attempting to collect on delinquent debts.

Additionally, even if you persuade the creditor to first terminate their assignment of collection authority, that does not immediately ensure that the debt collector will report deletion of their collection. They may refuse, or may delay.

I would recommend first atttempting to obtain a PFD from the debt collector, as it is more direct and binding.

If that fails, they the fallback is to attempt the more indirect procedure of offering to pay the creditor with their agreement to first teminate assignment of collection authority to the debt collector.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Update: DH called the agency assigned to collect the debt. The collection agency is Captial Accounts. They agreed to a PFD and sent a letter via email to confirm that they are requesting expungement from the CRAs now that it was PIF. Posting an update in case anyone searching for them in the future on the forums. I only saw one or two other posts about them when I searched for them myself.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Goal Score: 600(within a year)**MET MY GOAL** | Goal Score: 700**MET MY GOAL** | Goal score: 800

Take the myFICO Fitness Challenge

I❤️NY

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Unpaid Medical, PFD?

Thanks! One step closer in the rebuild process!