- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Wage Garnishment on Old Chase Account

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Wage Garnishment on Old Chase Account

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

@Cowboys4Life wrote:

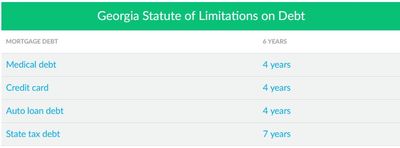

@FireMedic1 wrote:Kinda strange "the debt" isnt on your reports. CO's stay for 7 yrs. But then a judge signed the WG. Were you served any papers from the court? The SOL is 4 yrs in GA. After that they cant sue. So it had to be within that timeframe.

The SOL in GA is 6 years on credit card debt and written contracts. The SOL expiring does NOT mean that a creditor can't sue. They most certainly CAN. It simply means the defendant has a gold plated defense to the claim but it is not automatic. They must invoke that defense to be protected by it.

"In Georgia, written contracts have a statute of limitations period of 6 years from the time in which the debt becomes due and payable and the period runs from the date of last payment (OCGA 9-3-24). On the contrary an open account, implied promise or undertaking has a statute of limitation of only 4 years (OCGA 9-3-25). Prior to entering into an agreement to pay off a debt, a consumer should ensure the debt is actually still due and payable."

Its all over the place on so many sites @Cowboys4Life

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

@FireMedic1 wrote:

@Cowboys4Life wrote:

@FireMedic1 wrote:Kinda strange "the debt" isnt on your reports. CO's stay for 7 yrs. But then a judge signed the WG. Were you served any papers from the court? The SOL is 4 yrs in GA. After that they cant sue. So it had to be within that timeframe.

The SOL in GA is 6 years on credit card debt and written contracts. The SOL expiring does NOT mean that a creditor can't sue. They most certainly CAN. It simply means the defendant has a gold plated defense to the claim but it is not automatic. They must invoke that defense to be protected by it.

"In Georgia, written contracts have a statute of limitations period of 6 years from the time in which the debt becomes due and payable and the period runs from the date of last payment (OCGA 9-3-24). On the contrary an open account, implied promise or undertaking has a statute of limitation of only 4 years (OCGA 9-3-25). Prior to entering into an agreement to pay off a debt, a consumer should ensure the debt is actually still due and payable."

Its all over the place on so many sites @Cowboys4Life

I lived in Georgia for 17 years and used Magistrate Court 3 times. Those sites can say what they want but my direct experience is the courts go by the 6 year SOL. The majority of debt collection suits filed are breach of contract not account stated to use the 6 year statute. I can't recall any debt collection case being dismissed under an SOL defense based on 4 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

Unfortunately, GA courts have ruled that use and acceptance of a credit card creates a contract subject to the 6-year SOL. See Hill v. American Express, 289 Ga. App. 576, 578(2), 657 S.E.2d 547 (2008) (citing Davis v. Discover Bank, 277 Ga.App. 864, 865, 627 S.E.2d 819 (2006)). In both Hill and Davis, copies of the card member agreements were provided, so that may be necessary in a breach of contract claim for a credit card debt.

"This is not an action on an open account.

[A] contract was effected in this case when the plaintiff issued its credit card to the defendant to be accepted by [him] in accordance with the terms and conditions therein set forth, or at [his] option to be rejected by [him]. Such rejection need take the form of returning the card, or simply its non-use. The issuance of the card to the defendant amounted to a mere offer on plaintiff's part, and the contract became entire when defendant retained the card and thereafter made use of it. The card itself then constituted a formal and binding contract."

"We also reject Hill's contention that OCGA § 9-3-25 applies in this case because he did not sign the contract. Because this was a written contract, the form of Hill's acceptance is immaterial and the provisions of OCGA § 9-3-24 governing contracts in writing apply."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

@Cowboys4Life wrote:

@FireMedic1 wrote:

@Cowboys4Life wrote:

@FireMedic1 wrote:Kinda strange "the debt" isnt on your reports. CO's stay for 7 yrs. But then a judge signed the WG. Were you served any papers from the court? The SOL is 4 yrs in GA. After that they cant sue. So it had to be within that timeframe.

The SOL in GA is 6 years on credit card debt and written contracts. The SOL expiring does NOT mean that a creditor can't sue. They most certainly CAN. It simply means the defendant has a gold plated defense to the claim but it is not automatic. They must invoke that defense to be protected by it.

"In Georgia, written contracts have a statute of limitations period of 6 years from the time in which the debt becomes due and payable and the period runs from the date of last payment (OCGA 9-3-24). On the contrary an open account, implied promise or undertaking has a statute of limitation of only 4 years (OCGA 9-3-25). Prior to entering into an agreement to pay off a debt, a consumer should ensure the debt is actually still due and payable."

Its all over the place on so many sites @Cowboys4Life

I lived in Georgia for 17 years and used Magistrate Court 3 times. Those sites can say what they want but my direct experience is the courts go by the 6 year SOL. The majority of debt collection suits filed are breach of contract not account stated to use the 6 year statute. I can't recall any debt collection case being dismissed under an SOL defense based on 4 years.

Thats cool. I just looked up some info and thats what I found. Thats all man. Either way its still a court judgement and that can go on for a long time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

Alright guys point made. Just trying to help a poster and looked at the wrong sites. One says 4 one 6. No halo over my head.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

I really wasn't trying to belabor the point, @FireMedic1 . I just thought that court rulings might help with the issue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

@FireMedic1 wrote:

@Cowboys4Life wrote:

@FireMedic1 wrote:

@Cowboys4Life wrote:

@FireMedic1 wrote:Kinda strange "the debt" isnt on your reports. CO's stay for 7 yrs. But then a judge signed the WG. Were you served any papers from the court? The SOL is 4 yrs in GA. After that they cant sue. So it had to be within that timeframe.

The SOL in GA is 6 years on credit card debt and written contracts. The SOL expiring does NOT mean that a creditor can't sue. They most certainly CAN. It simply means the defendant has a gold plated defense to the claim but it is not automatic. They must invoke that defense to be protected by it.

"In Georgia, written contracts have a statute of limitations period of 6 years from the time in which the debt becomes due and payable and the period runs from the date of last payment (OCGA 9-3-24). On the contrary an open account, implied promise or undertaking has a statute of limitation of only 4 years (OCGA 9-3-25). Prior to entering into an agreement to pay off a debt, a consumer should ensure the debt is actually still due and payable."

Its all over the place on so many sites @Cowboys4Life

I lived in Georgia for 17 years and used Magistrate Court 3 times. Those sites can say what they want but my direct experience is the courts go by the 6 year SOL. The majority of debt collection suits filed are breach of contract not account stated to use the 6 year statute. I can't recall any debt collection case being dismissed under an SOL defense based on 4 years.

Thats cool. I just looked up some info and thats what I found. Thats all man. Either way its still a court judgement and that can go on for a long time.

Unfortunately a LOT of these sites haven't been updated in a long time or worse go off just what they read in the statutes which is not how the courts are applying the law(s). One area in GA that changed big time almost 10 years ago is the business records exemption laws. Under the Freddy Hanna scurge (now closed and repurposed into a new "firm") the laws regarding business records were really watered down and now it takes next to nothing to prevail in a case.

As for judgments they are good for 5 years in GA but can be renewed indefinitely and that includes reviving a dormant judgment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wage Garnishment on Old Chase Account

If you have filed a BK since they got the judgment and it was discharged then you need to have it vacated based on the BK. It was discharged even though it may not have been included in your schedules.