- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- When will this fall off?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

When will this fall off?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this fall off?

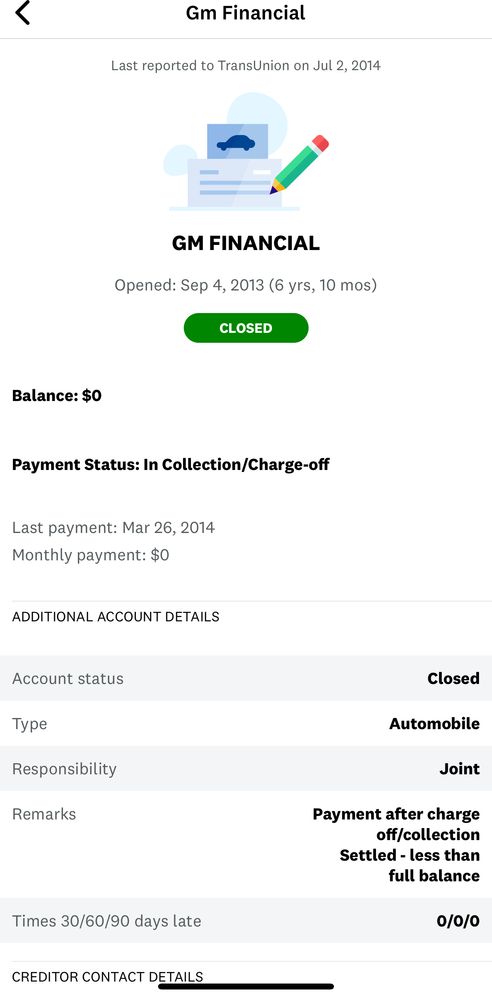

I have a repo from 2013 that shows last payment in March 2014. Should it fall off this year or next year?

Collection was a 1.5k balance.Never paid a dime on it on once it went to collections, but it shows that I did and that I paid in full.

Can someone explain

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will this fall off?

Whether it is paid or remains unpaid is irrelevant to credit report exclusion of either a charge-off reported by the creditor or a collection reported by a debt collector.

Each become excluded no later than 7 years plus 180 days from the date of first delinquency (DOFD) in the chain of delinquency that included the CO or collection. The CRAs will normally exclude at 7 years after the DOFD.

To determine the exclusion date, you need to know the DOFD.

If it is not shown in your commercial credit report, get a copy of your report from annualcreditreport.com.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will this fall off?

@povertybro wrote:I have a repo from 2013 that shows last payment in March 2014. Should it fall off this year or next year?

Collection was a 1.5k balance.Never paid a dime on it on once it went to collections, but it shows that I did and that I paid in full.

Can someone explain

That looks like CK (credit karma). If there is no balance showing (like with a CO) and you did not pay it, CK still will say "congrats, you have paid this off" or something to that extent, even when it is not true. The program is not smart enough to differentiate how it was paid off.

My SO has an unpaid CO from WFDS that just hit $0, bu no action from him, and CK said the same thing.

As mentioned above, the closest source if the most indepth credit report info is on annual credit report. It will include soecific dates of when to expect the account to drop off. Pull those reports. It is free (no scores included) and you can do so weekly through 4/2021. It usually includes entire payment histories, which most CRs do not offer (usually only 2 years worth). Definitely look into it!

CK is good for tracking some chamges and reporting trends, but I would not use it as a tool for an in depth look into your credit profile and payment history.

Good luck!