- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Upgrades and account closure question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upgrades and account closure question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upgrades and account closure question

Hello everyone! I just spent the last hour searching and reading posts on the forums here regarding upgrading credit cards and closing accounts. I have a general sense of the process but I wanted to make a post and get some feedback to make sure I am doing things correctly or if anyone had some insight that I may have overlooked.

I filed for Ch7 BK in March of this year, and was discharged I believe in June. At the time of my BK my FICO was around 512. After my discharge I was quite surprised that my score was shooting up, sometimes in excess of 50+ points each update. I knew I could not get approved for an unsecured card, so I got an open Sky secured card with a $500 limit. This seemed to really kick start my rebuild and I soon started getting preapprovals around August. I had never previously had a credit card in my life, but I knew that captial one was a good starter / rebuild card after BK so I kept my eye out. Almost immediatly in August I got a pre approval for the Cap1 Quicksilver card and I was really impressed there was no AF and the 1.5% cashback on everything seemed really good for someone who was rebuilding, so I applied. I was approved and issued a quicksilver card with a 3k CL. Around the same time I also applied for another zero AF card from Mission lane and recieved a 1.5k CL. So that put me at 3 cards with a total line of credit at 6k.

Fast forward to now. My FICO's are hovering just around 700, I cant seem to break that. My highest is 698 and my lowest (TU) is 677. I feel that at this point the $500 CL secured OpenSky card has served its purpose but since this card cannot be upgraded to an Unsecured card and the line cannot increase, then the smart thing to do would be to close this card since it included a $35 AF. I searched the forums on this and typically I see that closing accounts are bad, but thats due to age. This one is only a few months old so I should be ok to close it correct?

I also would very much like to increase my total line of credit, and I have read a few threads on this and see that I should wait until 60 days? is this from when I opened the account, or when my first statement was? I cant seem to find guidance on timing so please forgive me if ive overlooked that in my search. I also dont know if its best to call and ask for a line increase, or to use the method of "upgrading", as I am a little confused if this means upgrading my credit line or to a new card with a higher limit, so any clarification or advice here would be very much appreciated!

Lastly, thank you all for taking the time to read my post and for any help or insight you can provide. I have found these forums to be immensly helpful and am happy to be here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

Loans:

Revolving Accounts (in the order they were opened):

Closed accounts:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

Ahhh thats good to know, thank you! I had no idea accounts age while closed!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

If you wanted another card instead of waiting for a CLI, you can sign up for Credit Karma ow Wallet Hub (or both) and they will match you up with cards that fit your profile. A good one to get an invite for is the Ollo card which is currently (AFAIK) still invitation only and you can have it show up in the CK site to allow you to apply. Just watch out for the more predatory cards that CK pushes because there are a lot of those, you need to weed through the offers and make sure to apply for only the ones that would benefit you. CK is where I got both my Ollo and my Mission Lane from and I believe that Experian (the free version of their site) is where I got my Mercury card from.

Loans:

Revolving Accounts (in the order they were opened):

Closed accounts:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

Welcome to My Fico Forums, @rosco75 and congrats on your successes so far in rebuilding!

That Quicksilver with no AF and 1.5% cash back is a great card for you at this point. With Capital One, you can get a CLI once every 180 days. The date to remember is your last successful CLI date, not the last date you requested one. While you can ask multiple times per month, there's no point in asking too often and it might make you appear desperate, so I'd recommend trying for one only every couple of months after you believe your profile and spending may justify an increase. Capital One's CLI process is 100% automated and you do it via their app or website. It's a soft pull, so no harm in asking. You'll get an immediate decision. Successful CLI's with Capital One are HIGHLY dependent on moderate to heavy use of existing credit limit. Data points have shown you need to spend at least 45% of the CL (over a few months immediately before a request) to get an increase, so right now, you'd be shooting to consistently use the card and ask for a CLI after spending at least $1500. Of course, that number goes up as they raise your limit. Some Capital One cards don't grow if they are "bucketed" with a low limit approval, but yours appears to be a prime card with a $3K limit. It will likely grow, albeit slowly, with steady usage.

If the Open Sky card with the $35 AF has no monthly or maintenance fees, I'd be in no hurry to close it this year. *BTW, did you know that Capital One issues the Open Sky card, so there may have been a connection to your getting an offer on the Quicksilver? (ETA: This was incorrect, as caught by @OmarGB9 below.) Some lenders will refund a prorated portion of an AF, but I doubt you'd get a refund on the Open Sky fee. While I disdain paying fees, yours is a situation where it may have been the smart thing to do. Especially if the AF is not refundable, you could just keep the card in the sock drawer until the AF posts next summer before closing it. That would give you time to maybe add one more mainstream card sometime this winter or next spring to replace it, leaving you with three open cards the entire time. Three open and active reporting cards is supposedly the minimum for optimizing your FICO scores. But yes, absolutely, if you have better cards, don't continue to pay an AF or monthly fee to keep a secured or low limit starter card open.

It's true that cards will normally stay on your credit report for up to ten years, but there isn't a guarantee or industry standard on that. It's purely up to that lender. I've had lenders stop reporting quickly and others continue longer than the ten year point, so it can vary. As long as the closed card stays on the report, though, it does contribute to credit age. This is another reason I'd consider letting it age until the AF comes due next June (?) and then close it.

As for next card/lender recommendations, you have three cards: one secured; one prime $3K with 1.5% cash back, and one store store. Some people in your situation apply for more store cards since they often have more lenient approvals, but I'd suggest not doing that. Keeping store cards as a minority part of your card lineup is a good strategy. Regular bank cards have wider acceptance (out of store), focus more on cash back rewards instead of store credits, and will often grow much better than store cards. Discover is another major bank that is kinder to rebuild profiles, and so is Navy Federal Credit Union. Picking the right lenders and the right cards is important as you grow your profile.

I would highly suggest you use the resources on My Fico and feedback from the community to target your next cards instead of relying on commercial sites such as Credit Karma or others. Their "matches" are purely marketing and they get paid when you click on their card recommendations. I'd even had them give me ridiculous recommendations such as the same cards I already have or starter cards even though my profile is stronger. ![]()

"Upgrading" a card is usually meant as a "PC" or "product-change" from one card type to another. For example, with Capital One, you could have a "Platinum" Visa that has no rewards, a "Quicksilver" Visa that pays 1.5% rewards, or on the higher end cards with them, the "Venture" or "Savor" cards that offer even higher rewards in certain categories, albeit with an Annual Fee. The "upgrade" term has to do with card product, not the credit limit itself. Product changes allow you to convert one card into a different product without incurring additional hard credit pulls or adding a "new account" to your report. The donor card keeps the original age but the card features are changed into the new card.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

Thank you very much @Aim_High that is a lot of helpful information, it is very much apprciated!

I had no idea capital one manages the OpenSky card. I tried to apply for the Cap1 platinum card after getting a preapproval but I guess you cannot get another card with them shortly after getting approved for one, so because I had the quicksilver one I got denied.

I wish I read your response earlier, as I just happened to get off the phone with OpenSky closing that card. I just felt like if I had tossed the card in a drawer, then the $35 fee would hit and I would forget and miss a payment. I have worked so hard repairing my credit to this point that I am deeply afraid of missing a payment. So much so that I pay all of my bills the 1st week of the month reguardless of actually due dates. I have to actually force myself to keep a small balance on one card for the AZEO recommended practice of utilization.

I felt like 3 cards was the sweet spot, so once I get a third card I will be done. But my credit profile says I have a thin credit profile and reccomends 5 revolving accounts. Someone suggested I take out a SSL or any kind of personal loan to round out my profile, but Im scared to death of loans. Would it be better to just have my 1 car loan, and 4 credit cards? Or would 1 auto loan + 3 credit cards + 1 personal loan be best?

Very interesting reading on the "upgrades" and I look forward to being able to take advantage of such a thing in time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

You have to wait 6 months before you can app again with Cappy. You have a auto loan and dont need any other loans. Spread out your apps. Dont rush it because of the word "thin". You can try for the Ollo on CK. Their website wants invitation codes to apply. But ignore sites that say your odds are good or excellent. That includes MyFICO. Even bank sites will say your good and then get denied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

@Aim_High wrote:Welcome to My Fico Forums, @rosco75 and congrats on your successes so far in rebuilding!

That Quicksilver with no AF and 1.5% cash back is a great card for you at this point. With Capital One, you can get a CLI once every 180 days. The date to remember is your last successful CLI date, not the last date you requested one. While you can ask multiple times per month, there's no point in asking too often and it might make you appear desperate, so I'd recommend trying for one only every couple of months after you believe your profile and spending may justify an increase. Capital One's CLI process is 100% automated and you do it via their app or website. It's a soft pull, so no harm in asking. You'll get an immediate decision. Successful CLI's with Capital One are HIGHLY dependent on moderate to heavy use of existing credit limit. Data points have shown you need to spend at least 45% of the CL (over a few months immediately before a request) to get an increase, so right now, you'd be shooting to consistently use the card and ask for a CLI after spending at least $1500. Of course, that number goes up as they raise your limit. Some Capital One cards don't grow if they are "bucketed" with a low limit approval, but yours appears to be a prime card with a $3K limit. It will likely grow, albeit slowly, with steady usage.

If the Open Sky card with the $35 AF has no monthly or maintenance fees, I'd be in no hurry to close it this year. *BTW, did you know that Capital One issues the Open Sky card, so there may have been a connection to your getting an offer on the Quicksilver?

Eh??? Capital One does NOT manage Open Sky.

Capital Bank, which is not the same as Capital *One* Bank does.

https://www.capitalbankmd.com/

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

@OmarGB9 wrote:

@Aim_High wrote:*BTW, did you know that Capital One issues the Open Sky card, so there may have been a connection to your getting an offer on the Quicksilver?

Eh??? Capital One does NOT manage Open Sky.

Capital Bank, which is not the same as Capital *One* Bank does.

https://www.capitalbankmd.com/

You are correct, Sir, and thanks for the catch! I saw "Capital Bank" in their fine print and my mind just wanted to insert that "ONE" since I'm used to seeing it! (Hmmm ... do you think they mean for it to be confusing? Nah .... ) ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrades and account closure question

I took the advice and Applied for the Ollo card and was approved for a 1k CL. Its been days and the HP has hit my reports but oddly enough it was only a 1 point ding and otherwise didnt really effect me the way I assumed it would.

This puts me at 1 installment auto loan and 3 revolving credit card accounts with a combined CL of $5.5k

I have a Quicksilver cap1 card that I use regularly and pay it off twice a month down to zero while using it so theres always a small balance around />150 bucks. The Mission lane card I basically keep in a sock drawer and only use it every now and then to keep it active but pay it off immediatly after using it. I will be doing the same with the Ollo card. None of these cards have an AF.

My current FICO scores are (and I have no idea which one should be listed as the defualt one - bankcard or mortage?): 667(TU) / 679 (EX) / 697 (EQ)

I believe my TU score dipped because I made a newbie mistake and disputed something online and updated it which caused a 20 point drop.

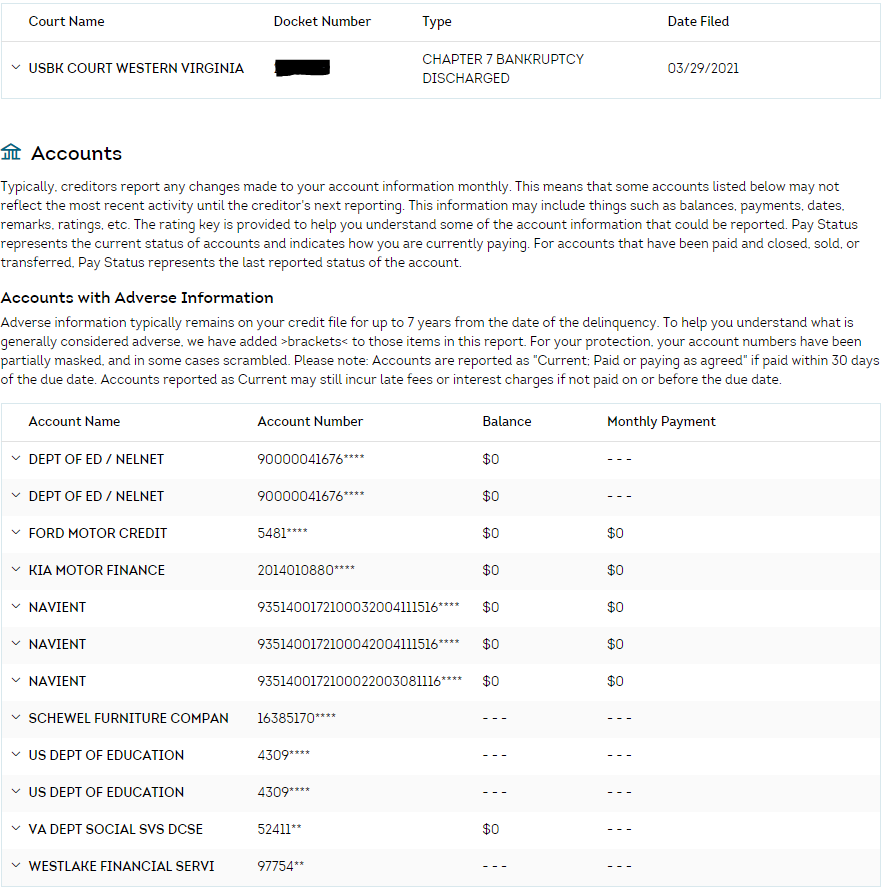

Here is whats left of my adverse tradelines:

As you can see most of these are student loans. Ford has 3 30 day lates which I have sent a goodwill letter to asking for them to remove. The account is paid off in full. The KIA was an auto loan that I co signed for an ex girlfriend (big mistake yes I know) who got a few lates and a repo ![]() I have asked them to please remove those as its been paid off in full as well. Schwell and westlake were accounts that were IIB. The VA dept of social services is something that I have no idea how it got there or why its listing as a charge off. Its from when I went to court for custody of my son and started paying child support. I have paid my support since day 1 and never missed a single month, so I have no idea why its reporting that way.

I have asked them to please remove those as its been paid off in full as well. Schwell and westlake were accounts that were IIB. The VA dept of social services is something that I have no idea how it got there or why its listing as a charge off. Its from when I went to court for custody of my son and started paying child support. I have paid my support since day 1 and never missed a single month, so I have no idea why its reporting that way.

My current rebuild project is to do something about the student loans, which I recieved a TDP discharge for a few months ago. Im waiting to see if the discharge will eventually reflect in the reports, which its supposed to.

EDIT: Looking up how to get screenshots to embedd.