- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- What is a healthy number of cards to build with?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What is a healthy number of cards to build with?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is a healthy number of cards to build with?

Hi all,

Quick question. Like most, I'm looking to build a strong, positive credit history. I'm wondering if I need to apply for one more card.

I currently have:

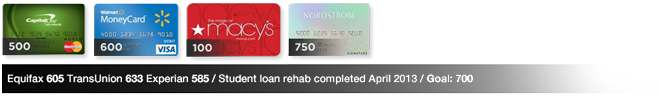

- CapitalOne Cash Rewards $500

- Walmart $600

- Macy's $100

- Nordstrom $750

I was considering getting one ore unsecured card. (CreditOne Platinum). My reasoning is to get all my hard pulls grouped closely so they may fall off together while I garden a healthy amount of credit movement. Not sure if there is a sweet spot. Afraid of too many, but also weary of too few slowing the process. Any assistance is appreciated!

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@mykalli wrote:Hi all,

Quick question. Like most, I'm looking to build a strong, positive credit history. I'm wondering if I need to apply for one more card.

I currently have:

- CapitalOne Cash Rewards $500

- Walmart $600

- Macy's $100

- Nordstrom $750

I was considering getting one ore unsecured card. (CreditOne Platinum). My reasoning is to get all my hard pulls grouped closely so they may fall off together while I garden a healthy amount of credit movement. Not sure if there is a sweet spot. Afraid of too many, but also weary of too few slowing the process. Any assistance is appreciated!

Thank you

Just curious on why you would want to app for Credit One? How long have you had each card?

I also want to point out a few things (For what its worth):

-Apping just to "group" your inquiries together is not a good idea

-The current accounts you have are fine for now but your limits are really low

-Let your current accounts age a while (ideally at least 12-24 months)

-Your scores seem to be all over the place (Assuming they are FICO) and chances of approval on most cards will be slim.

--If approved, more than likely it'll be matched near your current limits

I know it sucks, but it's going to take some time establish a strong positive history.

2010: 475 EQ 2011: 503 EQ 2012: 600 EQ2013:632 EQ

2010: 475 EQ 2011: 503 EQ 2012: 600 EQ2013:632 EQStarting Score: 634 EQ-3/13/13

Current Score: 706 EQ-8/29/13 703 EX-7/12/13 705 TU-8/9/13

Goal Score: 700

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

With those TLs already working for you, there is no need to sink to the depths of CreditOne. Believe me, I have been there and they will eat you alive with fees and other charges. It's not worth it.

Starting Score: TU 486 | EX 510 | EQ ???

Starting Score: TU 486 | EX 510 | EQ ???Current Score: TU 486 | EX 510 | EQ ???

Goal Score: 700

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

Thanks for the advice guys. I'm going to pass on the new card and continue building on the few cards I have currently. My short term goals:

- Utilize all my current cards. Currently they all have a zero balance. From what I've seen on the forums, 1-9% kept as a balance on each card will work better for my scores.

- Apply for nothing new.

- As always, try and remove anything negative from my reports.

- Sit tight for next 12 months, utilize well, pay ontime and try to increase my credit limits on what I already have.

This seems to be the smarter plan. If there's something else I'm missing, I'd appreciate your input.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

How long have you had the CapitalOne card? Have you tried going the email to EO office route to get a CLI with the CapOne card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@cwwatts1202 wrote:

Actually you want go keep at small balance of 1-9% on one card, keep the rest at $0.

Thats good to know. Is the 1-9% based on the one card I'll use, or my entire credit available on all cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

You want overall utilization to be at 9% or under.