- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Wellsfargo chargeoff paid but reporting FP

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Wellsfargo chargeoff paid but reporting FP

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wellsfargo chargeoff paid but reporting FP

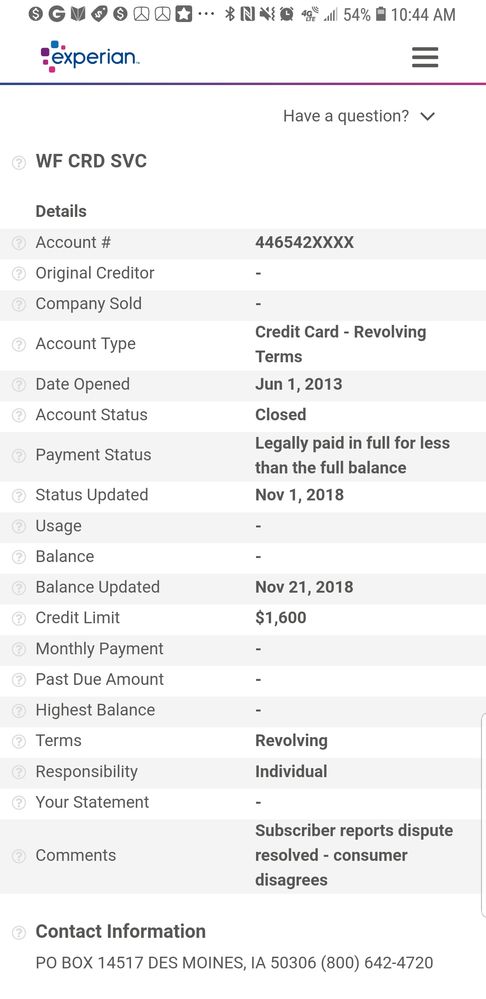

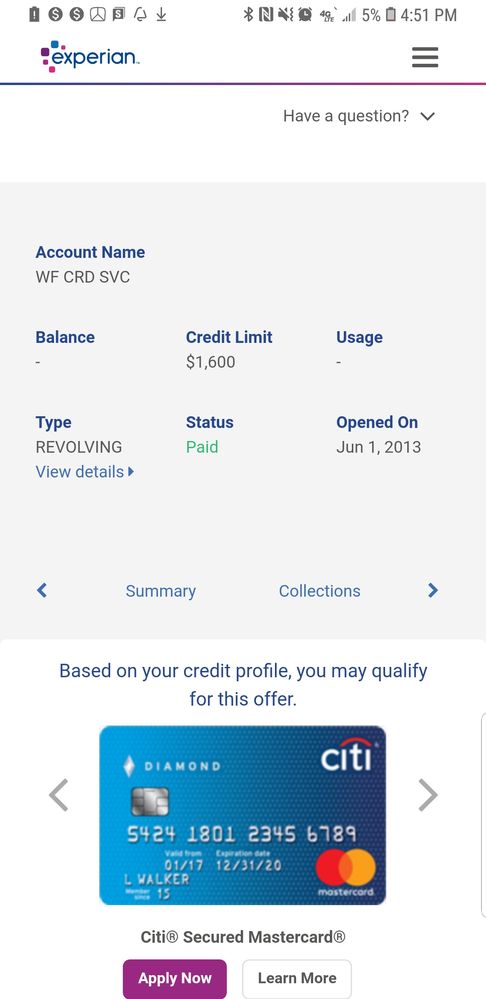

This morning, I received an alert through experian regarding comments to the account. I checked my report and noticed that comments were added. Also, something else that stood out to me is that it's still reporting FP (failed to pay) monthly. Are they allowed to do this? I've included a screenshot in the message below

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wellsfargo chargeoff paid but reporting FP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wellsfargo chargeoff paid but reporting FP

It is inaccurate reporting, and clearly basis for dispute.

Once you have settled a debt, regardless of whether paid in full of settled for less, the current status flips from delinquency to paid.

The prior payment history profile records the historical prior monthly status for prior months.

It is clearly inconsistent and inaccurate to show a current status for a given month of paid, or paid for less,which are both non-delinquency current status, and then show that status for that same month in subsequent reporting as any delinquency status in the payment history profile.

As an aside, FP is not a formal delinquency reporting code that is reported to the CRAs. They must report as either, for example, 90-late or CO.

FP is a designation that was used by the vendor who put together the commercial credit report, and is only an interpretation of what was reported to the CRA. Thus, a dispute of an FP designation may create problems with the CRA, as the current and prior monthly status reporting in their files will not be FP.

As a final observation, you might reconsider filing any dispute.

The post states that the account was charged-off. A creditor has the option after taking a CO to report the current status and prior payment history profile showing of prior monthly delinquency status as either the time since initial delinquency (e.g., 90-late) OR as CO, which is reporting that the account was delinquent and additonally charged to profit and loss.

If you dispute the accuracy of the payment history profile by contesting the FP showing after it was paid, the creditor might decide to substitute CO for any prior month that the account was delinquent and had also been charged-off.

A CO is generally viewed as a more serious reporting of delinquency,and you might wish to avoid any showing of CO in your profile by not filing a dispute that causes them to review their reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wellsfargo chargeoff paid but reporting FP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wellsfargo chargeoff paid but reporting FP

A Paid current status on an account with the original creditor is a non-delinquency status.

It shows that the prior period of delinquency has been terminated, and the debt has been discharged.

The issue with a creditor account is that if it has a current status of Paid for a given month, then that month should not then be shown with any delinquency status under the Payment History Profile for that same month in subsequent reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wellsfargo chargeoff paid but reporting FP

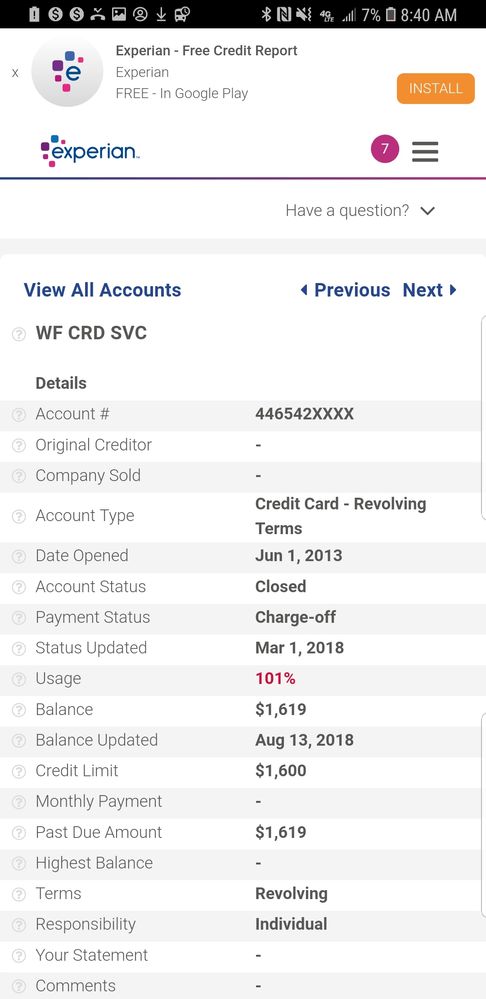

I found the screen shot from before I made a payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content