- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Student Loan Collections Are Haunting Me: Hall...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

*Updated* Advice Needed! College Collection is Haunting Me

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

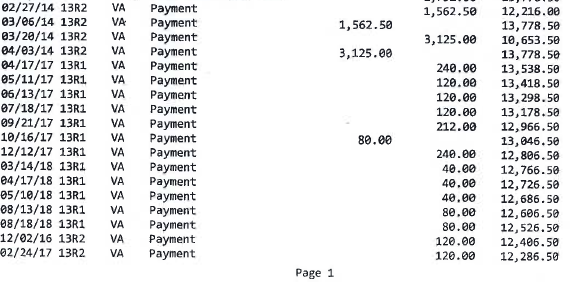

There is a payment/ credit that says transfer from '13 R1 to R2. Where is the money coming from that it is being transferred from the Fall to the Spring that it doesn't show up already and you still have a balance for the Fall?

Second, the last four lines state they are a description of "payment" however I notice first you are credited with the amount, then you are booked for the exact same amount negating the payment. Do you know why this is (maybe it simply bounced or is it more complicated?).

I agree with dynamicvb. They did have covered the remaining balance in your financial aid package though loans. I'm not sure it's something you can fight at this point though; an appeal or something would probably have to have been done then. Unfortunately, Dept of Education's helpfulness can often end after writing the check for a debt that kids that young have yet to understand the magnitude of.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

@dynamicvb wrote:Okay, I went back and read your invoice better. So you had loans but did not have enough to cover all the fees or you did not pay them and the balance carried over. I don't understand why the school let you do this. So are these the only two terms you attended. Fall of 2013 and Spring of 14? Did you complete at least 60% of spring before dropping out?

It sounds like you should have been offered a lot more than you got in loans as since you where pell eligible it was definitely you did not have family contributions to make up the balance. Regardless you did not have enough in aid and loans to cover the first term tuition. I'm suprised they let you registered for the second term unless you had agreed to some sort of payment plan.

Are the federal loans still in deferment or are you paying them too?

These are different pots so you owe them both. It sounds to me like you got some really crappy advice from the Finaid counselor you talked to originally at the school.

Yes I think that is the name "Federal William D. Ford Direct loans" and no I did not graduate. Also I dropped out of college there. One year at a previous college (two semesters) and the one year at the college that I'm currently in collections with (two semesters).

The loans from my previous college that I am current on and pay for monthly are called "DIRECT STAFFORD" loans. I havent had any issues with them. Now as for the loans in the document I added in my initial post they did not show up in @National Student Loan Database (NSLDS) that @Anonymous had mentioned tracks all of my loans. The only thing that shows up is the pell grant, but thats not the issue at hand. So the Ford subsidized/unsubsidied isnt on on my record. Which leads me to think it was kicked back to the university and now I'm having to pay. for.![]()

Thats just my guess, I have very little to go off on execpt for what i have in that sheet above.

The fact that you havent seen this before is worrisome to me, feeling like im up S*** creek without a paddle. ![]()

I dont know why the school allowed it either I was 19 at the time most 19 year olds i knew weren’t astute financial scholars who understood loans and whether I was covered. All I knew was i signed the loans and it allowed me to go to college and I'd pay it back later when I get started on my career. Also I finished both the fall and the spring semester so thats what confused me it was summer time and i knew I wasnt going back to finish sadly. So I'd think i completed 60%+ of that semester, lets go with 100% lol.

I never thought that the loans that I did have would'nt cover the overall amount, I figured that was the reason why I had gotten the loans in the first place oddly enough. I recieved pell grants, I'm not sure what that should of meant in regards with more loans to cover but I know I got them per the document.

I'm paying my federal loans and they are current (from frior school) no lates or anything.

And to finish YES I'd presume I got very crappy advice. These people barely cared at all I remember the counselor's just being glad to get you into classes and out of their face. i thought college was gonna be differnt and they'd sit you down and talk it out or something. Buuut thats not how the world works so here I am.

Thank you for the reply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

@Anonymous wrote:

Two additional questions:

There is a payment/ credit that says transfer from '13 R1 to R2. Where is the money coming from that it is being transferred from the Fall to the Spring that it doesn't show up already and you still have a balance for the Fall?

Second, the last four lines state they are a description of "payment" however I notice first you are credited with the amount, then you are booked for the exact same amount negating the payment. Do you know why this is (maybe it simply bounced or is it more complicated?).

I agree with dynamicvb. They did have covered the remaining balance in your financial aid package though loans. I'm not sure it's something you can fight at this point though; an appeal or something would probably have to have been done then. Unfortunately, Dept of Education's helpfulness can often end after writing the check for a debt that kids that young have yet to understand the magnitude of.

@Anonymous the part that says "XFER from 13R2 to 13R1" your guess is as good as mine what I have shown you is ALL of the documentation that I've ever recieved in regards to the break down of my balance. Stuff like that doesn't even make sense to me, the fact of money moving back and forth. Some of it out of thin air it seems ![]()

As for that payment portion at the bottom that is cut off is the payments from the collection company. My educated guess is that the $1,562.50 & $3,125.00 is all the fee for my account going into collections. I'm just realizing right now that that may be what that is because I've been confused the whole while as to where that money has come from. The bottom of the sheet is very disorganized jumping from payments od 2018 to 2016 back to 2017, all it is is my payments that i have sent to the collections to pay my balance.

That really sucks that it may be too late to remedy this situation.... Anyway thank you for your input it's pretty rough trying to get fully underneath this. This myfico forum has a wealth of people who has gone through stuff like this. Just wanted to see if there is any way to make this right.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

I would definitely ask about those four transactions from the first picture though. They credit you with a payment then take it back. That's over $4500. My guess would be that's toward the school because in '14 you were still in school. Your loans were in deferment.

I've been doing some more reading on this and I definitely think those school debts are just a regular debt subject to the SOL, etc. I would give them something if you can but I would really focus on those loans.

You are in the perfect position to fix this if they are defaulted and hopefully they haven't garnished your wages (this will be the next step. They do not need to sue you to do this as they are federal loans). Go ahead and rehab or consolidate now. This will put your back in God standing, removing the default status (rehab only), allow you better payment plans, and raise your credit score. Another reason to focus on the Federal loans is the interest rate. On Income-driven repayment plans the gov will pay a portion of your subsidized loans interest rate. After your done with rehab you'll be left with only the much smaller school debt in collections.

In fact, if it were me, I would contact the collection agency (only the one listed on the NSLDS) today and start the paperwork to rehab (or consolidate). It's easy.

When you're ready to pay off the university debt, I read a post on here how someone was able to negotiate with the school directly to have them paid in full with the collection fees removed. That had to paid in 60 days though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

@Anonymous wrote:

Yeah, once this stuff is years old like the student loans are it can be hard to understand without talking to the school. Then what's the point...you owe it, so it seems like a waste of energy.

I would definitely ask about those four transactions from the first picture though. They credit you with a payment then take it back. That's over $4500. My guess would be that's toward the school because in '14 you were still in school. Your loans were in deferment.

I've been doing some more reading on this and I definitely think those school debts are just a regular debt subject to the SOL, etc. I would give them something if you can but I would really focus on those loans.

You are in the perfect position to fix this if they are defaulted and hopefully they haven't garnished your wages (this will be the next step. They do not need to sue you to do this as they are federal loans). Go ahead and rehab or consolidate now. This will put your back in God standing, removing the default status (rehab only), allow you better payment plans, and raise your credit score. Another reason to focus on the Federal loans is the interest rate. On Income-driven repayment plans the gov will pay a portion of your subsidized loans interest rate. After your done with rehab you'll be left with only the much smaller school debt in collections.

In fact, if it were me, I would contact the collection agency (only the one listed on the NSLDS) today and start the paperwork to rehab (or consolidate). It's easy.

When you're ready to pay off the university debt, I read a post on here how someone was able to negotiate with the school directly to have them paid in full with the collection fees removed. That had to paid in 60 days though.

How can I do that if the collection agency isn’t even listed on the NSLDS? The only loans that are on the site are from my first year in college and that’s not the one I have issues with. Unless you’re saying through rehabbing that one I can mix that with my collection and have it both rehabed?

Can you elaborate which one you’re talking about consolation or rehab. I feel like I’m close to a solution here but my brain isn’t putting the square block in the square hole ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

If it's a private loan those have different rules.

EDIT: Oops, so I'm re-reading it. You said your loans were in forbearance and then they went to collections. Is this included in the $15k in your post or is that amount all owed to the school?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

@Anonymous wrote:

The only loans you listed in the picture are from '13 to '14. Those are federal loans so they would be listed on the NSLDS. If those are in a good status and those aren't the loans, what loans is in collections?

If it's a private loan those have different rules.

EDIT: Oops, so I'm re-reading it. You said your loans were in forbearance and then they went to collections. Is this included in the $15k in your post or is that amount all owed to the school?

Yes and no.

i put my Stanford loans from my first year of college at another school into forbarence then I started paying them so I’m current right now.

As for the collections that is my second year of college which was at another school. That is what this whole thread/post is about and that is the 15k in collection debt. That is the one that has the ford loan in it. But when I pay the school/collection they don’t say a percentage goes to this or that it just goes to the “collection balance”. I know it’s weird to understand. It’s my balance with them and I only just recently got a hold on the situation. None of the collection or the ford loan showed up in the NSLDS website. So my guess is it’s all wrapped into one school debt that is my collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

I assumed the Ford Loan was a William D. Ford Federal Direct Loan. What type of loan is it?

The NSLDS will only list your federal loans, Pell grants, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

@Anonymous wrote:

Okay, that makes so much more sense.

I assumed the Ford Loan was a William D. Ford Federal Direct Loan. What type of loan is it?

The NSLDS will only list your federal loans, Pell grants, etc.

Thats the conundrum now isn’t it.

![]()

I can’t figure it out, I don’t want to call the school and start asking too many questions without a point of action. It may prompt them to want to come for it all. All I know is even when I would talk to education “refinance” lenders about the balance they wouldn’t touch it because it’s not federal or gov loans anymore even if it was. Now it just is a “owed amount of money to the school”.

But on the paper it says Ford so it might be but again it doesn’t show up on the NSDLS site like my other good loans and pell grants therefore it’s just another chunck of change in my school debt collection.

Just my interpretation though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan Collections Are Haunting Me: Halloween Special

even with loans that are from the '80s and '90s.

What about the studentloan.gov or studentaid.gov site? I know what you mean about not wanting to poke the bear. It might be necessary though because if these are federal loans you can do something.

It's not so old that they shouldn't easily be able to fulfill a request for a copy of the Promissory Note. And you should be able to discuss with the school, although I would be careful about admitting the debt is accurately yours or admitting that you owe the money.

The reason I brought up the part about those four "payment"s is if you can discuss this with the school and find out what it means, maybe they weren't supposed to be reversed. This would wipe $4500+ off the debt if it were a lucky error. 😁